1.

Prepare the transaction in the sales journal, cash receipts journal and general journal and verify the total column and rule the column.

1.

Explanation of Solution

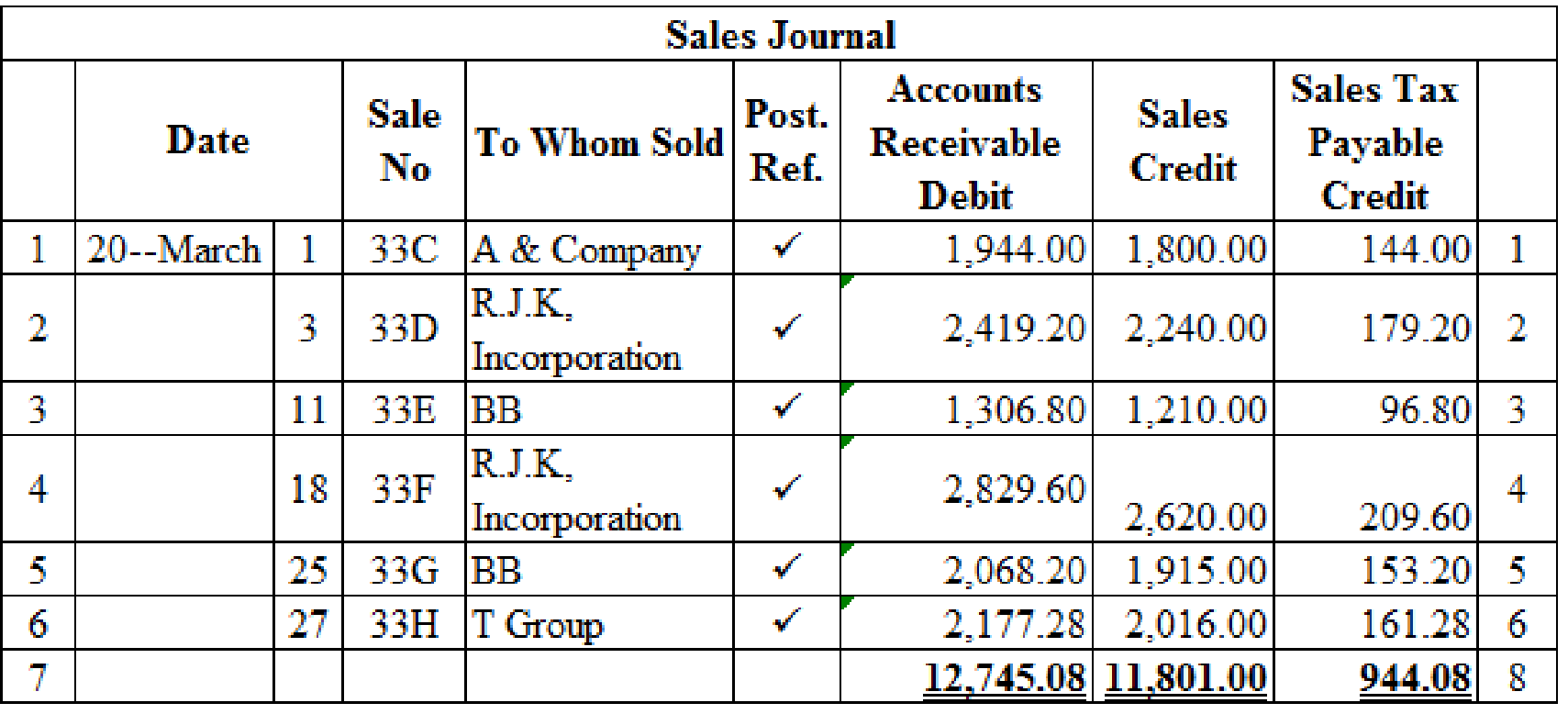

Sales Journal

Sales journal is one form of special journal book, which records all the sales transactions that are sold to customers on credit. In a single column sales journal, debit aspect of accounts receivable and credit aspect of inventory are recorded, and then posted to individual subsidiary customer account.

Prepare the given transaction in a sales journal and verify the total column and rule the column:

Table (1)

Working note 1:

Calculate the amount of accounts receivable (debit) on dated 1st March:

Working note 2:

Calculate the amount of accounts receivable (debit) on dated 3rd March:

Working note 3:

Calculate the amount of accounts receivable (debit) on dated 11th March:

Working note 4:

Calculate the amount of accounts receivable (debit) on dated 18th March:

Working note 5:

Calculate the amount of accounts receivable (debit) on dated 25th March:

Working note 6:

Calculate the amount of accounts receivable (debit) on dated 27th March:

Verification of total debit and credit column:

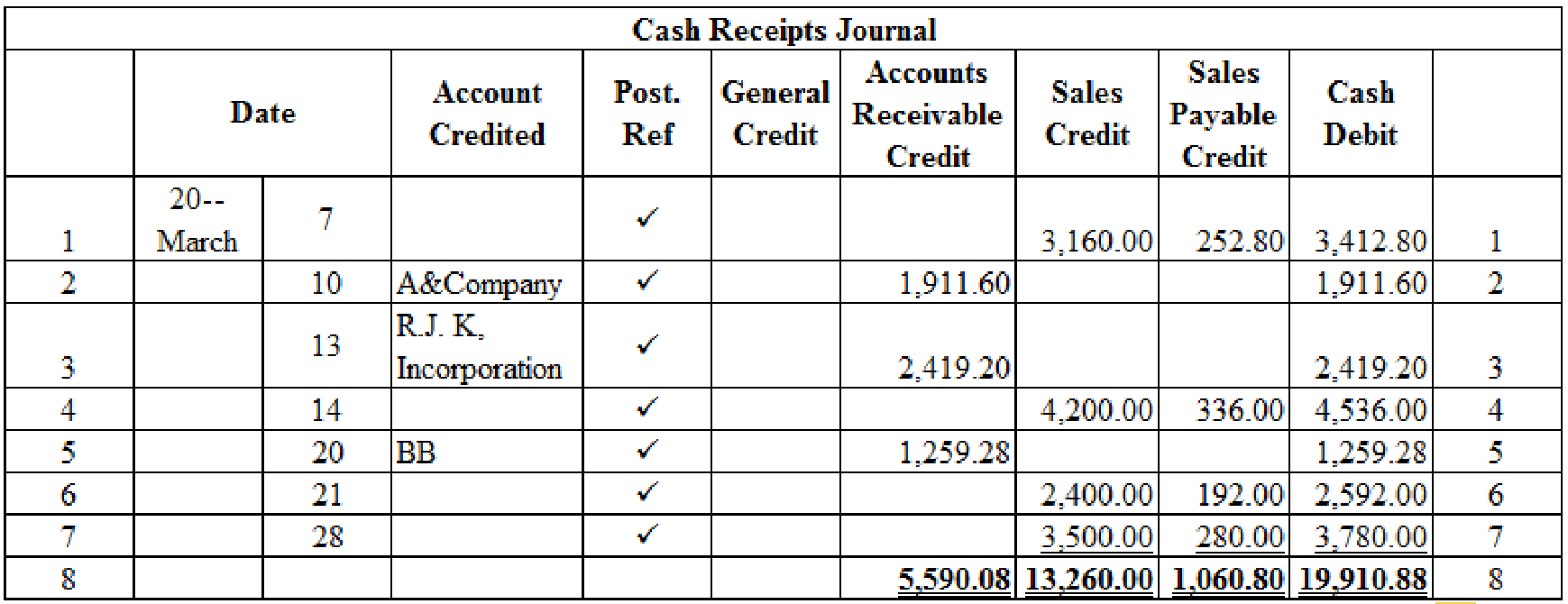

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column:

Table (2)

Working note 1:

Calculate the amount of cash on dated 7th March:

Working note 2:

Calculate the amount of cash on dated 14th March:

Working note 3:

Calculate the amount of cash on dated 21st March:

Working note 4:

Calculate the amount of cash on dated 28th March:

Verification of total debit and credit column:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on March 5:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| March | 5 | Sales Returns and Allowances | 401.1 | 30.00 | ||

| Sales Tax Payable | 231 | 2.40 | ||||

| Accounts Receivable, A &Company | 122/✓ | 32.40 | ||||

| (Record merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A &Company is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note:

Compute sales tax payable amount.

Transaction on March 16:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| March | 16 | Sales Returns and Allowances | 401.1 | 44.00 | ||

| Sales Tax Payable | 231 | 3.52 | ||||

| Accounts Receivable, BB | 122/✓ | 47.52 | ||||

| (Record merchandise returned) | ||||||

Table (4)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, BB is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 1:

Compute sales tax payable amount.

Working note 2:

Compute accounts receivable amount.

2.

Post the prepared journals to the general ledger, and the accounts receivable ledger accounts.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 1 | Balance | ✓ | 9,741.00 | |||

| 31 | CR9 | 19,910.88 | 29,651.88 | ||||

Table (5)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 1 | Balance | ✓ | 1,058.25 | |||

| 5 | J5 | 32.40 | 1,025.85 | ||||

| 16 | J5 | 47.52 | 978.33 | ||||

| 31 | S6 | 12,745.08 | 13,723.41 | ||||

| 31 | CR9 | 5,590.08 | 8,133.33 | ||||

Table (6)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 5 | J5 | 2.40 | 2.40 | |||

| 16 | J5 | 3.52 | 5.92 | ||||

| 31 | S6 | 944.08 | 938.16 | ||||

| 31 | CR9 | 1,060.80 | 1,998.96 | ||||

Table (7)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 31 | S6 | 11,801.00 | 11,801.00 | |||

| 31 | CR9 | 13,260.00 | 25,061.00 | ||||

Table (8)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| March | 5 | J5 | 30.00 | 30.00 | |||

| 16 | J5 | 44.00 | 74.00 | ||||

Table (9)

Post the journals to the accounts receivable ledger:

| NAME Corporation A & Company | ||||||

| ADDRESS 1424 J Creek Road, N, In 47448-2245 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 1 | S6 | 1,944.00 | 1,944.00 | ||

| 5 | J5 | 32.40 | 1,911.60 | |||

| 10 | CR9 | 1,911.60 | 0 | |||

Table (10)

| NAME BB | ||||||

| ADDRESS 6422 E. B Road, B, In 47401-7756 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 11 | S6 | 1,306.80 | 1,306.80 | ||

| 16 | J5 | 47.52 | 1,259.28 | |||

| 20 | CR9 | 1,259.28 | 0 | |||

| 25 | S6 | 2,068.20 | 2,068.20 | |||

Table (11)

| NAME RJ Incorporation | ||||||

| ADDRESS 3315 l Avenue, B, in 47401-7223 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 3 | S6 | 2,419.20 | 2,419.20 | ||

| 13 | CR9 | 2,419.20 | 0 | |||

| 18 | S6 | 2,829.60 | 2,829.60 | |||

Table (12)

| NAME T Group | ||||||

| ADDRESS 2300 E. National Road, Cd, IN 46229-4824 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| March | 1 | Balance | ✓ | 1,058.25 | ||

| 27 | S6 | 2,177.28 | 3,235.53 | |||

Table (13)

Want to see more full solutions like this?

Chapter 12 Solutions

EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardin the “Problems – Series A” section 8-19A of Ch. 8, “Performance Evaluation” of Fundamentals of Managerial Accounting Concepts. Scenario: The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $25,290 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, you, the treasurer, prepared the following budget for the Year 2 luncheon. Usin Excel—showing all work and formulas—to complete the following: I need help Preparing a flexible budget. Computing the sales volume variance and the variable cost volume variances based on a comparison between the master budget and the flexible budget. And Computing flexible budget variances by comparing the flexible budget with the actual results.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

- Cher Enterprises reported net income of $2,100,000. The average total liabilities were $6,800,000 and the average total stockholders' equity was $7,400,000. Interest expense was $250,000 and the tax rate was 30%. What is the return on assets ratio?arrow_forwardThe manufacturing overhead is_.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning