Concept explainers

Direct materials and direct labor,

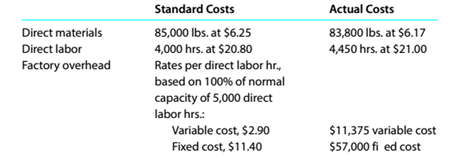

Route 66 Tire Co. manufactures automobile tires.

Instructions

Determine (a) the price variance, quantity variance, and total direct materials cost variance; (b) the rale variance, time variance, and total direct labor cost variance; and (c) Appendix: variable factory overhead controllable variance, the fixed factory overhead volume variance, and total factory overhead cost variance.

(a)

Concept Introduction:

Price variance:-It is the difference between price per unit in standard and actual price of product and multiplying that with quantity purchased in actual.

Quantity variance:-It is referred to the amount which is computed by multiplying the standard price per unit with the difference between quantity in actual term and standard term of product.

Direct Material cost variance:-This amount is calculated as the difference between standard cost and actual cost of direct material. The result is favorable when price variance is more than quantity variance. The result is unfavorable when price variance is less than quantity variance.

The price variance, quantity variance and total direct materials cost variance.

Answer to Problem 13.5P

Direct material price variance

Direct material quantity variance

Direct material cost variance

Explanation of Solution

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material cost variance is as follows:

(b)

Concept Introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:-It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour cost variance:

This amount is calculated as the difference between the actual cost and standard cost of direct labour for production. If answer is in negative than it is favourable. If answer is in positive than it is unfavorable.

The rate variance, time variance and total direct labour cost variance.

Answer to Problem 13.5P

Direct labor rate variance

Direct labor time variance

Direct labor cost variance

Explanation of Solution

Computation of Direct labor rate variance is as follows:

Computation of Direct labor time variance is as follows:

Computation of Direct laborcost variance is as follows:

(c)

Concept Introduction:

Volume variance:-It is referred to the amount which is computed by multiplying the fixed standard cost rate per hour with the difference between the actual hours and standard hours of variable factory overhead.

Variable factory overhead cost variance:-This amount is calculated as the difference between the contrallable variance and volume variance of variable factory overhead. If price is in negative, then it is favourable. If price is in positive then it is unfavorable.

The variable factory overhead controlled variance, fixed factory overhead volume variance and total factory overhead cost variance.

Answer to Problem 13.5P

Variable factory overhead controlledvariance

Variable factory overhead volume variance

Variable factory overhead cost variance

Explanation of Solution

Computation of Variable factory overhead controlled variance is as follows:

Computation of Variable factory overhead volume variance is as follows:

Computation of Variable factory overhead cost variance is as follows:

Want to see more full solutions like this?

Chapter 13 Solutions

Survey of Accounting - With CengageNOW 1Term

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the solution to this general accounting question with accurate Accounting calculations.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College