1.

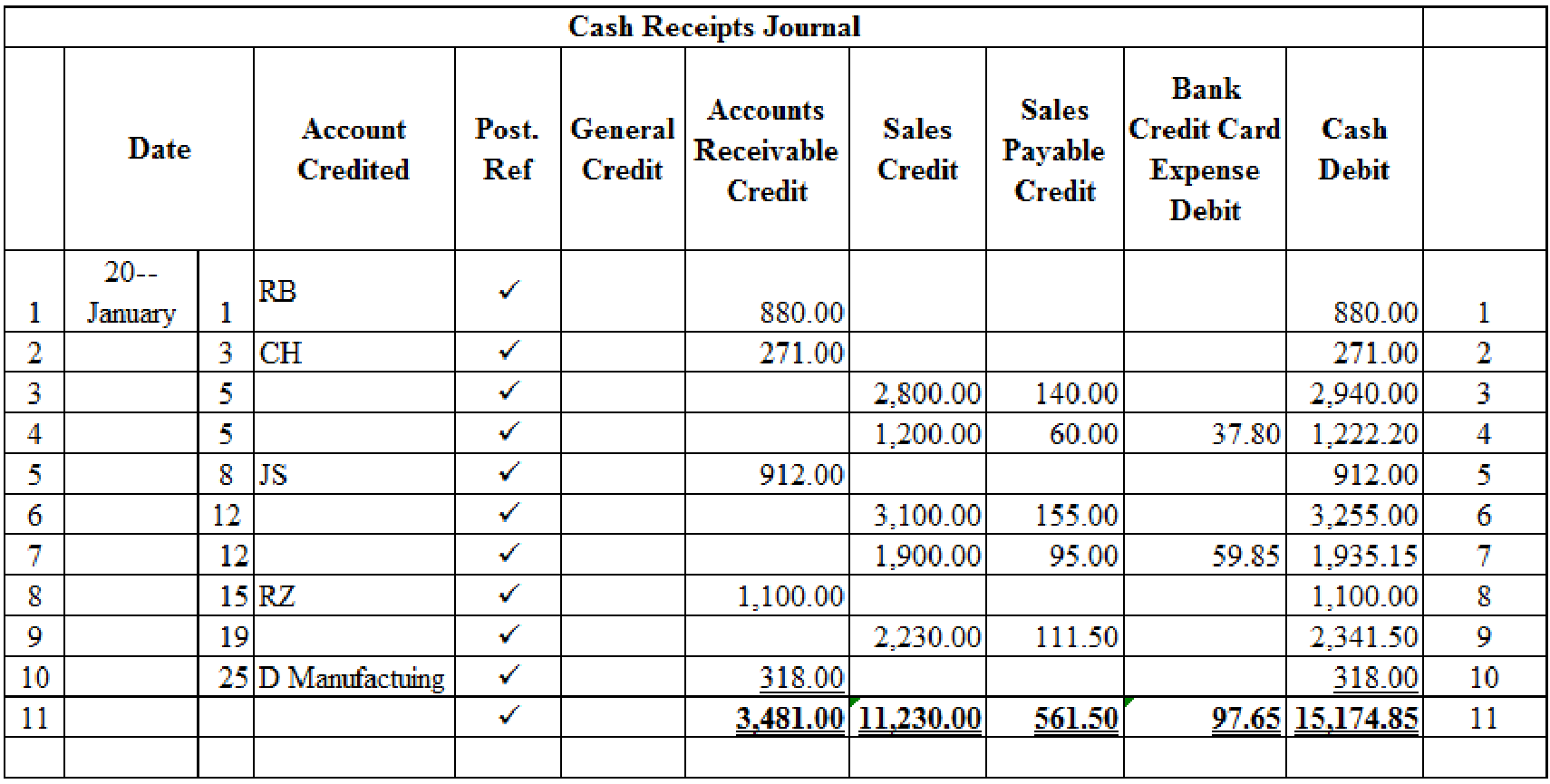

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances.

1.

Explanation of Solution

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances:

Table (1)

Verification of total debit and credit column:

Working note 1:

Calculate the amount of cash on dated 5th January:

Working note 2:

Calculate the amount of bank credit card expense on dated 5th January:

Working note 3:

Calculate the amount of cash on dated 5th January:

Working note 4:

Calculate the amount of cash on dated 12th January:

Working note 5:

Calculate the amount of bank credit card expense on dated 12th January:

Working note 6:

Calculate the amount of cash on dated 12th January:

Working note 7:

Calculate the amount of cash on dated 19th January:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on January 11:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 11 | Sales Returns and Allowances | 401.1 | 40.00 | ||

| Sales Tax Payable | 231 | 2.00 | ||||

| Accounts Receivable, MA | 122/✓ | 42.00 | ||||

| (Record merchandise returned) | ||||||

Table (2)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

Transaction on January 18:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 21 | Sales Returns and Allowances | 401.1 | 31.00 | ||

| Sales Tax Payable | 231 | 1.55 | ||||

| Accounts Receivable, RZ | 122/✓ | 32.55 | ||||

| (Record merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, RZ is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

2.

Post the prepared journal to the general ledger, and to the accounts receivable ledger.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 1 | Balance | ✓ | 2,890.75 | |||

| 31 | CR10 | 15,174.85 | 18,065.60 | ||||

Table (4)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 1 | Balance | ✓ | 6,300.00 | |||

| 11 | J8 | 42.00 | 6,258.00 | ||||

| 21 | J8 | 32.55 | 6,225.45 | ||||

| 31 | CR10 | 3,481.00 | 2,744.45 | ||||

Table (5)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 11 | J8 | 2.00 | 2.00 | |||

| 21 | J8 | 1.55 | 3.55 | ||||

| 31 | CR10 | 561.50 | 557.95 | ||||

Table (6)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 31 | CR10 | 11,230.00 | 11,230.00 | |||

Table (7)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 11 | J8 | 40.00 | 40.00 | |||

| 21 | J8 | 31.00 | 71.00 | ||||

Table (8)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 31 | CR10 | 97.65 | 97.65 | |||

Table (9)

Post the journals to the accounts receivable ledger.

| NAME RB | ||||||

| ADDRESS 229 SE 65th Avenue, P, Or 97215-1451 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 1,400.00 | ||

| 1 | CR10 | 880.00 | 520.00 | |||

| 11 | J8 | 42.00 | 478.00 | |||

Table (10)

| NAME D Manufacturing | ||||||

| ADDRESS 447 6th Avenue, F Staff, AZ 86004-6842 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 318.00 | ||

| 25 | CR10 | 318.00 | 0 | |||

Table (11)

| NAME CH | ||||||

| Address 1462 N. S Blvd., Los Cruces, Nm 88012-7791 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | 815 | |||||

| January | 1 | Balance | ✓ | 271 | 544 | |

| 3 | CR10 | |||||

Table (12)

| NAME JS | ||||||

| ADDRESS 5997 Blackgold Lane, G, TX 76051-2366 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 1,481.00 | ||

| 20 | CR10 | 912.00 | 569.00 | |||

Table (13)

| NAME RZ | ||||||

| ADDRESS 6881 S Drive, San D, CA 92127-8671 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 2,286.00 | ||

| 15 | CR10 | 1,100.00 | 1,186.00 | |||

| 18 | J8 | 32.55 | 1,153.45 | |||

Table (14)

Want to see more full solutions like this?

Chapter 12 Solutions

College accounting, chapters 1-9

- Everton Production forecasts that total overhead for the current year will be $8,400,000 and that total machine hours will be 180,000 hours. Year to date, the actual overhead is $9,100,000, and the actual machine hours are 195,000 hours. Suppose Everton Production uses a predetermined overhead rate based on machine hours for applying overhead as of this point in time (year to date). In that case, what is the amount of overapplied or underapplied overhead?arrow_forwardHelparrow_forwardDid owner's equity increase or decrease?arrow_forward

- I want Answerarrow_forwardReferring to section “The WH Framework for Business Ethics” of Ch. 2, “Business Ethics” of Dynamic Business Law for information on the WH Framework. Reviewing the scenario and complete the activity below. This scenario can also be found in the “Questions & Problems” section of Ch. 2, “Business Ethics” in Dynamic Business Law. Scenerio Steven J. Trzaska was the head of L’Oreal USA’s regional patent team, managing the procedure by which the company patented products. As an attorney barred in Pennsylvania, Trzaska had to adhere to professional rules of conduct established by the Supreme Court of Pennsylvania in addition to rules promulgated by the US Patent and Trademark Office (USPTO). In 2014, L’Oreal S.A., the French parent company of L’Oreal USA, enacted a global quota of patent applications each regional office had to file each year. Employees were informed that failure to meet the quota would negatively impact their careers and even their continued employment at L’Oreal.…arrow_forwardNot use ai solution please and accounting questionarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub