Concept explainers

A.

Statement of

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Free cash flow describes the net cash provided from operating activities after making required adjustments for dividends and capital expenditures. In other words, it is the cash flow arrived after making payment for capital expenditures and dividend payments.

To Identify: The company which appears to be the largest at the end of Year 3.

A.

Answer to Problem 13.3ADM

The company which appears to be the largest using the revenue at the end of Year 3 is Company AT.

Explanation of Solution

Company AT has more revenue of $132,447 which is more than the revenue of Company F of revenue $12,466. Hence, Company AT appears to be the largest using the revenue at the end of Year 3.

B.

To Identify: The company which appears to be growing faster across the three years.

B.

Answer to Problem 13.3ADM

Identify the company which appears to be growing faster across the three years.

| Company | Year 3 | Year 2 | Year 1 |

| AT | 104% (1) | 101% (2) | 100% |

| F | 245% (3) | 155% (4) | 100% |

Table (1)

Explanation of Solution

Working Note:

Calculate the growth rate of Company AT for the two years.

Calculate the growth rate of Company F for the two years.

Hence, the company which appears to be growing faster across the three years is Company F.

C.

To Compute: The cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities for all three years for each company.

C.

Answer to Problem 13.3ADM

Compute the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities for all three years for each company.

| Company | Year 3 | Year 2 | Year 1 |

| AT | 68% (5) | 61% (6) | 50% (7) |

| F | 34% (8) | 32% (9) | 77% (10) |

Table (2)

Explanation of Solution

Working Note:

Calculate the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT for three years.

For Year 3:

For Year 2:

For Year 1:

Calculate the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company F for three years.

For Year 3:

For Year 2:

For Year 1:

Hence, the company which appears to be growing faster across the three years is Company F.

D.

To Identify: The company which appears to require more cash to purchase property, plant, and equipment and to explain its impact on free cash flow.

D.

Answer to Problem 13.3ADM

By using the computation in (C), it is clear that the company which appears to require more cash to purchase property, plant, and equipment is Company AT, and its impact on free cash flow is more negative.

Explanation of Solution

The cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT for Year 1 is 50% which is much less than that of Company F of 77%. But for Year 2, and Year 3, the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT are 61%, and 68%, which are greater than those of Company F of 32%, and 34%.

Hence, as the cash used to purchase property, plant, and equipment as a percent of the cash flows from operating activities of Company AT from Year 1 to Year 3 is increasing, the company which appears to require more cash to purchase property, plant, and equipment is Company AT, and its net impact on free cash flow is more negative.

E.

To Compute: The ratio of free cash flow to revenue for all three years for each company.

E.

Explanation of Solution

Compute the free cash flow of Company AT.

| Year 3 | Year 2 | Year 1 | |

| Cash flows from operating activities | $ 31,338 | $34,796 | $ 39,176 |

Cash used to purchase property, plant, and equipment |

(21,433) |

(21,228) |

(19,728) |

| Free cash flow | $ 9,905 | $13,568 | $ 19,448 |

Table (3)

Compute the ratio of free cash flow to revenue for Company AT.

| Year 3 | Year 2 | Year 1 | |

| Free cash flow (A) | $ 9,905 | $13,568 | $ 19,448 |

| Revenue (B) | 132,447 | 128,752 | 127,434 |

| Ratio of free cash flow to revenues

|

7.5% | 10.5% | 15.3% |

Table (4)

Compute the free cash flow of Company F.

| Year 3 | Year 2 | Year 1 | |

| Cash flows from operating activities | $ 5,457 | $4,222 | $1,612 |

Cash used to purchase property, plant, and equipment |

(1,831) |

(1,362) |

(1,235) |

| Free cash flow | $ 3,626 | $2,860 | $ 377 |

Table (5)

Compute the ratio of free cash flow to revenue for Company F.

| Year 3 | Year 2 | Year 1 | |

| Free cash flow (A) | $ 3,626 | $2,860 | $ 377 |

| Revenue (B) | 12,466 | 7,872 | 5,089 |

| Ratio of free cash flow to revenues

|

29.1% | 36.3% | 7.4% |

Table (6)

Hence, the ratio of free cash flow to revenue for Year 3, Year 2, and Year 1 for Company AT are 7.5%, 10.5%, and 15.3% respectively. And for Company F, they are 29.1%, 36.3%, and 7.4% respectively.

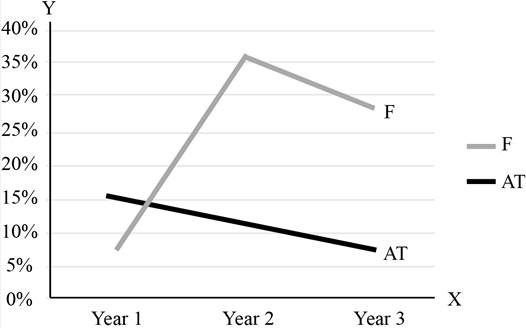

To plot: The data on a line chart with the years on the horizontal axis.

Explanation of Solution

Plot the data on a line chart with the years on the horizontal axis.

Figure (1)

F.

To Interpret: The chart.

F.

Explanation of Solution

The ratio of free cash flow to revenue of Company AT for Year 1 was better when compared to Company F. But in the Year 2, and Year 3, the ratios of free cash flow to revenue of Company F were much greater than Company AT. The cash flows from operating activities of Company F have significantly increased over the years. Due to this, there is an increase in the ratio of free cash flows to revenues. The decline in the ratio of free cash flows to revenues of Company AT is due to the decline in the cash flows from operating activities, and increase in the cash needed to purchase property, plant, and equipment over the three years. The net result of this is that the ratio is declined.

Want to see more full solutions like this?

Chapter 13 Solutions

Corporate Financial Accounting

- Horngren's Financial & Managerial Accounting: The Managerial Chapters, 8th Edition. Lily-Mae makes handheld calculators in two models: basic and professional. Lily-Mae estimated $812,500 of manufacturing overhead and 625,000 machine hours for the year. The basic model actually consumed 250,000 machine hours, and the professional model consumed 375,000 machine hours.Compute the predetermined overhead allocation rate using machine hours (MHr) as the allocation base. How much overhead is allocated to the basic model? To the professional model? Basic $325,000arrow_forward3. A corporation's working capital is calculated using which amounts? Total Assets And Total Liabilities Total Assets And Current Liabilities Current Assets And Current Liabilitiesarrow_forwardThe changes that occurred during a recent year in the accounts Retained Earnings and Treasury Stock will be presented in which financial statement? Balance Sheet Income Statement Statement Of Cash Flows Statement Of Comprehensive Income Statement Of Stockholders' Equityarrow_forward

- The amount spent for capital expenditures will be reported in which section of the statement of cash flows? Cash Provided/used In Financing Activities Cash Provided/used In Investing Activities Cash Provided/used In Operating Activities Supplemental Informationarrow_forwardWhich of the following will appear as a negative amount on a statement of cash flows that was prepared using the indirect method? A Decrease In Inventory An Increase In Accounts Payable An Increase In Accounts Receivable Depreciation Expensearrow_forwardWhich of the following will appear as a positive amount on a statement of cash flows that was prepared using the indirect method? An Increase In Accounts Receivable An Increase In Inventory A Decrease In Accounts Payable Depreciation Expensearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College