a.

Prepare the

a.

Explanation of Solution

Stockholders’ equity section: The section of balance sheet which reports the changes in stock, paid-in capital,

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2017.

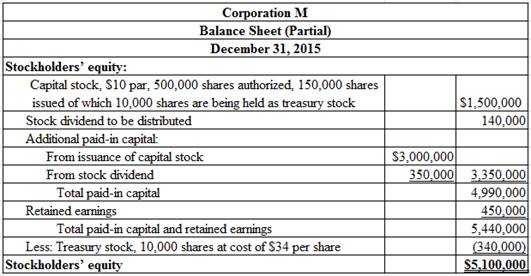

Table (1)

Working Notes:

Compute the capital stock value.

Compute the amount of stock dividends to be distributed.

Step 1: Compute the number of shares to be distributed as stock dividends.

Step 2: Compute the amount of stock dividends to be distributed (Refer to Equation (1) for stock dividend shares value).

Compute additional paid-in capital from issuance of stock.

Compute additional paid-in capital from stock dividends (Refer to Equation (1) for stock dividend shares).

Compute amount of retained earnings for the year ended December 31, 2015.

Step 1: Compute amount of retained earnings distributable for stock dividends (Refer to Equation (1) for stock dividend shares value).

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2015 | |

| Retained earnings, January 1, 2015 | $0 |

| Add: Net income | 940,000 |

| 940,000 | |

| Less: Stock dividends | (490,000) |

| Retained earnings, December 31, 2015 | $450,000 |

Table (2)

Note: Refer to Equation (2) for value and computation of stock dividends.

Thus, the total stockholders’ equity of Corporation M December 31, 2015 is $5,100,000.

b.

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2016.

b.

Explanation of Solution

Prepare the stockholders’ equity section of the balance sheet for Corporation M at December 31, 2016.

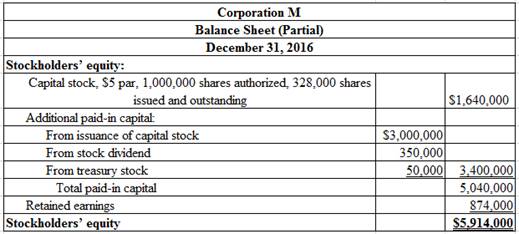

Table (3)

Working Notes:

Compute the number of shares issued and outstanding, after the stock dividend and stock split transactions.

Compute the capital stock value (Refer to Equation (3) for value of number of shares issued and outstanding).

Compute additional paid-in capital value from treasury stock.

Compute amount of retained earnings for the year ended December 31, 2016.

Step 1: Compute amount of cash dividends.

Step 2: Compute amount of retained earnings.

| Corporation M | |

| Statement of Retained Earnings | |

| For the Year Ended December 31, 2016 | |

| Retained earnings, January 1, 2018 | $450,000 |

| Add: Net income | 1,080,000 |

| 1,530,000 | |

| Less: Cash dividends | (656,000) |

| Retained earnings, December 31, 2016 | $874,000 |

Table (4)

Note: Refer to Table (2) for value and computation of opening retained earnings balance, and Equation (4) for value and computation of cash dividends.

Thus, the total stockholders’ equity of Corporation M at December 31, 2016 is $5,914,000.

Want to see more full solutions like this?

Chapter 12 Solutions

Financial & Managerial Accounting

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education