1.

Prepare the

1.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Prepare the journal entries in the books of Company D for the year 2016.

| Date | Account Title and Explanation | Debit | Credit |

| February 3, 2016 | Investment in Available-for-sale Securities | $36,000 | |

| Cash | $36,000 | ||

| (To record the purchase of Company B's 3000 shares) | |||

| April 1, 2016 | Investment in Available-for-sale Securities | $20,000 | |

| Interest income (1) | $600 | ||

| Cash | $20,600 | ||

| (To record the purchase of Incorporation S's bonds) | |||

| June 30, 2016 | Cash | $1,950 | |

| Dividend income | $750 | ||

| Interest income (2) | $1,200 | ||

| (To record the interest and dividend received) | |||

| September 1, 2016 | Investment in Available-for-sale Securities | $88,000 | |

| Cash | $88,000 | ||

| (To record the purchase of Company W's 4000 shares) | |||

| November 1, 2016 | Investment in Available-for-sale Securities | $30,000 | |

| Interest income (3) | $1,375 | ||

| Cash | $31,375 | ||

| (To record the purchase of Incorporation W's bonds) | |||

| December 1, 2016 | Cash | $1,650 | |

| Interest income (4) | $1,650 | ||

| (To record the interest received from Company E's bond) | |||

| December 1, 2016 | Cash | $30,300 | |

| Investment in Available-for-sale Securities | $30,000 | ||

| Gain on sale of Available-for-sale Securities | $300 | ||

| (To record the sale of Company E's bond on profit) | |||

| December 30, 2016 | Cash | $750 | |

| Dividend income | $750 | ||

| (To record the dividend received for Company B's share) | |||

| December 30, 2016 | Cash | $35,300 | |

| Loss on sale of Available-for-sale Securities | $700 | ||

| Investment in Available-for-sale Securities | $36,000 | ||

| (To record the sale of Company B's share on loss) | |||

| December 31, 2016 | Cash | $1,200 | |

| Interest income (5) | $1,200 | ||

| (To record the interest received from Incorporation S's bond) | |||

| December 31, 2016 | Allowance for change in fair value of investment | $4,200 | |

| Unrealized holding gain/loss: Available-for-sale securities (7) | $4,200 | ||

| (To adjust the allowance and the unrealized gain on holding the Securities) |

Table (1)

Working note (1):

Determine the amount of interest income paid by Company D.

Working note (2):

Calculate the amount of interest income received from Incorporation S’s bond.

Working note (3):

Calculate the amount of interest income paid by Company D.

Working note (4):

Calculate the amount of interest income received from Company E’s bond.

Working note (5):

Calculate the amount of interest income.

Working note (6):

Determine the fair value of investment in Corporation W’s stock.

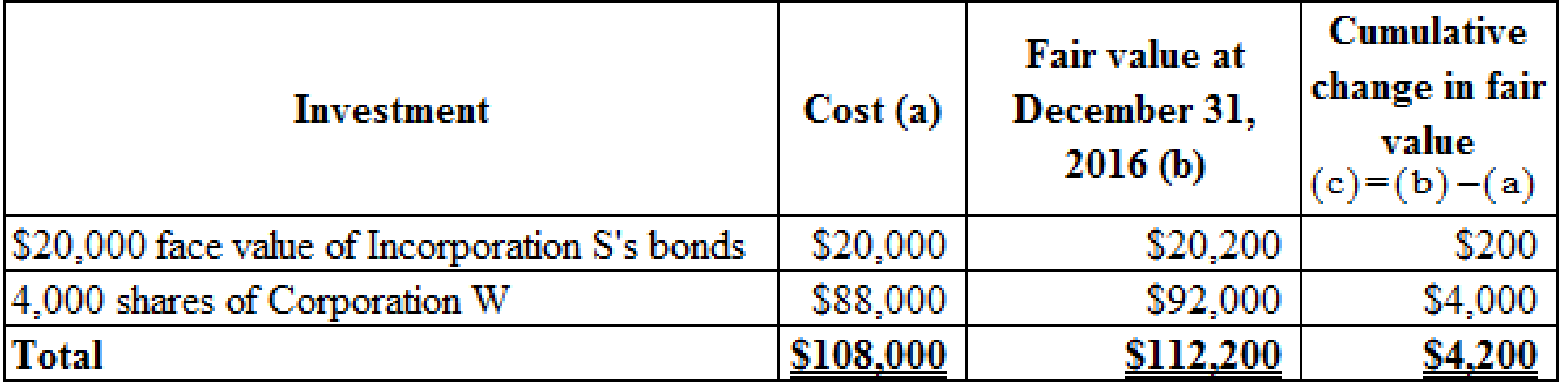

Working note (7):

Determine the net amount of unrealized gain or loss on available-for-sale securities as on December 31, 2016.

Table (2)

2.

Show the items of income or loss of Company D for the year ended December 31, 2016.

2.

Explanation of Solution

Show the items of income or loss of Company D for the year ended December 31, 2016.

| Particulars | Amount |

| Interest income (8) | $2,075 |

| Dividend income (9) | $1,500 |

| Loss on sale of available-for-sale securities | ($ 700) |

| Gain on sale of available-for-sale securities | $300 |

Table (3)

Working note (8):

Calculate the amount of interest income.

Working note (9):

Calculate the amount of dividend income.

3.

Show the carrying value of Company D’s investment in available-for-sale securities at its

3.

Explanation of Solution

Show the carrying value of Company D’s investment in available-for-sale securities at its balance sheet at December 31, 2016.

| Company D | |

| Balance sheet Statement (Partial) | |

| As at December 31, 2016 | |

| Assets | Amount |

| Current assets: | |

| Investment in available-for-sale securities (at cost) | $108,000 |

| Add : Allowance for change in fair value of investment | $4,200 |

| Investment in available-for-sale securities (at fair value) | $112,200 |

Table (4)

Want to see more full solutions like this?

Chapter 13 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Stellar Systems Logistics purchases a new cargo van for $48,000. The sales taxes are $3,600. The company name is custom-wrapped on the sides of the van for $1,200. The van's annual registration fee is $200. Before use, the van undergoes a required inspection costing $350. What amount should Stellar Systems Logistics record as the cost of the new van? Need helparrow_forwardI want to correct answer general accounting questionarrow_forwardEach month, Brighton Corp. incurs $320,000 total manufacturing costs (25% fixed) and $180,000 distribution and marketing costs (40% fixed). Their monthly sales revenue is $600,000. What is the markup percentage on full cost to arrive at the current selling price?arrow_forward

- Need answer the general accounting question not use aiarrow_forwardAt the beginning of the year, Keller Company's liabilities equal $55,000. During the year, assets increase by $85,000, and at year-end assets equal $190,000. Liabilities decrease by $10,000 during the year. What is the beginning and ending amounts of equity?arrow_forwardI need help with accountingarrow_forward

- general accountarrow_forwardHi expert please give me answer general accounting questionarrow_forwardDuring its first year, Pine Co. reported a $12 per-unit profit under absorption costing, but the total profit would have been $9,000 less under variable costing. Production exceeded sales by 300 units, and the average contribution margin was 60%. a. What is the fixed cost per unit? b. What is the sales price per unit? c. What is the variable cost per unit? d. What is the unit sales volume if total profit under absorption costing was $96,000?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning