a.

Prepare the

a.

Explanation of Solution

Stockholders’ equity section: The section of balance sheet which reports the changes in stock, paid-in capital,

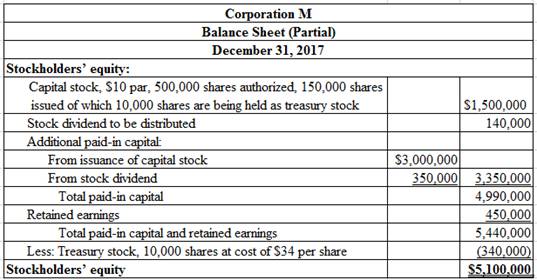

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2017.

Table (1)

Working Notes:

Compute the capital stock value.

Compute the amount of stock dividends to be distributed.

Step 1: Compute the number of shares to be distributed as stock dividends.

Step 2: Compute the amount of stock dividends to be distributed (Refer to Equation (1) for stock dividend shares value).

Compute additional paid-in capital from issuance of stock.

Compute additional paid-in capital from stock dividends (Refer to Equation (1) for stock dividend shares).

Compute amount of retained earnings for the year ended December 31, 2017.

Step 1: Compute amount of retained earnings distributable for stock dividends (Refer to Equation (1) for stock dividend shares value).

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2017 | |

| Retained earnings, January 1, 2017 | $0 |

| Add: Net income | 940,000 |

| 940,000 | |

| Less: Stock dividends | (490,000) |

| Retained earnings, December 31, 2017 | $450,000 |

Table (2)

Note: Refer to Equation (2) for value and computation of stock dividends.

Thus, the total stockholders’ equity of Corporation M December 31, 2017 is $5,100,000.

b.

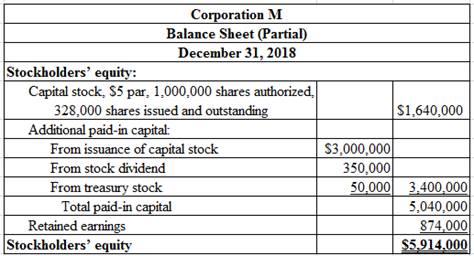

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2018.

b.

Explanation of Solution

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2018.

Table (3)

Working Notes:

Compute the number of shares issued and outstanding, after the stock dividend and stock split transactions.

Compute the capital stock value (Refer to Equation (3) for value of number of shares issued and outstanding).

Compute additional paid-in capital value from treasury stock.

Compute amount of retained earnings for the year ended December 31, 2018.

Step 1: Compute amount of cash dividends.

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2018 | |

| Retained earnings, January 1, 2018 | $450,000 |

| Add: Net income | 1,080,000 |

| 1,530,000 | |

| Less: Cash dividends | (656,000) |

| Retained earnings, December 31, 2018 | $874,000 |

Table (4)

Note: Refer to Table (2) for value and computation of opening retained earnings balance, and Equation (4) for value and computation of cash dividends.

Thus, the total stockholders’ equity of Corporation M at December 31, 2018 is $5,914,000.

Want to see more full solutions like this?

Chapter 12 Solutions

FINANCIAL ACCOUNTING (LOOSELEAF)

- Summit Industries' accounting records reflect the following inventories: Dec. 31, 2021 Dec. 31, 2020 Raw materials inventory: $250,000 $230,000 Work in process inventory: $350,000 $300,000 During 2021, $500,000 of raw materials were purchased, direct labor costs amounted to $600,000, and manufacturing overhead incurred was $520,000. Calculate Summit Industries' total cost of goods manufactured in 2021.arrow_forwardBrahma Manufacturing uses a job order cost system and applies overhead based on estimated rates. The overhead application rate is based on total estimated overhead costs of $310,000 and direct labor hours of 10,500. During the month of March 2022, actual direct labor hours of 11,200 were incurred. Use this information to determine the amount of factory overhead that was applied in March. (Round the answer to the nearest whole dollar.)arrow_forwardGeneral Accountingarrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education