Cost Allocations: Comparison of Dual and Single Rates

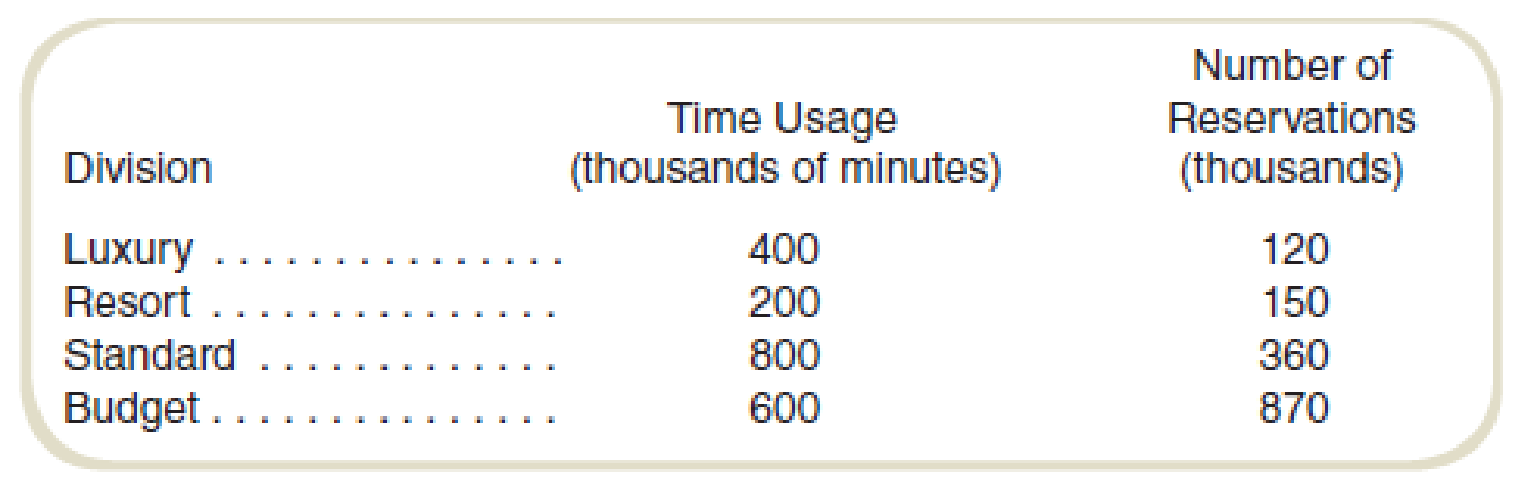

Pacific Hotels operates a centralized call center for the reservation needs of its hotels. Costs associated with use of the center are charged to the hotel group (luxury, resort, standard, and budget) based on the length of time of calls made (time usage). Idle time of the reservation agents, time spent on calls in which no reservation is made, and the fixed cost of the equipment are allocated based on the number of reservations made in each group. Due to recent increased competition in the hotel industry, the company has decided that it is necessary to better allocate its costs in order to price its services competitively and profitably. During the most recent period for which data are available, the use of the call center for each hotel group was as follows:

During this period, the cost of the call center amounted to $840,000 for personnel and $650,000 for equipment and other costs.

Required

- a. Determine the allocation to each of the divisions using the following:

- 1. A single rate based on time used.

- 2. Dual rates based on time used (for personnel costs) and number of reservations (for equipment and other cost).

- b. Write a short report to management explaining whether a single rate or dual rates should be used and why.

a.

Determine the allocation to each of the divisions using the following:

1. A single rate based on the time used.

2. Dual rates based on time used (for personnel costs) and some reservations (for equipment and other cost).

Explanation of Solution

Cost allocation:

Cost allocation is the process of distributing a common cost into the departments that have used the cost. The cost is allocated on the basis of the utilization of the resource.

1.

Allocation of total cost on the basis of a single rate based on time used:

| Particular |

The ratio of time usage (a) |

Amount |

| Luxury | 0.2 (1) | $298,000 |

| Resort | 0.1 (2) | $149,000 |

| Standard | 0.4 (3) | $596,000 |

| Budget | 0.3 (4) | $447,000 |

| Total cost | 1,490,000 |

Table: (1)

Thus, the total cost allocation for luxury, resort, standard and budget is $298,000, $149,000, $596,000 and $447,000.

Working note 1:

Calculate the ratio of time usage for luxury:

Working note 2:

Calculate the ratio of time usage for the resort:

Working note 3:

Calculate the ratio of time usage for standard:

Working note 4:

Calculate the ratio of time usage for luxury:

2.

Calculate the allocation of cost on Dual rates based on time used (for personnel costs) and some reservations (for equipment and other cost):

Allocation of cost for personnel costs:

| Particular |

The ratio of time usage (a) |

Amount |

| Luxury | 0.2 (1) | $168,000 |

| Resort | 0.1 (2) | $84,000 |

| Standard | 0.4 (3) | $336,000 |

| Budget | 0.3 (4) | $252,000 |

| Total cost | 840,000 |

Table: (2)

Thus, the personnel cost allocation for luxury, resort, standard and budget is $168,000, $84,000, $336,000 and $252,000.

Allocation of cost for equipment and other costs:

| Particular |

The ratio of the number of reservations (a) |

Amount |

| Luxury | 0.08 (1) | $52,000 |

| Resort | 0.1 (2) | $65,000 |

| Standard | 0.24 (3) | $156,000 |

| Budget | 0.58 (4) | $377,000 |

| Total cost | $650,000 |

Table: (3)

Thus, the personnel cost allocation for luxury, resort, standard and budget is $168,000, $84,000, $336,000 and $252,000.

Working note 5:

Calculate the ratio of the number of reservations for luxury:

Working note 6:

Calculate the ratio of the number of reservations for the resort:

Working note 7:

Calculate the ratio of the number of reservations for standard:

Working note 8:

Calculate the ratio of the number of reservations for luxury:

b.

Write a short report to management explaining whether a single rate or dual rates should be used and why.

Explanation of Solution

The cost should be allocated on the basis of the dual rate system.

In single rate allocation, the cost of equipment and other cost do not correlate with the time usage. So allocating the cost of equipment and other cost is not reasonable in this case.

Dual rate system has better correlation with the costs and usage. The cost of personnel’s is directly correlated with the time usage, and the cost of equipment and other cost are directly correlated with the number of reservations.

Thus, cost should be allocated on the basis of the dual rate system.

Want to see more full solutions like this?

Chapter 12 Solutions

FUND.OF COST ACCT >CUSTOM<

- Kindly help me with accounting questionsarrow_forwardCharlotte Metals' operating activities for the year are listed below: Beginning inventory $950,600 Ending inventory Purchases Sales revenue $420,700 $825,900 $1,601,850 Operating expenses $720.7* What is the cost of goods sold (COGS) for the year?arrow_forwardQuick answer of this accounting questionsarrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub