Concept explainers

Exercise 4-5A Allocating

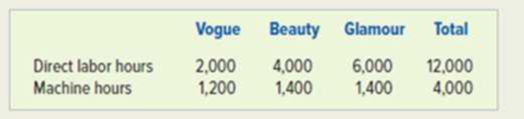

Tyson Hats Corporation manufactures three different models of hats: Vogue. Beauty, and Glamour. Tyson expects to incur $480,000 of overhead cost during the next fiscal year. Other budget information follows:

Required

a. Use direct labor hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

b. Use machine hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

c. Describe a set of circumstances where it would be more appropriate to use direct labor hours as the allocation base.

d. Describe a set of circumstances where it would be more appropriate to use machine hours as the allocation base.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Which inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationcorrect aarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identification needarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationarrow_forward

- no aiI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. need help but clear amswerarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyneedarrow_forwardNo AI The income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

- Please provide the correct answer with financial accounting questionarrow_forwardHi expert please given correct answer with accounting questionarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning