Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

27th Edition

ISBN: 9781337272162

Author: Reeve, James M., Duchac, Jonathan, WARREN, Carl S.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 13, Problem 13.22EX

Statement of

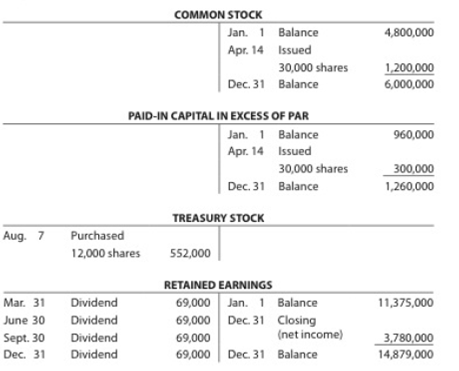

The stockholders' equity T accounts of I-Cards Inc. for the fiscal year ended December 31, 20Y9, are as follows. Prepare a statement of stockholders' equity for the year ended December 31, 20Y9.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I need help with this financial accounting question using the proper financial approach.

What is total equity

What is the standard rate per direct labor hour?

Chapter 13 Solutions

Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

Ch. 13 - Of two corporations organized at approximately the...Ch. 13 - Prob. 2DQCh. 13 - A corporation with both preferred stock and common...Ch. 13 - An owner of 2,500 shares of Simmons Company common...Ch. 13 - Prob. 5DQCh. 13 - What is the primary purpose of a stock split?Ch. 13 - Prob. 7DQCh. 13 - The treasury stock in Discussion Question 7 is...Ch. 13 - What are the three classifications of restrictions...Ch. 13 - Indicate how prior period adjustments should he...

Ch. 13 - A Dividends per share Reinhardt Furniture Company...Ch. 13 - Dividends per share Zero Calories Company has...Ch. 13 - Entries for issuing stock On May 23, Stoltz Realty...Ch. 13 - Entries for issuing stock On January 22, Zentric...Ch. 13 - Prob. 13.3APECh. 13 - Entries for cash dividends The declaration,...Ch. 13 - Prob. 13.4APECh. 13 - Entries for stock dividends Antique Buggy...Ch. 13 - Prob. 13.5APECh. 13 - Entries for treasury stock On May 27, Hydro...Ch. 13 - Reporting stockholders' equity Using the following...Ch. 13 - Reporting stockholders' equity Using the following...Ch. 13 - Retained earnings statement Rockwell Inc. reported...Ch. 13 - Retained earnings statement None Cruises Inc....Ch. 13 - Earnings per share Financial statement data for...Ch. 13 - Earnings per share Financial statement data for...Ch. 13 - Dividends per share Imaging Inc., a developer of...Ch. 13 - Dividends per share Lightfoot Inc., a software...Ch. 13 - Prob. 13.3EXCh. 13 - Prob. 13.4EXCh. 13 - Issuing stock for assets other than cash On April...Ch. 13 - Prob. 13.6EXCh. 13 - Issuing stock Willow Creek Nursery, with an...Ch. 13 - Issuing stock Work Place Products Inc., a...Ch. 13 - Entries for cash dividends The declaration,...Ch. 13 - Prob. 13.10EXCh. 13 - Prob. 13.11EXCh. 13 - Prob. 13.12EXCh. 13 - Prob. 13.13EXCh. 13 - Prob. 13.14EXCh. 13 - Treasury stock transactions Lawn Spray Inc....Ch. 13 - Prob. 13.16EXCh. 13 - Reporting paid-in capital The following accounts...Ch. 13 - Stockholders' Equity section of balance sheet The...Ch. 13 - Prob. 13.19EXCh. 13 - Retained earnings statement Sumter Pumps...Ch. 13 - Prob. 13.21EXCh. 13 - Statement of stockholders' equity The...Ch. 13 - EPS Junkyard Am, Inc., had earnings of 516,000 for...Ch. 13 - Prob. 13.24EXCh. 13 - EPS Caterpillar Inc. and Deere Company are two...Ch. 13 - Prob. 13.1APRCh. 13 - Prob. 13.2APRCh. 13 - Selected stock transactions The following selected...Ch. 13 - Entries for selected corporate transactions Morrow...Ch. 13 - Entries for selected corporate transactions...Ch. 13 - Prob. 13.1BPRCh. 13 - Stock transaction for corporate expansion Pulsar...Ch. 13 - Selected stock transactions Diamondback Welding ...Ch. 13 - Entries for selected corporate transactions Nav-Go...Ch. 13 - Entries for selected corporate transactions West...Ch. 13 - Prob. 13.1CPCh. 13 - Prob. 13.2CPCh. 13 - Communication Motion Designs Inc. has paid...Ch. 13 - Prob. 13.5CPCh. 13 - Prob. 13.6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oakridge Hardware has assets equal to $475,000 and liabilities equal to $290,000 at year-end. What is the total equity for Oakridge Hardware at year-end? HELParrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCypress Products manufactures a product with a standard direct lab or cost of 2.2 hours at $17.00 per hour. During September, 2,750 units were produced using 6,160 hours at $16.25 per hour. The labor quantity variance was $__.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License