1.

Calculate the maximum machine annual operating cost of the overhauled AccDril for replacing decision.

1.

Explanation of Solution

Calculate the maximum machine annual operating cost of the overhauled AccDril for replacing decision as follows:

Working note (1):

Calculate the difference in the present value of

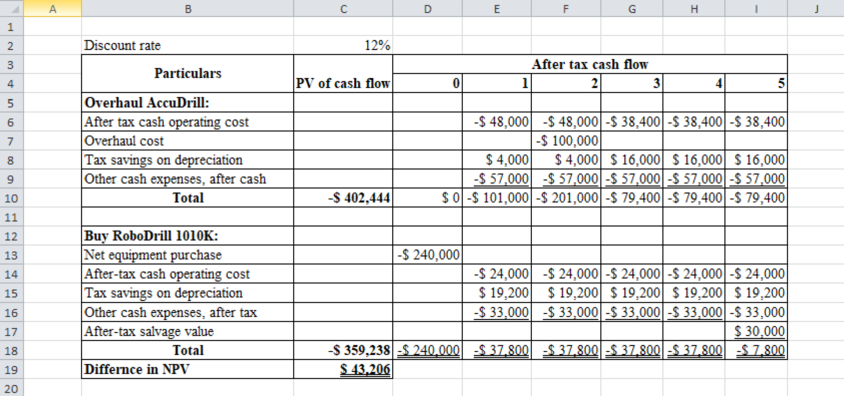

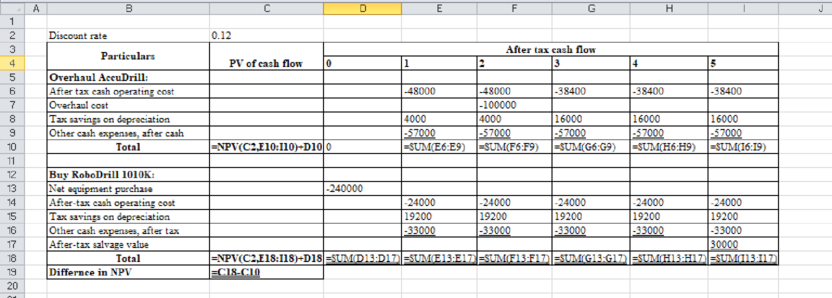

Table (1)

Table (2)

Note: Sum the PV factors from years 3, 4, and 5:

2.

Calculate the maximum amount of annual after-tax operating cost for the new machine in order to change the decision using the Goal seek function in Excel.

2.

Explanation of Solution

Calculate the maximum amount of annual after-tax operating cost for the new machine in order to change the decision using the Goal seek function in Excel as follows:

Table (3)

Excel workings:

Table (4)

3.

State whether company should invest overhaul now and after 2 years or overhaul Accdrill for 2 years.

3.

Explanation of Solution

State whether company should invest overhaul now and after 2 years or overhaul Accdrill for 2 years as follows:

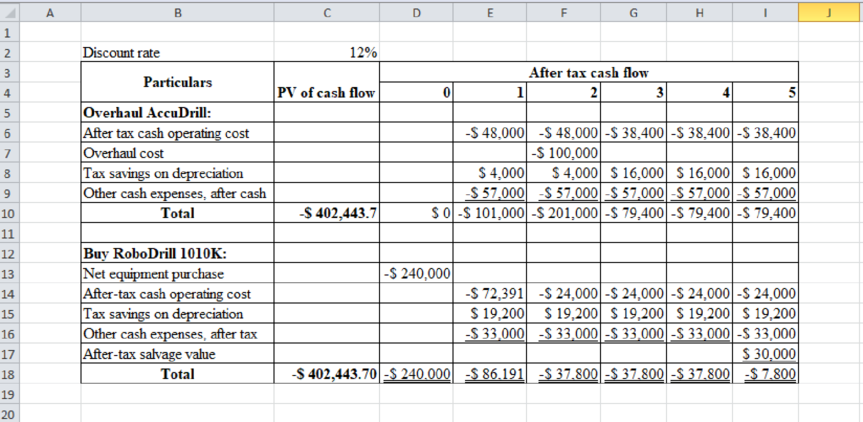

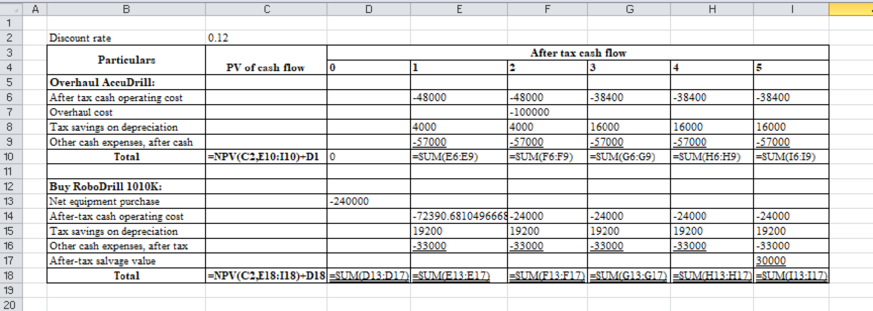

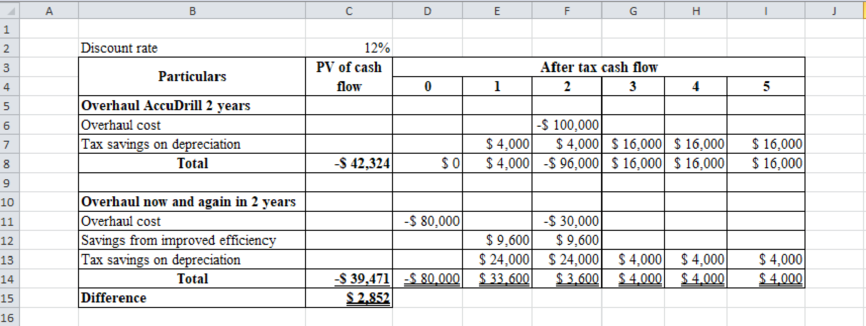

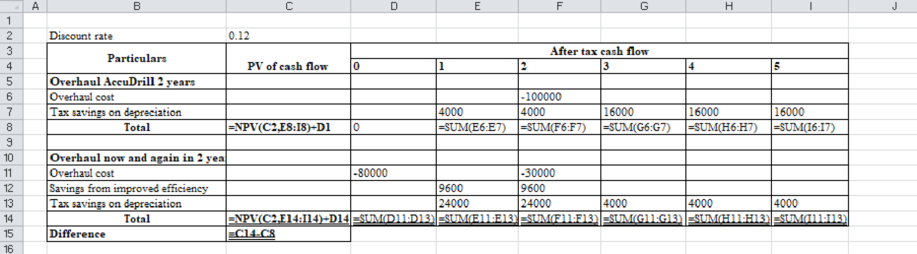

Table (5)

In this case, company can overhaul the machine now, because overhaul now and again in 2 years has favor difference and it has less negative

Excel workings:

Table (6)

Working note (2):

| Calculate the tax savings on | |

| Particulars | Amount($) |

| Depreciation expense per year (a) | $ 10,000 |

| Income tax rate (b) | 40% |

| Tax savings on depreciation, year 1 and 2 | $ 4,000 |

Table (7)

Working note (3):

| Calculate the tax savings on depreciation, year 3, 4 and 5 | |

| Particulars | Amount($) |

| Book value before overhaul | $ 20,000 |

| Add: Overhaul cost, year3 | $ 100,000 |

| Total amount to be depreciated (c ) | $ 120,000 |

| Number of years (d) | 3 |

| Depreciation expense per year (e ) | $ 40,000 |

| Income tax rate (f) | 40% |

| Tax saving on depreciation, year 3, 4 and 5 | $ 16,000 |

Table (8)

Working note (4):

| Overhaul now and again in two years | |

| Particulars | Amount($) |

| Savings from the improved productivity | $ 16,000 |

| Less: Income taxes on savings @40% | $ 6,400 |

| After tax savings | $ 9,600 |

Table (9)

Working note (5):

| Depreciation tax savings: year 1 and 2 | |

| Particulars | Amount($) |

| Book value at the time of overhaul | $ 40,000 |

| Add: Overhaul cost | $ 80,000 |

| Total amount to be depreciated (h) | $ 120,000 |

| Number of years (i) | 2 |

| Depreciation expense per year (j) | $ 60,000 |

| Tax rate (k) | 40% |

| Tax savings on depreciation | $ 24,000 |

Table (10)

Working note (6):

| Depreciation tax savings: year 3, 4 and 5 | |

| Particulars | Amount($) |

| Overhaul cost (l) | $ 30,000 |

| Number of years (m) | 3 |

| Depreciation expense per year (n) | $ 10,000 |

| Income tax rate (o) | 40% |

| Tax savings on depreciation | $ 4,000 |

Table (11)

4.

State whether company should overhaul now.

4.

Explanation of Solution

State whether company should overhaul now as follows:

The cost difference between the two alternatives is $2,852 that is less that 0.3%

Want to see more full solutions like this?

Chapter 12 Solutions

COST MANAGMENT WITH CONNECT ACCESS

- Hello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardOn March 1, 20X1, your company,which uses Units-of-Production (UOP) Depreciation, purchases a machine for $300,000.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education