INTERMEDIATE FINANCIAL MANAGEMENT

14th Edition

ISBN: 9780357516669

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 11P

Scenario Analysis

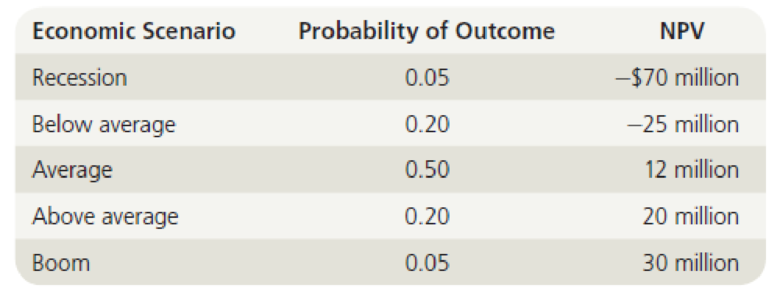

Shao Industries is considering a proposed project for its capital budget. The company estimates the project’s

What are the project’s expected NPV, standard deviation, and coefficient of variation?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Which of the following is NOT a type of derivative in finance?a) Futuresb) Optionsc) Bondsd) Swaps

Please answer this question properly and no ai.

What is a dividend yield? a) Total dividends paid by a company b) Dividend per share as a percentage of stock price c) Net income retained by a company d) Annual return on investment

Don't use tool .

What is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investment

Chapter 13 Solutions

INTERMEDIATE FINANCIAL MANAGEMENT

Ch. 13 - Define each of the following terms:

Project cash...Ch. 13 - Prob. 2QCh. 13 - Why is it true, in general, that a failure to...Ch. 13 - Prob. 4QCh. 13 - Prob. 5QCh. 13 - Prob. 6QCh. 13 - Why are interest charges not deducted when a...Ch. 13 - Prob. 8QCh. 13 - Prob. 9QCh. 13 - Distinguish among beta (or market) risk,...

Ch. 13 - Prob. 11QCh. 13 - New-Project Analysis

The Campbell Company is...Ch. 13 - Scenario Analysis Shao Industries is considering a...Ch. 13 - Prob. 1MCCh. 13 - Prob. 2MCCh. 13 - Prob. 3MCCh. 13 - Prob. 5MCCh. 13 - Prob. 6MCCh. 13 - Calculate the cash flows for each year. Based on...Ch. 13 - Prob. 8MCCh. 13 - (1) What are the three types of risk that are...Ch. 13 - Prob. 12MCCh. 13 - Prob. 13MCCh. 13 - What is a real option? What are some types of real...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need help in this question! What is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investmentarrow_forwardPlease help me in this question quickly! What is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investmentarrow_forwardNo chatgpt !! What is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investmentarrow_forward

- What is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investment need help!arrow_forwardWhat is a dividend yield?a) Total dividends paid by a companyb) Dividend per share as a percentage of stock pricec) Net income retained by a companyd) Annual return on investmentarrow_forwardProvide correct solution! What does ROI stand for in finance? A) Return on InvestmentB) Revenue on InvestmentC) Rate of InterestD) Risk of Investmentarrow_forward

- Need help!! Which type of risk can be eliminated through diversification?a) Market riskb) Systematic riskc) Unsystematic riskd) Inflation riskarrow_forwardWhat is the term for the difference between a bond's face value and its market price?a) Yieldb) Premium or discountc) Principald) Accrued interestarrow_forwardWhich type of risk can be eliminated through diversification?a) Market riskb) Systematic riskc) Unsystematic riskd) Inflation riskarrow_forward

- No AI What is the term for the difference between a bond's face value and its market price?a) Yieldb) Premium or discountc) Principald) Accrued interestarrow_forwardDon't use ChatGPT!! A company has a profit margin of 14 percent on sales of $35,000,000. If the company has total assets of $29,500,000, and an after-tax interest cost on total debt of 4.2 percent, what is the company's ROA? a. 12.91% b. 19.41% C. 12.01% d. 16.61% e. 15.11%arrow_forwardI need help in this question! Don't use ChatGPT!! A company has a profit margin of 14 percent on sales of $35,000,000. If the company has total assets of $29,500,000, and an after-tax interest cost on total debt of 4.2 percent, what is the company's ROA? a. 12.91% b. 19.41% C. 12.01% d. 16.61% e. 15.11%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License