Concept explainers

a.

To Identify: The company which appears to be the largest at the end of Year 3.

a.

Answer to Problem 13.4MAD

The company which appears to be the largest using the revenue at the end of Year 3 is Company AT.

Explanation of Solution

Company AT has more revenue of $163,786 which is more than the revenue of Company F of revenue $27,638. Hence, Company AT appears to be the largest using the revenue at the end of Year 3.

b.

To Identify: The company which appears to be growing faster across the three years.

b.

Explanation of Solution

Identify the company which appears to be growing faster across the three years.

| Company | Year 3 | Year 2 | Year 1 |

| AT | 123% (1) | 110% (2) | 100% |

| F | 221% (3) | 143% (4) | 100% |

Table (1)

Working Note:

Calculate the growth rate of Company AT for the two years.

Calculate the growth rate of Company F for the two years.

Hence, the company which appears to be growing faster across the three years is Company F.

c.

To Compute: The cash used to purchase property, plant, and equipment as a percent of the

c.

Explanation of Solution

Compute the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities for all three years for each company.

| Company | Year 3 | Year 2 | Year 1 |

| AT | 56% (5) | 56% (6) | 68% (7) |

| F | 28% (8) | 24% (9) | 25% (10) |

Table (2)

Working Note:

Calculate the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT for three years.

For Year 3:

For Year 2:

For Year 1:

Calculate the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company F for three years.

For Year 3:

For Year 2:

For Year 1:

d.

To Identify: The company which appears to require more cash to purchase property, plant, and equipment and to explain its impact on

d.

Answer to Problem 13.4MAD

By using the computation in (C), it is clear that the company which appears to require more cash to purchase property, plant, and equipment is Company F, and its impact on free cash flow is more negative.

Explanation of Solution

The cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company F for Year 1 is 25% which is much less than that of Company F of 68%. But for Year 2, and Year 3, the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT are 56%, and 56%, which are greater than those of Company F of 24%, and 28%.

Hence, as the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company F from Year 1 to Year 3 is increasing, the company which appears to require more cash to purchase property, plant, and equipment is Company F and its net impact on free cash flow is more negative.

e.

To Compute: The ratio of free cash flow to revenue for all three years for each company.

e.

Explanation of Solution

Compute the free cash flow of Company AT.

| Year 3 | Year 2 | Year 1 | |

| Cash flows from operating activities | $ 39,344 | $35,880 | $ 31,338 |

Cash used to purchase property, plant, and equipment |

(22,408) |

(20,015) |

(21,433) |

| Free cash flow | $ 16,936 | $15,865 | $ 9,905 |

Table (3)

Compute the ratio of free cash flow to revenue for Company AT.

| Year 3 | Year 2 | Year 1 | |

| Free cash flow (A) | $ 16,936 | $15,865 | $ 9,905 |

| Revenue (B) | 163,786 | 146,801 | 132,447 |

| Ratio of free cash flow to revenues

|

10.3% | 10.8% | 7.5% |

Table (4)

Compute the free cash flow of Company F.

| Year 3 | Year 2 | Year 1 | |

| Cash flows from operating activities | $16,108 | $10,320 | $7,326 |

Cash used to purchase property, plant, and equipment |

(4,491) |

(2,523) |

(1,831) |

| Free cash flow | $ 11,617 | $7,797 | $ 5,495 |

Table (5)

Compute the ratio of free cash flow to revenue for Company F.

| Year 3 | Year 2 | Year 1 | |

| Free cash flow (A) | $ 11,617 | $7,797 | $ 5,495 |

| Revenue (B) | 27,638 | 17,928 | 12,466 |

| Ratio of free cash flow to revenues

|

42% | 43.4% | 44% |

Table (6)

Hence, the ratio of free cash flow to revenue for Year 3, Year 2, and Year 1 for Company AT are 10.3%, 10.8%, and 7.5% respectively. And for Company F, they are 42%, 43.4%, and 44% respectively.

F.

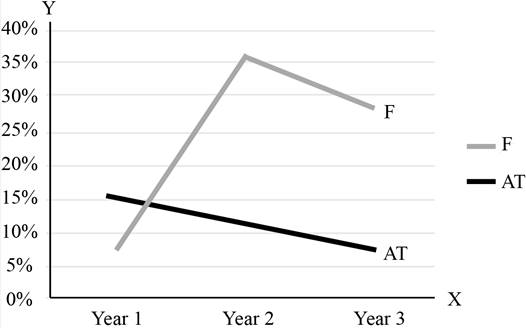

To plot: The data on a line chart with the years on the horizontal axis.

F.

Explanation of Solution

Plot the data on a line chart with the years on the horizontal axis.

Figure (1)

The ratio of free cash flow to revenue of Company AT for Year 1 was better when compared to Company F. But in the Year 2, and Year 3, the ratios of free cash flow to revenue of Company F were much greater than Company AT. The cash flows from operating activities of Company F have significantly increased over the years. Due to this, there is an increase in the ratio of free cash flows to revenues. The decline in the ratio of free cash flows to revenues of Company AT is due to the decline in the cash flows from operating activities, and increase in the cash needed to purchase property, plant, and equipment over the three years. The net result of this is that the ratio is declined.

Want to see more full solutions like this?

Chapter 13 Solutions

CORPORATE FINANCIAL ACCOUNTING 15TH ED

- Net income is $145,000, accounts payable increased by $8,000, inventory decreased by $7,500, and accounts receivable increased by $10,000 during the year. Using the indirect method, what is the net cash provided by operations? (a) $150,500 (b) $138,000 (c) $140,500 (d) $134,000arrow_forwardSolve this problemarrow_forwardWhat is the net income?? Provide fast answerarrow_forward

- During June, Clara spent $1,200 to buy 30 products and sold 6 of them for $80 each. Clara should record as an expense for June. A. $2,400 B. $480 C. $1,200 D. $240arrow_forwardPlease provide the answer to this financial accounting question with proper stepsarrow_forwardMy problem with accounting questionarrow_forward

- Please give me this general accounting questions answerarrow_forwardKelly Textiles estimated manufacturing overhead for the year to be $315,600. At the end of the year, the actual direct labor hours worked were 27,600 hours. The actual manufacturing overhead incurred was $310,800, and overhead was overapplied by $12,000. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in calculating the predetermined overhead rate must have been___. a. 27,600 direct labor-hours b. 26,800 direct labor-hours c. 27,000 direct labor-hours d. 28,000 direct labor-hours Right answerarrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forward

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning