a.

Prepare the

a.

Explanation of Solution

Stockholders’ equity section: The section of balance sheet which reports the changes in stock, paid-in capital,

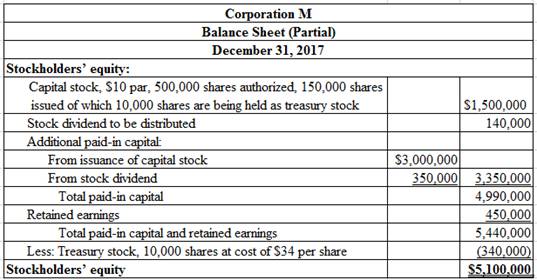

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2017.

Table (1)

Working Notes:

Compute the capital stock value.

Compute the amount of stock dividends to be distributed.

Step 1: Compute the number of shares to be distributed as stock dividends.

Step 2: Compute the amount of stock dividends to be distributed (Refer to Equation (1) for stock dividend shares value).

Compute additional paid-in capital from issuance of stock.

Compute additional paid-in capital from stock dividends (Refer to Equation (1) for stock dividend shares).

Compute amount of retained earnings for the year ended December 31, 2017.

Step 1: Compute amount of retained earnings distributable for stock dividends (Refer to Equation (1) for stock dividend shares value).

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2017 | |

| Retained earnings, January 1, 2017 | $0 |

| Add: Net income | 940,000 |

| 940,000 | |

| Less: Stock dividends | (490,000) |

| Retained earnings, December 31, 2017 | $450,000 |

Table (2)

Note: Refer to Equation (2) for value and computation of stock dividends.

Thus, the total stockholders’ equity of Corporation M December 31, 2017 is $5,100,000.

b.

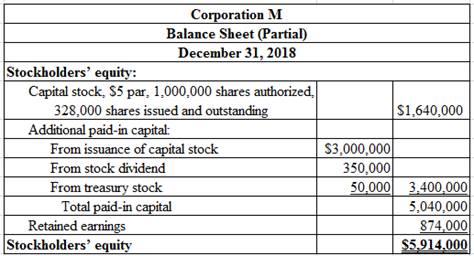

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2018.

b.

Explanation of Solution

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2018.

Table (3)

Working Notes:

Compute the number of shares issued and outstanding, after the stock dividend and stock split transactions.

Compute the capital stock value (Refer to Equation (3) for value of number of shares issued and outstanding).

Compute additional paid-in capital value from treasury stock.

Compute amount of retained earnings for the year ended December 31, 2018.

Step 1: Compute amount of cash dividends.

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2018 | |

| Retained earnings, January 1, 2018 | $450,000 |

| Add: Net income | 1,080,000 |

| 1,530,000 | |

| Less: Cash dividends | (656,000) |

| Retained earnings, December 31, 2018 | $874,000 |

Table (4)

Note: Refer to Table (2) for value and computation of opening retained earnings balance, and Equation (4) for value and computation of cash dividends.

Thus, the total stockholders’ equity of Corporation M at December 31, 2018 is $5,914,000.

Want to see more full solutions like this?

Chapter 12 Solutions

Connect Online Access for Financial Accounting

- Merin Manufacturing produces a single product and follows a JIT policy where ending inventory must equal 20% of the next month's sales. It estimates that July's ending inventory will consist of 32,000 units. August and September sales are estimated to be 210,000 and 225,000 units, respectively. Merin assigns variable overhead at a rate of $4.25 per unit of production. Fixed overhead equals $385,000 per month. Compute the number of units to be produced and the total budgeted overhead that would appear on the factory overhead budget for the month of August.arrow_forwardNina Manufacturing had a Work in Process balance of $79,000 on January 1, 2021. The year-end balance of Work in Process was $87,000 and the Cost of Goods Manufactured was $560,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2021.arrow_forwardFind outarrow_forward

- Hello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardQuintana Corporation projected current year sales of 42,000 units at a unit sale price of $32.50. Actual current year sales were 39,500 units at $33.75 per unit. Actual variable costs, budgeted at $22.75 per unit, totaled $21.90 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $392,000. What is the sales volume variance for total revenue? I want answerarrow_forwardWhat is hemingway corporation taxable income?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education