a.

Prepare the

a.

Explanation of Solution

Stockholders’ equity section: The section of balance sheet which reports the changes in stock, paid-in capital,

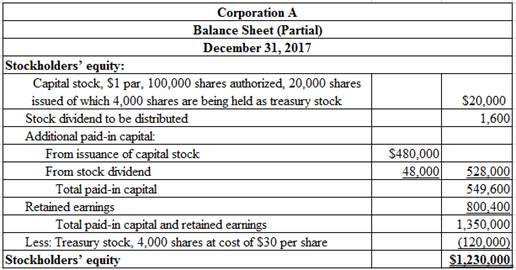

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2017.

Table (1)

Working Notes:

Compute the capital stock value.

Compute the amount of stock dividends to be distributed.

Step 1: Compute the number of shares to be distributed as stock dividends.

Step 2: Compute the amount of stock dividends to be distributed (Refer to Equation (1) for stock dividend shares value).

Compute additional paid-in capital from issuance of stock.

Compute additional paid-in capital from stock dividends (Refer to Equation (1) for stock dividend shares).

Compute amount of retained earnings for the year ended December 31, 2017.

Step 1: Compute amount of retained earnings distributable for stock dividends (Refer to Equation (1) for stock dividend shares value).

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2017 | |

| Retained earnings, January 1, 2017 | $0 |

| Add: Net income | 850,000 |

| 850,000 | |

| Less: Stock dividends | (49,600) |

| Retained earnings, December 31, 2017 | $800,400 |

Table (2)

Note: Refer to Equation (2) for value and computation of stock dividends.

Thus, the total stockholders’ equity of Corporation M December 31, 2017 is $1,230,000.

b.

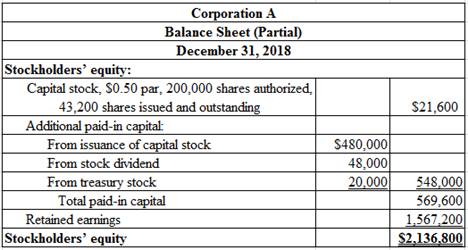

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2018.

b.

Explanation of Solution

Prepare the stockholders’ equity section of the balance sheet for Corporation A at December 31, 2018.

Table (3)

Working Notes:

Compute the number of shares issued and outstanding, after the stock dividend and stock split transactions.

Compute the capital stock value (Refer to Equation (3) for value of number of shares issued and outstanding).

Compute additional paid-in capital value from treasury stock.

Compute amount of retained earnings for the year ended December 31, 2018.

Step 1: Compute amount of cash dividends.

Step 2: Compute amount of retained earnings.

| Corporation A | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2018 | |

| Retained earnings, January 1, 2018 | $800,400 |

| Add: Net income | 810,000 |

| 1,610,400 | |

| Less: Cash dividends | (43,200) |

| Retained earnings, December 31, 2018 | $1,567,200 |

Table (4)

Note: Refer to Table (2) for value and computation of opening retained earnings balance, and Equation (4) for value and computation of cash dividends.

Thus, the total stockholders’ equity of Corporation A at December 31, 2018 is $1,567,200.

Want to see more full solutions like this?

Chapter 12 Solutions

GEN COMBO FINANCIAL & MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardMaple Grove Enterprises purchased land and a building for cash of $1,050,000.arrow_forwardSterling Fabrication Ltd. operates at a normal capacity of30,000 direct labor hours. The company’s variable manufacturing overhead is $39,000, and its fixed overhead is $21,000 when operating at normal capacity. What is its standard manufacturing overhead rate per unit(per direct labor hour)?arrow_forward

- If the liabilities of a company increased RM75,000 during a period of time and the owner's equity in the company increased RM15,000 during the same period, the assets of the company must have: A. Decreased RM90,000 B. Increased RM60,000 C. Increased RM90,000 D. Decreased RM60,000arrow_forwardThe best estimate of the total variable cost per unit isarrow_forwardWhat is the beginning and ending amount of equity ?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education