1.

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances.

1.

Explanation of Solution

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column and use the general journal to record the sales returns and allowances:

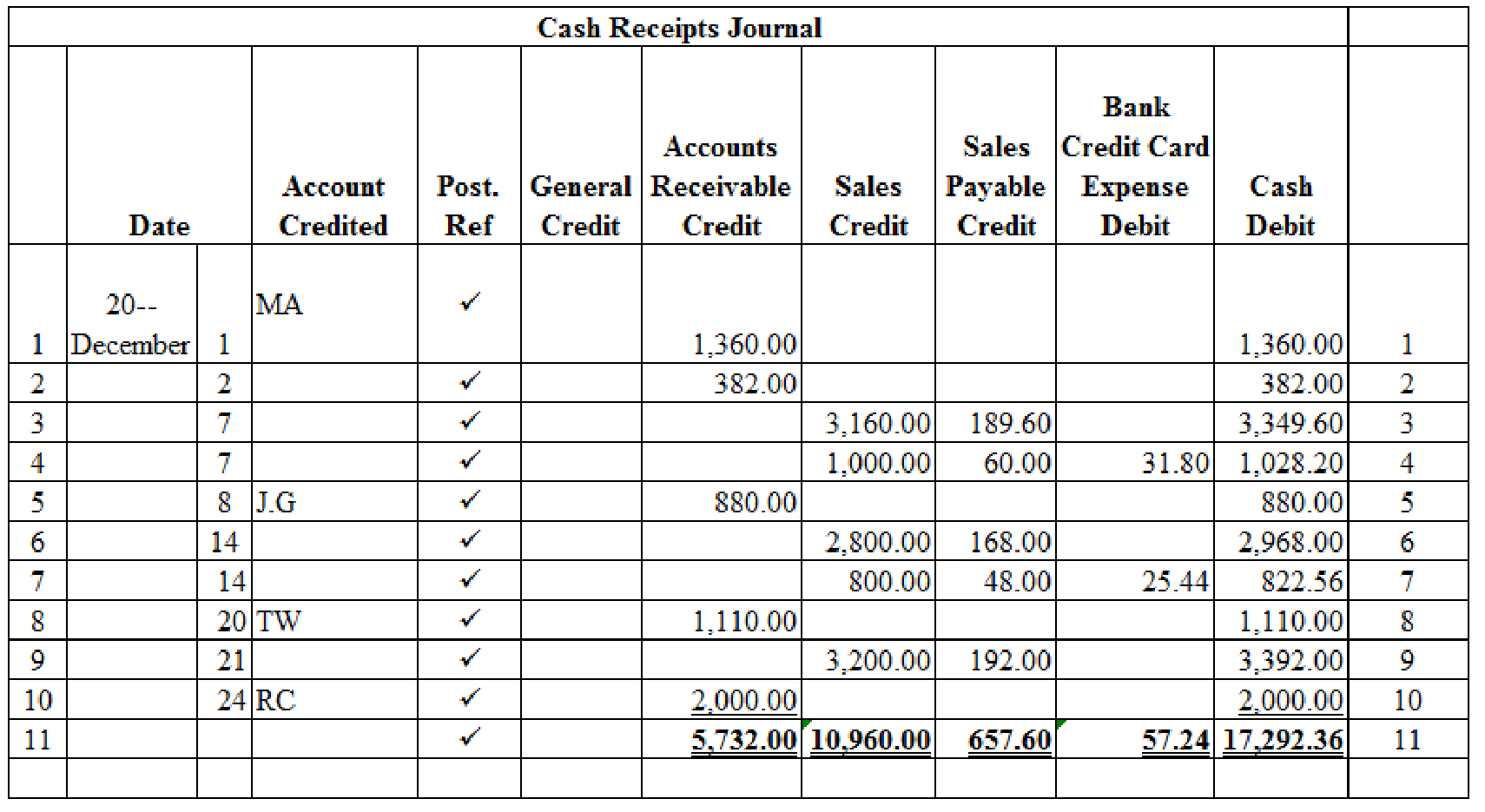

Table (1)

Verification of total debit and credit column:

Working note 1:

Calculate the amount of cash on dated 7th December:

Working note 2:

Calculate the amount of bank credit card expense on dated 7th December:

Working note 3:

Calculate the amount of cash on dated 7th December:

Working note 4:

Calculate the amount of cash on dated 14th December:

Working note 5:

Calculate the amount of bank credit card expense on dated 14th December:

Working note 6:

Calculate the amount of cash on dated 14th December:

Working note 7:

Calculate the amount of cash on dated 21st December:

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on December 11:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 11 | Sales Returns and Allowances | 401.1 | 60.00 | ||

| Sales Tax Payable | 231 | 3.60 | ||||

| Accounts Receivable, MA | 122/✓ | 63.60 | ||||

| (To record the merchandise returned) | ||||||

Table (2)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount.

Transaction on December 21:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| December | 21 | Sales Returns and Allowances | 401.1 | 22.00 | ||

| Sales Tax Payable | 231 | 1.32 | ||||

| Accounts Receivable, A Manufacturing | 122/✓ | 23.32 | ||||

| (To record the merchandise returned) | ||||||

Table (3)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, A Manufacturing is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working note 1:

Compute the sales tax payable amount.

Working note 2:

Compute the accounts receivable amount;

2.

Post the prepared journal to the general ledger, and to the accounts receivable ledger.

2.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,862.00 | |||

| 31 | CR10 | 17,292.36 | 27,154.36 | ||||

Table (4)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 1 | Balance | ✓ | 9,352.00 | |||

| 11 | J8 | 63.60 | 9,288.40 | ||||

| 21 | J8 | 23.32 | 9,265.08 | ||||

| 31 | CR10 | 5,732.00 | 3,533.08 | ||||

Table (5)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 3.60 | 3.60 | |||

| 21 | J8 | 1.32 | 4.92 | ||||

| 31 | CR10 | 657.60 | 652.68 | ||||

Table (6)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 10,960.00 | 10,960.00 | |||

Table (7)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 11 | J8 | 60.00 | 60.00 | |||

| 21 | J8 | 22.00 | 82.00 | ||||

Table (8)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| December | 31 | CR10 | 57.24 | 57.24 | |||

Table (9)

Post the journals to the accounts receivable ledger.

| NAME MA | ||||||

| ADDRESS 233 W 11th Avenue, D, Mi 59500-1154 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 2,480.00 | ||

| 1 | CR10 | 1,360.00 | 1,120.00 | |||

| 11 | J8 | 63.60 | 1,056.40 | |||

Table (10)

| NAME A Manufacturing | ||||||

| ADDRESS 284 W 88 Street, D, Mi 59522-1168 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 982.00 | ||

| 2 | CR10 | 382.00 | 600.00 | |||

| 21 | J8 | 23.32 | 576.68 | |||

Table (11)

| NAME JG | ||||||

| ADDRESS P.O. Box 864, D, Mi 59552-0864 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 880.00 | ||

| 8 | CR10 | 880.00 | 0 | |||

Table (12)

| NAME TW | ||||||

| ADDRESS 100 N w S Street., D, Mi 59210-1337 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 1,810.00 | ||

| 20 | CR10 | 1,110.00 | 700.00 | |||

Table (13)

| NAME RC | ||||||

| ADDRESS 11312 Fourteenth Avenue South, D, Mi 59221-1142 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| December | 1 | Balance | ✓ | 3,200.00 | ||

| 24 | CR10 | 2,000.00 | 1,200.00 | |||

Table (14)

Want to see more full solutions like this?

Chapter 12 Solutions

CENGAGENOWV2 FOR HEINTZ/PARRY'S COLLEGE

- Questin 5arrow_forwardBelle Garments manufactures customized T-shirts for football teams. The business uses a perpetual inventory system and has a highly labour-intensive production process, so it assigns manufacturing overhead based on direct labour cost. The business operates at a profit margin of 33% on sales. Belle Garments expects to incur $2,205,000 of manufacturing overhead costs and estimated direct labour costs of $3,150,000 during 2025. At the end of December 2024, Belle Line Garments reported work in process inventory of $93,980 - Job FBT 101 - $51,000 & Job FBT 102 - $42,980 The following events occurred during January 2025. i) Purchased materials on account, $388,000. The purchase attracted freight charges of $4,000 ii) Incurred manufacturing wages of $400,000 iii) Requisitioned direct materials and used direct labour in manufacturing. Job # FBT 101 FBT 102 FBT 103 FBT 104 Direct Materials $70,220 97,500 105,300 117,000 iv) Issued indirect materials to production, $30,000. Direct Labour $61,200…arrow_forwardThe trial balance for K and J Nursery, Incorporated, listed the following account balances at December 31, 2024, the end of its fiscal year: cash, $27,000; accounts receivable, $22,000; inventory, $36,000; equipment (net), $91,000; accounts payable, $25,000; salaries payable, $10,500; interest payable, $6,500; notes payable (due in 18 months), $41,000; common stock, $72,000. Determine the year-end balance in retained earnings for K and J Nursery, Incorporated.arrow_forward

- Brun Company produces its product through two processing departments: Mixing and Baking. Information for the Mixing department follows. Direct Materials Conversion Unit Percent Complete Percent Complete Beginning work in process inventory 7.500 Units started this period 104,500 Units completed and transferred out 100.000 Ending work in process inventory 12.000 100% 25% Beginning work in process inventory Direct materials Conversion $6.800 14.500 $21.300 Costs added this period Drect materials 116,400 Conversion Total costs to account for 1.067,000 1.183.400 $1.204.700 Required 1. Prepare the Mixing department's production cost report for November using the weighted average method Check (1) C$1.000 2. Prepare the November 30 journal entry to transfer the cost of completed units from Mixing to Bakingarrow_forwardNonearrow_forwardNot need ai solution please solve this general accounting questionarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning