Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

5th Edition

ISBN: 9780134642093

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.33AP

Prepare statement of

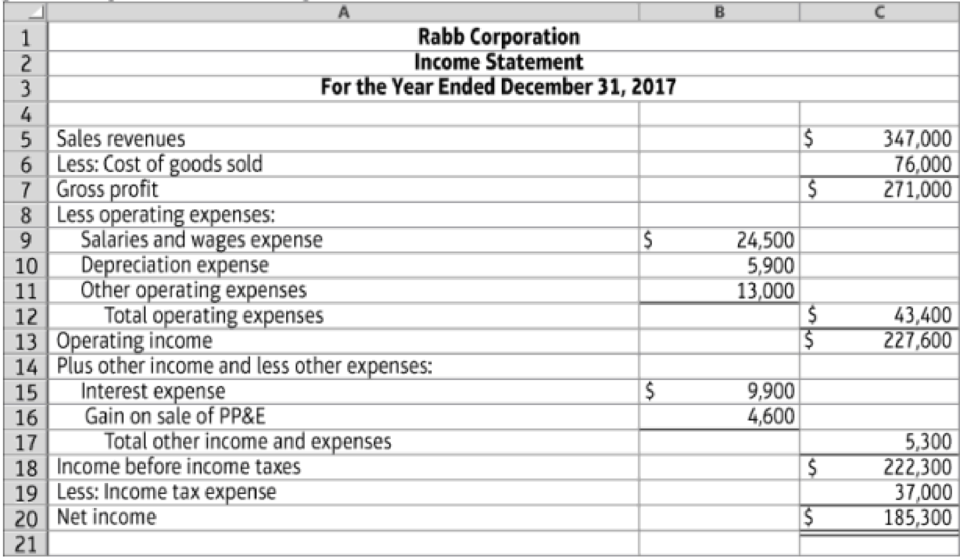

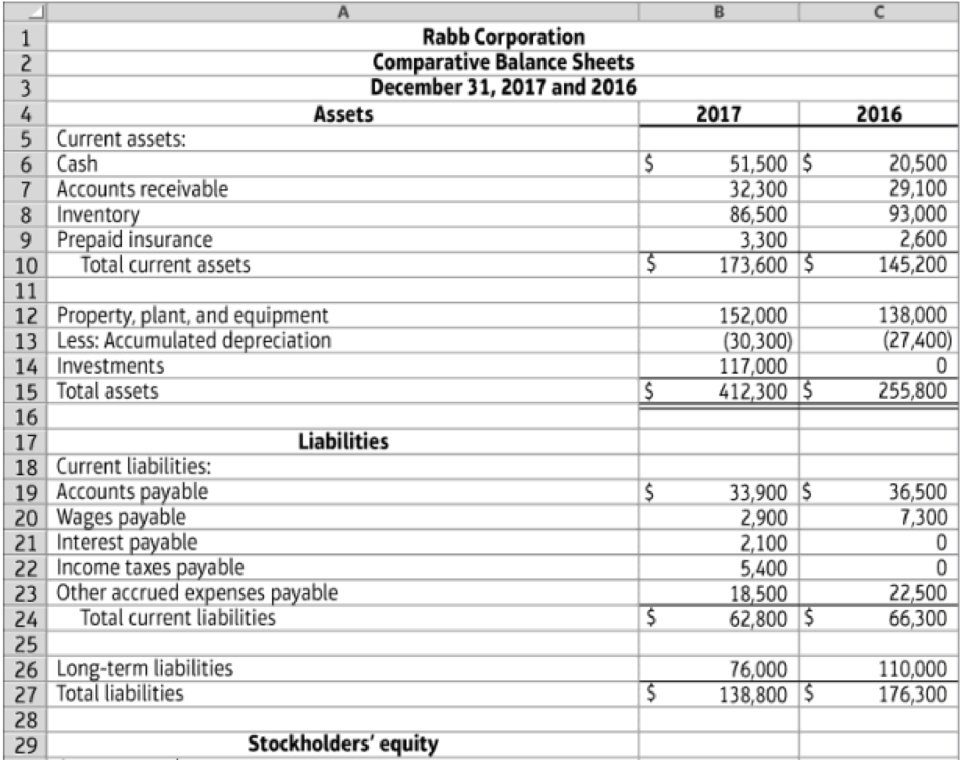

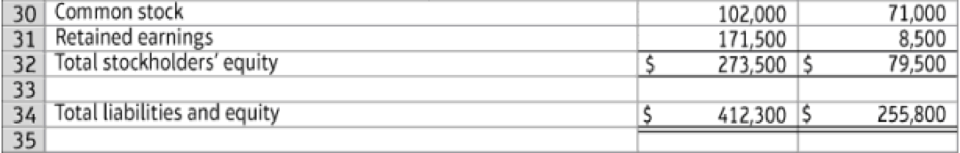

The 2017 and 2016 balance sheets of Rabb Corporation follow. The 2017 income statement is also provided. Rabb had no noncash investing and financing transactions during 2017. During the year, the company sold equipment for $15,100, which had originally cost $13,500 and had a book value of $10,500. The company did not issue any notes payable during the year but did issue common stock for $31,000. The company purchased plant assets and long-term investments with cash.

13.4-40 Full Alternative Text

13.4-41 Full Alternative Text

Requirements

- 1. Prepare the statement of cash flows for Rabb Corporation for 2017 using the indirect method.

- 2. Evaluate the company’s cash flows for the year. Discuss each of the categories of cash flows in your response.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A company receives a utility bill but doesn’t pay it immediately. What is the correct journal entry?

A) Debit Utilities Payable, Credit CashB) Debit Utilities Expense, Credit Utilities PayableC) Debit Utilities Expense, Credit Accounts ReceivableD) Debit Cash, Credit Utilities Expense

Which financial statement shows revenues and expenses?

A) Balance SheetB) Statement of Cash FlowsC) Income StatementD) Statement of Financial Position

What is the main purpose of adjusting entries?

A) To record transactions after the period endsB) To correct errorsC) To match revenues and expenses in the correct periodD) To close accountscorrect

Chapter 13 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

Ch. 13 - (Learning Objective 1) Which of the following is...Ch. 13 - Prob. 2QCCh. 13 - Prob. 3QCCh. 13 - Prob. 4QCCh. 13 - Prob. 5QCCh. 13 - Prob. 6QCCh. 13 - Prob. 7QCCh. 13 - Prob. 8QCCh. 13 - Prob. 9QCCh. 13 - (Learning Objective 3) Which one of the following...

Ch. 13 - Prob. 13.1SECh. 13 - Prob. 13.2SECh. 13 - Prob. 13.3SECh. 13 - Prob. 13.4SECh. 13 - Prob. 13.5SECh. 13 - Calculate financing cash flows (Learning...Ch. 13 - Prob. 13.7SECh. 13 - Prob. 13.8SECh. 13 - Prob. 13.9SECh. 13 - Prob. 13.10SECh. 13 - Prob. 13.11SECh. 13 - Prob. 13.12AECh. 13 - Prob. 13.13AECh. 13 - Prob. 13.14AECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.16AECh. 13 - Prob. 13.17AECh. 13 - Prob. 13.18AECh. 13 - Prob. 13.19AECh. 13 - Prob. 13.20AECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.22BECh. 13 - Prob. 13.23BECh. 13 - Prob. 13.24BECh. 13 - Calculate operating cash flows (indirect method)...Ch. 13 - Prob. 13.26BECh. 13 - Prob. 13.27BECh. 13 - Prob. 13.28BECh. 13 - Prob. 13.29BECh. 13 - Prob. 13.30BECh. 13 - Classify sustainable activities effect on cash...Ch. 13 - Prob. 13.32APCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.34APCh. 13 - Prob. 13.35APCh. 13 - Prob. 13.36BPCh. 13 - Prepare statement of cash flows (indirect method)...Ch. 13 - Prob. 13.38BPCh. 13 - Prob. 13.39BPCh. 13 - Prob. 13.40SCCh. 13 - Discussion Analysis A13-41 Discussion Questions...Ch. 13 - Prob. 13.42ACTCh. 13 - Ethics involved with statement of cash flows...Ch. 13 - Prob. 13.44ACTCh. 13 - Prob. 13.45ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the main purpose of adjusting entries? A) To record transactions after the period endsB) To correct errorsC) To match revenues and expenses in the correct periodD) To close accountsneedarrow_forwardWhat is the main purpose of adjusting entries? A) To record transactions after the period endsB) To correct errorsC) To match revenues and expenses in the correct periodD) To close accountsarrow_forwardA company receives a utility bill but doesn’t pay it immediately. What is the correct journal entry? A) Debit Utilities Payable, Credit CashB) Debit Utilities Expense, Credit Utilities PayableC) Debit Utilities Expense, Credit Accounts ReceivableD) Debit Cash, Credit Utilities Expense needarrow_forward

- A company receives a utility bill but doesn’t pay it immediately. What is the correct journal entry? A) Debit Utilities Payable, Credit CashB) Debit Utilities Expense, Credit Utilities PayableC) Debit Utilities Expense, Credit Accounts ReceivableD) Debit Cash, Credit Utilities Expenseno aiarrow_forwardWhat is recorded when a business earns revenue but hasn't received payment yet? A) Unearned RevenueB) Accounts PayableC) CashD) Accounts Receivableneedarrow_forwardWhich account normally has a credit balance? A) Prepaid RentB) Salaries ExpenseC) Accounts PayableD) Cashneedarrow_forward

- Which account normally has a credit balance? A) Prepaid RentB) Salaries ExpenseC) Accounts PayableD) Casharrow_forwardWhich account normally has a credit balance? A) Prepaid RentB) Salaries ExpenseC) Accounts PayableD) Cashno aiarrow_forwardWhich is an example of a contra-asset account? A) Accumulated DepreciationB) Unearned RevenueC) Interest PayableD) Retained Earningsno aiarrow_forward

- Answer ?? financial accountingarrow_forwardWhich is an example of a contra-asset account? A) Accumulated DepreciationB) Unearned RevenueC) Interest PayableD) Retained EarningsI needarrow_forwardWhich is an example of a contra-asset account? A) Accumulated DepreciationB) Unearned RevenueC) Interest PayableD) Retained Earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License