1.

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances.

1.

Explanation of Solution

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

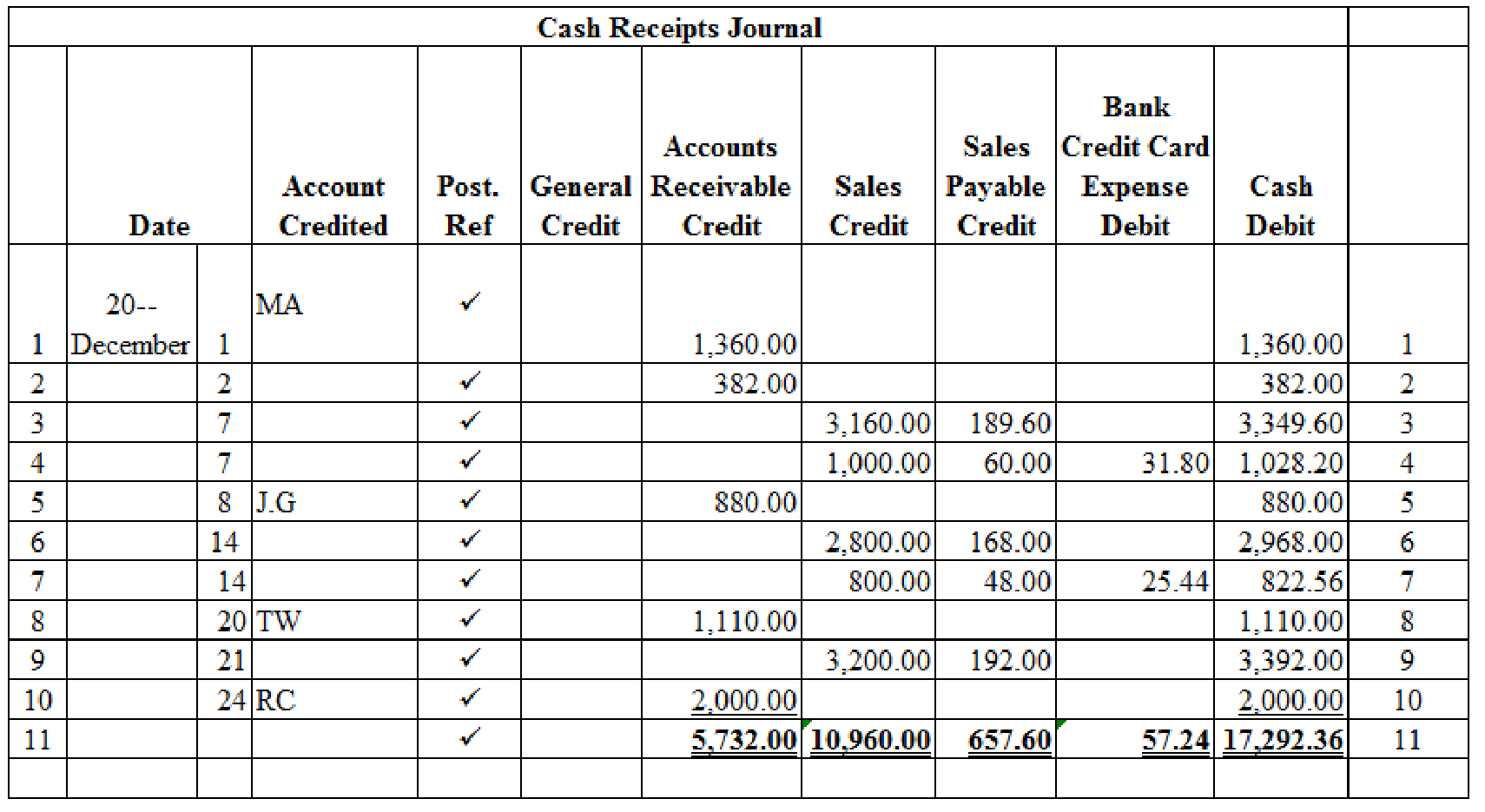

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances:

Table (1)

Verification of total debit and credit column:

Working note 1:

Calculate the amount of cash on dated 7th December:

Working note 2:

Calculate the amount of bank credit card expense on dated 7th December:

Working note 3:

Calculate the amount of cash on dated 7th December:

Working note 4:

Calculate the amount of cash on dated 14th December:

Working note 5:

Calculate the amount of bank credit card expense on dated 14th December:

Working note 6:

Calculate the amount of cash on dated 14th December:

Working note 7:

Calculate the amount of cash on dated 21st December:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on December 11:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 11 | Sales Returns and Allowances | 401.1 | 60.00 | ||

| Sales Tax Payable | 231 | 3.60 | ||||

| Accounts Receivable, MA | 122/✓ | 63.60 | ||||

| (To record the merchandise returned) | ||||||

Table (2)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

Transaction on December 21:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 21 | Sales Returns and Allowances | 401.1 | 22.00 | ||

| Sales Tax Payable | 231 | 1.32 | ||||

| Accounts Receivable, A Manufacturing | 122/✓ | 23.32 | ||||

| (To record the merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A Manufacturing is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount;

2.

Post the prepared journal to the general ledger, and to the accounts receivable ledger.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,862.00 | |||

| 31 | CR10 | 17,292.36 | 27,154.36 | ||||

Table (4)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,352.00 | |||

| 11 | J8 | 63.60 | 9,288.40 | ||||

| 21 | J8 | 23.32 | 9,265.08 | ||||

| 31 | CR10 | 5,732.00 | 3,533.08 | ||||

Table (5)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 3.60 | 3.60 | |||

| 21 | J8 | 1.32 | 4.92 | ||||

| 31 | CR10 | 657.60 | 652.68 | ||||

Table (6)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 10,960.00 | 10,960.00 | |||

Table (7)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 60.00 | 60.00 | |||

| 21 | J8 | 22.00 | 82.00 | ||||

Table (8)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 57.24 | 57.24 | |||

Table (9)

Post the journals to the accounts receivable ledger.

| NAME MA | ||||||

| ADDRESS 233 W 11th Avenue, D, Mi 59500-1154 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 2,480.00 | ||

| 1 | CR10 | 1,360.00 | 1,120.00 | |||

| 11 | J8 | 63.60 | 1,056.40 | |||

Table (10)

| NAME A Manufacturing | ||||||

| ADDRESS 284 W 88 Street, D, Mi 59522-1168 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 982.00 | ||

| 2 | CR10 | 382.00 | 600.00 | |||

| 21 | J8 | 23.32 | 576.68 | |||

Table (11)

| NAME JG | ||||||

| ADDRESS P.O. Box 864, D, Mi 59552-0864 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 880.00 | ||

| 8 | CR10 | 880.00 | 0 | |||

Table (12)

| NAME TW | ||||||

| ADDRESS 100 N w S Street., D, Mi 59210-1337 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 1,810.00 | ||

| 20 | CR10 | 1,110.00 | 700.00 | |||

Table (13)

| NAME RC | ||||||

| ADDRESS 11312 Fourteenth Avenue South, D, Mi 59221-1142 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 3,200.00 | ||

| 24 | CR10 | 2,000.00 | 1,200.00 | |||

Table (14)

Want to see more full solutions like this?

Chapter 12 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

- How can I solve this financial accounting problem using the appropriate financial process?arrow_forwardhow much overhead cost would be assigned to product G98X using the activity based costing system ?arrow_forwardThe closing price of a stock is $74.55, and the net earnings per share are $3.50. The stock's P/E ratio is .arrow_forward

- Cariman contracts delivery drivers to service customers. Cariman owns the vans and pays for the gas. With reference to the following independent situations for Cariman, determine where (a) responsibility and (b) controllability lie. Suggest what might be done to solve the problem or to improve the situation: (20 marks)a) In the manufacturing plant the production manager is not happy with the material that the purchasing manager has been purchasing. In May the production manager stops requesting materials from the supply warehouse, and starts purchasing them directly from a different materials supplier. Actual materials costs in May are higher than budgeted.b) Overhead costs in the manufacturing plant for June are much higher than budgeted. Investigation reveals a utility rate hike in effect that was not figured into the budget.arrow_forwardprovide correct option please accounting questionarrow_forwardNeed help this question general accountingarrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardGeneral accounting questionarrow_forwardThe Snape Corporation has the following data for 2014: Selling price per unit $10 Variable costs per unit $6 Fixed costs Units sold $20,000 12,000 Snape's 2014 operating leverage is: a) 0.50 b) 2.00 c) 4.00 d) 1.71arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning