1.

Calculate the maximum machine annual operating cost of the overhauled AccDril for replacing decision.

1.

Explanation of Solution

Calculate the maximum machine annual operating cost of the overhauled AccDril for replacing decision as follows:

Working note (1):

Calculate the difference in the present value of

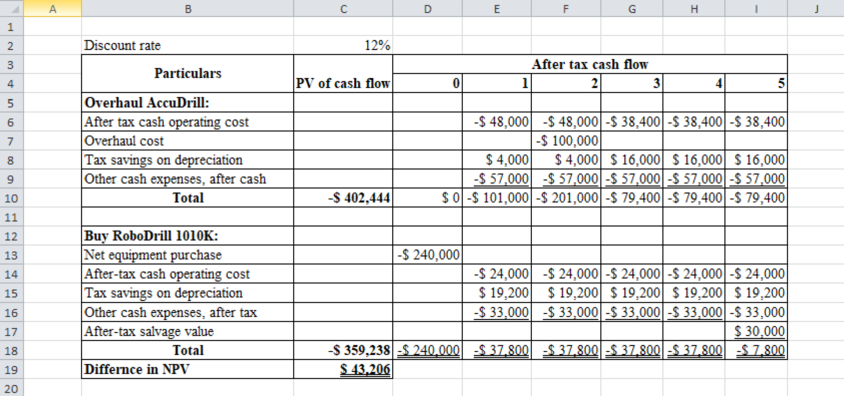

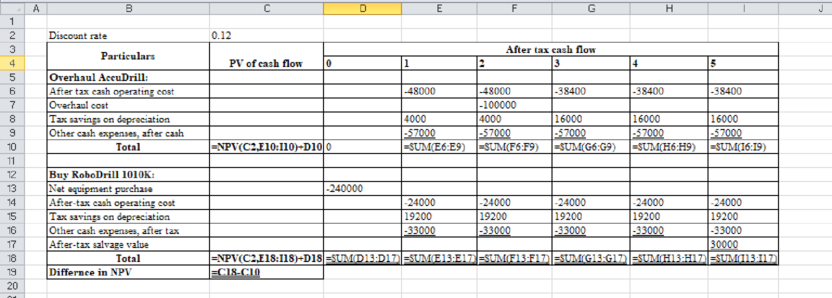

Table (1)

Table (2)

Note: Sum the PV factors from years 3, 4, and 5:

2.

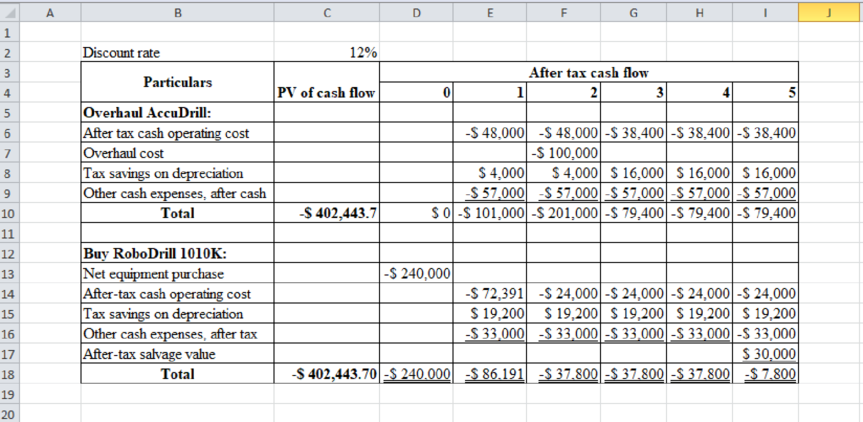

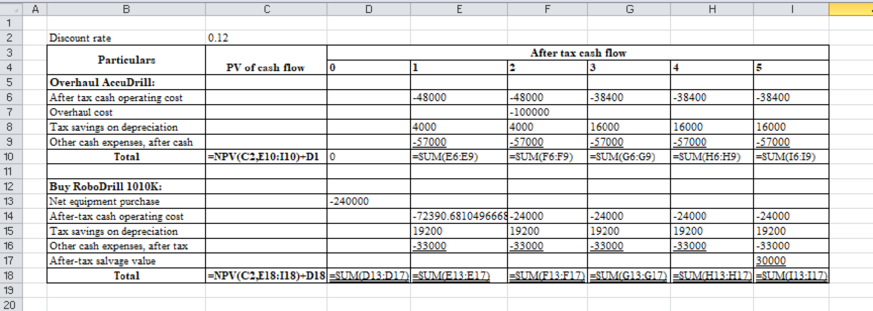

Calculate the maximum amount of annual after-tax operating cost for the new machine in order to change the decision using the Goal seek function in Excel.

2.

Explanation of Solution

Calculate the maximum amount of annual after-tax operating cost for the new machine in order to change the decision using the Goal seek function in Excel as follows:

Table (3)

Excel workings:

Table (4)

3.

State whether company should invest overhaul now and after 2 years or overhaul Accdrill for 2 years.

3.

Explanation of Solution

State whether company should invest overhaul now and after 2 years or overhaul Accdrill for 2 years as follows:

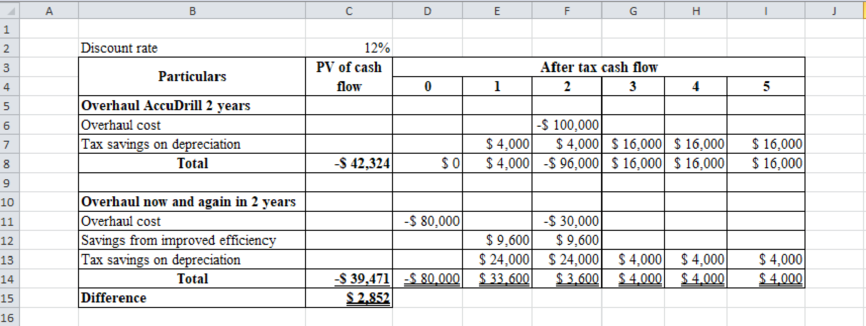

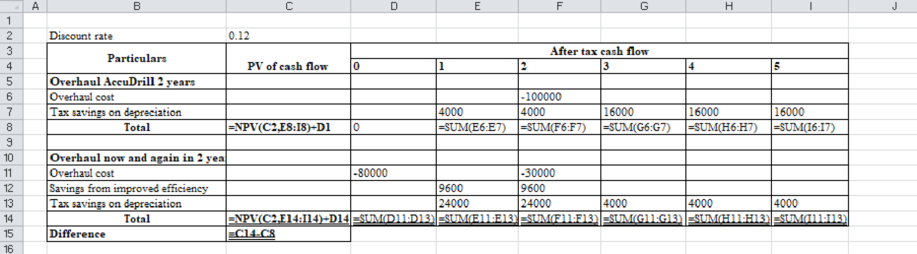

Table (5)

In this case, company can overhaul the machine now, because overhaul now and again in 2 years has favor difference and it has less negative

Excel workings:

Table (6)

Working note (2):

| Calculate the tax savings on | |

| Particulars | Amount($) |

| Depreciation expense per year (a) | $ 10,000 |

| Income tax rate (b) | 40% |

| Tax savings on depreciation, year 1 and 2 | $ 4,000 |

Table (7)

Working note (3):

| Calculate the tax savings on depreciation, year 3, 4 and 5 | |

| Particulars | Amount($) |

| Book value before overhaul | $ 20,000 |

| Add: Overhaul cost, year3 | $ 100,000 |

| Total amount to be depreciated (c ) | $ 120,000 |

| Number of years (d) | 3 |

| Depreciation expense per year (e ) | $ 40,000 |

| Income tax rate (f) | 40% |

| Tax saving on depreciation, year 3, 4 and 5 | $ 16,000 |

Table (8)

Working note (4):

| Overhaul now and again in two years | |

| Particulars | Amount($) |

| Savings from the improved productivity | $ 16,000 |

| Less: Income taxes on savings @40% | $ 6,400 |

| After tax savings | $ 9,600 |

Table (9)

Working note (5):

| Depreciation tax savings: year 1 and 2 | |

| Particulars | Amount($) |

| Book value at the time of overhaul | $ 40,000 |

| Add: Overhaul cost | $ 80,000 |

| Total amount to be depreciated (h) | $ 120,000 |

| Number of years (i) | 2 |

| Depreciation expense per year (j) | $ 60,000 |

| Tax rate (k) | 40% |

| Tax savings on depreciation | $ 24,000 |

Table (10)

Working note (6):

| Depreciation tax savings: year 3, 4 and 5 | |

| Particulars | Amount($) |

| Overhaul cost (l) | $ 30,000 |

| Number of years (m) | 3 |

| Depreciation expense per year (n) | $ 10,000 |

| Income tax rate (o) | 40% |

| Tax savings on depreciation | $ 4,000 |

Table (11)

4.

State whether company should overhaul now.

4.

Explanation of Solution

State whether company should overhaul now as follows:

The cost difference between the two alternatives is $2,852 that is less that 0.3%

Want to see more full solutions like this?

Chapter 12 Solutions

EBOOK COST MANAGEMENT

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardAssess the implications of the globalization of business operations on the harmonization of accounting practices across national boundaries. What challenges do multinational companies face in ensuring the comparability and consistency of their financial reporting, and how might international accounting standards help address these issues?arrow_forward

- The Terra corporation uses the straight-line method to depreciate its machinery. On March 1, 2022, the company purchased some machinery for $360,000. The machinery is estimated to have a useful life of eight years and a salvage value of $40,000. How much depreciation expense should Terra record for the machinery in the adjusting entry on December 31, 2022?arrow_forwardCorrect Answerarrow_forwardI need assistance with ths general accounting question using appropriate principles.arrow_forward

- What is the value of its total assets? Solve of general accounting questionarrow_forwardA company has total current assets of $742,000, total current liabilities of $316,000, total stockholders' equity of $1,457,000, total plant and equipment (net) of $1,225,000, total assets of $1,967,000, and total liabilities of $510,000. What is the company's working capital is?arrow_forwardThe balance sheets of Buffett Industries reported net fixed assets of $910,000 at the end of Year 1 and $670,000 at the end of Year 2. Net sales for Year 2 totaled $2,100,000. What is the fixed-asset turnover ratio for Year 2?arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardA business has $175,000 total liabilities. At start-up, the owners invested $425,000 in the business. Unfortunately, the business has suffered a cumulative loss of $145,000 up to the present time. What is the amount of its total assets at the present time?arrow_forwardWillow Café Co. purchased coffee roasting equipment for $62,000. The equipment has a salvage value of $6,000 and an expected useful life of 8 years. Using the declining balance method at double the straight-line rate, calculate the first year's depreciation expense. a) $15,500 b) $13,950 c) $12,400 d) $10,750arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education