EBK ADVANCED FINANCIAL ACCOUNTING

12th Edition

ISBN: 9781260165104

Author: Christensen

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.21P

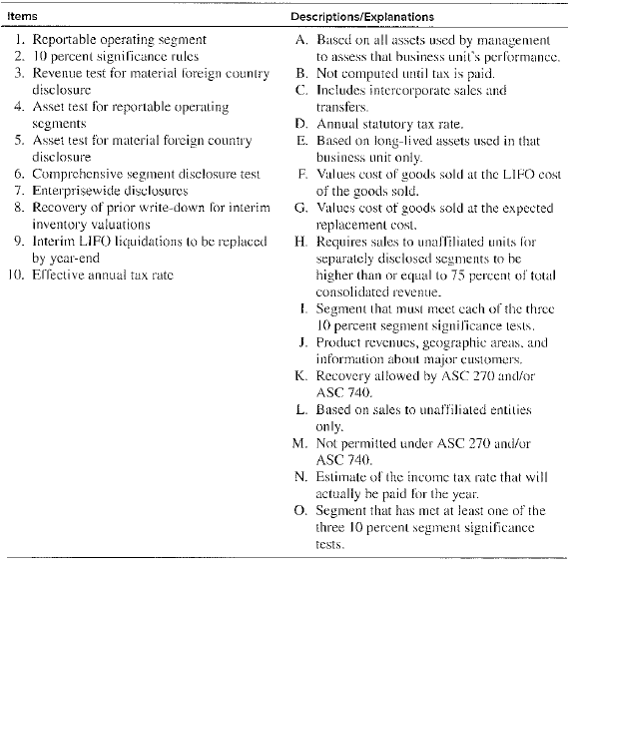

Matching Terms

Match the items in the left-hand column with thedescriptions/explanations in the right-hand column.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Please provide the solution to this financial accounting question with accurate financial calculations.

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Chapter 13 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Ch. 13 - Prob. 13.1QCh. 13 - Prob. 13.2QCh. 13 - What are the three 10 percent significance tests...Ch. 13 - Prob. 13.4QCh. 13 - A company has 10 industry segments, of which the...Ch. 13 - Prob. 13.6QCh. 13 - Prob. 13.7QCh. 13 - Prob. 13.8QCh. 13 - Prob. 13.9QCh. 13 - Prob. 13.10Q

Ch. 13 - Prob. 13.11QCh. 13 - Prob. 13.12QCh. 13 - Prob. 13.13QCh. 13 - Prob. 13.14QCh. 13 - Maness Company made a change in accounting for its...Ch. 13 - Prob. 13.1CCh. 13 - Prob. 13.2CCh. 13 - Prob. 13.3CCh. 13 - Prob. 13.7CCh. 13 - Prob. 13.8CCh. 13 - Prob. 13.9CCh. 13 - Reportable Segments Data for the seven operating...Ch. 13 - Prob. 13.2.1ECh. 13 - Prob. 13.2.2ECh. 13 - Prob. 13.2.3ECh. 13 - Prob. 13.2.4ECh. 13 - Prob. 13.2.5ECh. 13 - Prob. 13.2.6ECh. 13 - Prob. 13.2.7ECh. 13 - Prob. 13.2.8ECh. 13 - Prob. 13.2.9ECh. 13 - Prob. 13.2.10ECh. 13 - Prob. 13.2.11ECh. 13 - Prob. 13.3.1ECh. 13 - Prob. 13.3.2ECh. 13 - Multiple-Choice Questions on Interim Reporting...Ch. 13 - Prob. 13.3.4ECh. 13 - Prob. 13.3.5ECh. 13 - Prob. 13.3.6ECh. 13 - Prob. 13.3.7ECh. 13 - Prob. 13.3.8ECh. 13 - Prob. 13.3.9ECh. 13 - Prob. 13.3.10ECh. 13 - LIFO Liquidation During July, Laesch Company,...Ch. 13 - Inventory Write-Down and Recovery Cub Company, a...Ch. 13 - MutiniedChoice Questions on Income Taxes at...Ch. 13 - Prob. 13.6.2ECh. 13 - Prob. 13.6.3ECh. 13 - MutiniedChoice Questions on Income Taxes at...Ch. 13 - Prob. 13.6.5ECh. 13 - Prob. 13.6.6ECh. 13 - Prob. 13.7ECh. 13 - Prob. 13.8ECh. 13 - Prob. 13.9ECh. 13 - Prob. 13.10ECh. 13 - Prob. 13.11ECh. 13 - Prob. 13.12ECh. 13 - Prob. 13.13PCh. 13 - Prob. 13.14PCh. 13 - Interim Income Statement Chris Inc. has...Ch. 13 - Prob. 13.17PCh. 13 - Prob. 13.20PCh. 13 - Matching Terms Match the items in the left-hand...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY