Concept explainers

COST-BENEFIT ANALYSIS

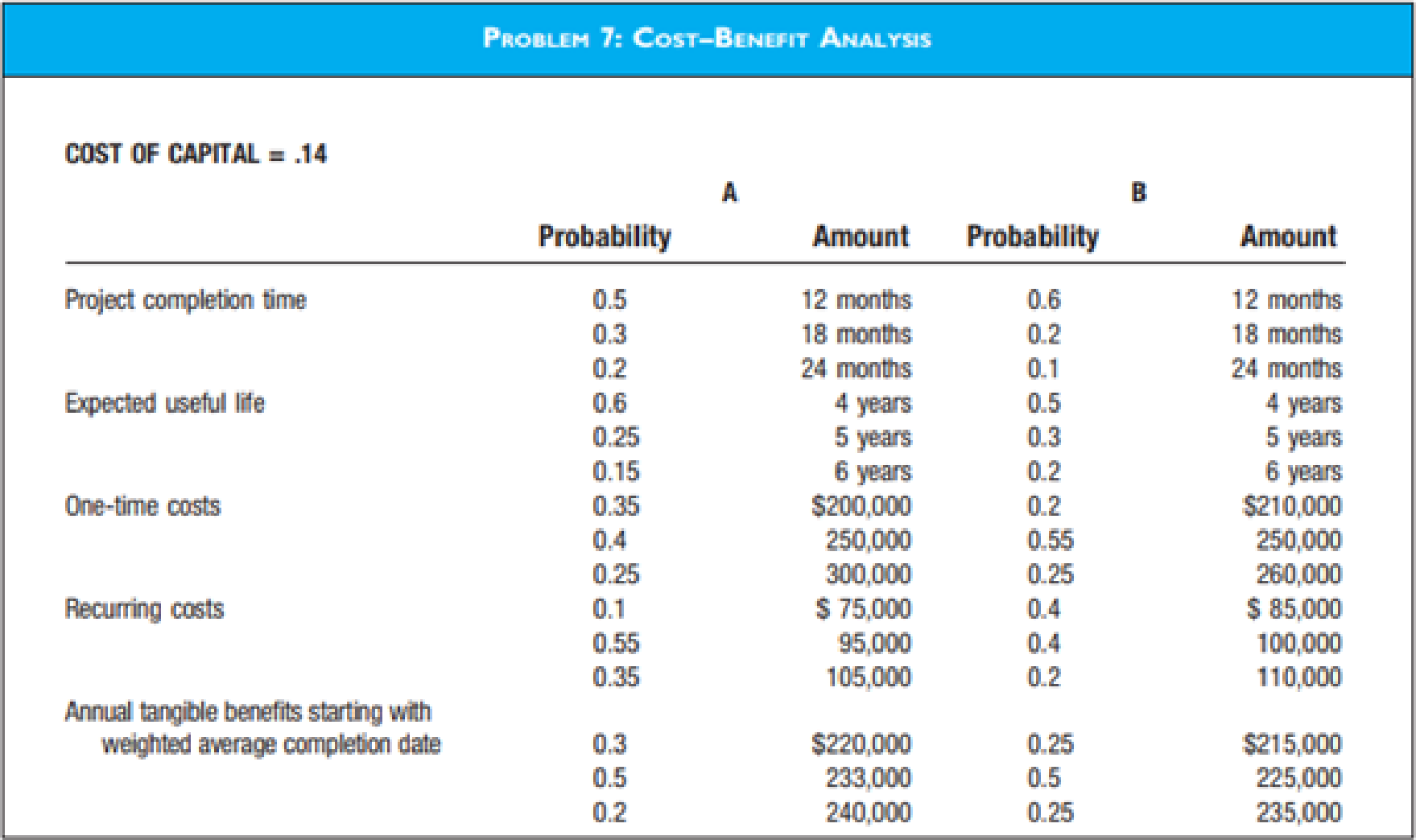

Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects.

- a. Compute the

net present value of each alternative. Round the cost projections to the nearest month. - b. Repeat step (a) for the payback method.

- c. Which method do you think provides the best source of information? Why?

a.

Calculate the net present value of each alternative.

Explanation of Solution

Net Present Value:

Net present value (NPV) is defined as a method which is used in capital budgeting to compute the profitability of an investment. It can be calculated by subtracting the cash inflow of present value from cash outflow of a period of time.

Given information:

Average time period is 5 year.

Discount rate is 0.14.

Present value of annuity at discount rate of 0.14 and time 5 year is 3.433.

Calculation of Net present value of project A:

The formula to calculate net present value of project A is,

The table given below represents the annual cash flow of project A:

|

Probability (A) |

Recurring cost (B) |

Cash inflow |

Probability (C) |

Weighted average benefits (D) |

Cash outflow |

Cash Flow |

| 0.1 | $75,000 | $7,500 | 0.3 | $220,000 | $66,000 | $9,000 |

| 0.55 | $95,000 | $52,250 | 0.5 | $233,000 | $116,500 | $64,250 |

| 0.35 | 105,000 | $36,750 | 0.2 | $240,000 | $48,000 | $11,250 |

| Total | $96,500 | Total | $230,500 | $84,500 | ||

Table (1)

From Table (1), total cash inflow of project A is $84,500.

Substitute $84,500 for Cash flow and

Hence, net present value of project A is $290,088.50 per year.

Calculation of Net present value of project B:

The formula to calculate net present value of project B is given in equation (1)

The table given below represents the annual cash flow of project B:

|

Probability (A) |

Recurring cost (B) |

Cash inflow |

Probability (C) |

Weighted average benefits (D) |

Cash outflow |

Cash Flow |

| 0.4 | $85,000 | $34,000 | 0.25 | $215,000 | $53,750 | $1,750 |

| 0.4 | $100,000 | $40,000 | 0.5 | $225,000 | $112,500 | $72,500 |

| 0.2 | $110,000 | $22,000 | 0.25 | $235,000 | $58,750 | $36,750 |

| Total | $96,000 | Total | $225,000 | $111,000 | ||

Table (2)

From Table (2), total cash inflow of project B is $111,000.

Substitute $111,000 for Cash flow and

Hence, net present value of project B is $381,063.

b.

Compute payback method of each alternative.

Explanation of Solution

Payback Method:

Payback method is defined as the method of capital budgeting which is used to measure the length of time required to recover the cost of investment in a project.

Calculation of period using payback method of project A:

The formula to calculate payback period of project A is,

The table given below represents total initial investment of project A:

| Probability factor | One-time cost | Initial investment |

| 0.35 | $200,000 | $70,000 |

| 0.4 | $250,000 | $100,000 |

| 0.25 | $300,000 | $75,000 |

| Total | $245,000 | |

Table (3)

From Table (3), total initial investment of project A is $245,000.

Substitute $245,000 for initial investment and $84,500 Cash flow in the above formula.

Hence, the payback period of project A is 3 year.

Calculation of period using payback method of project B:

The formula to calculate payback period of project B is given in equation (2).

The table given below represents total initial investment of project B:

| Probability factor | One-time cost | Initial investment |

| 0.2 | $210,000 | $42,000 |

| 0.55 | $250,000 | $137,500 |

| 0.25 | $260,000 | $65,000 |

| Total | $244,500 | |

Table (4)

From Table (4), total initial investment of project B is $244,500.

Substitute $244,500 for initial investment and $111,000 Cash flow in the above formula.

Hence, the payback period of project B is 2 year.

c.

Explain which method net present value method or payback period method provides better information of investment.

Explanation of Solution

Net Present Value:

Net present value (NPV) is defined as a method which is used in capital budgeting to compute the profitability of an investment. It can be calculated by subtracting the cash inflow of present value from cash outflow of a period of time.

Net present value provides the information about the profitability of investment. On the other hand, payback period method gives the information about time required to recover the cost of investment.

Therefore, to analyse the budgeting of an investment both the methods are equally important.

Want to see more full solutions like this?

Chapter 13 Solutions

Accounting Information Systems

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

- Can you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardHow is the debt-to-equity ratio calculated, and what does it indicate? helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning