Analyze Performance Report for Decentralized Organization

Hall O’ Fame Products is a nationwide sporting goods manufacturer. The company operates with a widely based manufacturing and distribution system that has led to a highly decentralized management structure. Each division manager is responsible for producing and distributing corporate products in one of eight geographical areas of the country.

Division managers are evaluated using a performance measure that is calculated as the division’s contribution to corporate profits before taxes less a 20 percent investment charge on the division’s investment base. The investment base of each division is the sum of its year-end balances of

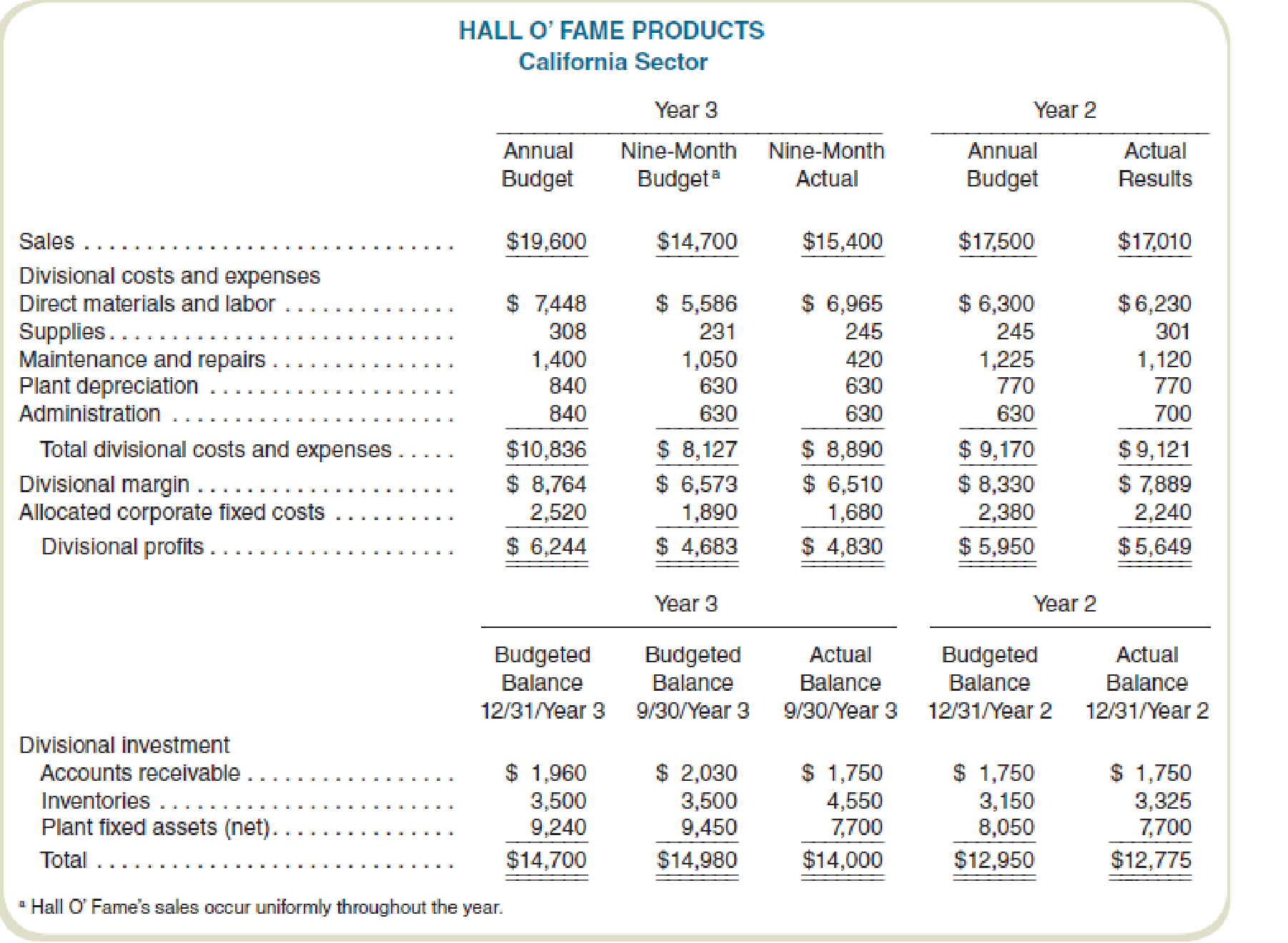

James Davenport, division manager for the California sector, prepared the year 2 and preliminary year 3 budgets for his division late in year 1. Final approval of the year 3 budget took place in late year 2 after adjustments for trends and other information developed during year 2. Preliminary work on the year 4 budget also took place at that time. In early October of year 3, Davenport asked the division controller to prepare a report that presents performance for the first nine months of year 3. The report follows:

Required

- a. Evaluate the performance of James Davenport for the nine months ending September 30, year 3. Support your evaluation with pertinent facts from the problem.

- b. Identify the features of Hall O’ Fame’s division performance measurement reporting and evaluation system that need to be revised if it is to effectively reflect the responsibilities of the divisional managers.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

FUNDAMENTALS OF COST ACCOUNTING BUNDLE

- Don't use ai given answer accounting questionsarrow_forwardRequirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: Period cost Product cost a. Depreciation on plant equipment Depreciation on salespersons' automobiles Insurance on plant building Marketing manager's salary Direct materials used Manufacturing overhead g. Electricity bill for human resources office h. Production employee wagesarrow_forwardI want to correct answer general accounting questionarrow_forward

- Tungsten, Inc. manufactures both normal and premium tube lights. The company allocates manufacturing over machine hours as the allocation base. Estimated overhead costs for the year are $108,000. Additional estimated information is given below. Machine hours (MHr) Direct materials Normal 23,000 $60,000 Premium 31,000 $480,000 Calculate the predetermined overhead allocation rate. (Round your answer to the nearest cent.) OA. $4.70 per direct labor hour OB. $3.48 per machine hour OC. $2.00 per machine hour OD. $0.20 per direct labor hourarrow_forward< Factory Utilities Indirect Materials Used $1,300 34,500 Direct Materials Used 301,000 Property Taxes on Factory Building 5,100 Sales Commissions 82,000 Indirect Labor Incurred 25,000 Direct Labor Incurred 150,000 Depreciation on Factory Equipment 6,300 What is the total manufacturing overhead?arrow_forwardDiscuss the financial reporting environment and financial statements. What is the purpose of accounting? What impact does the AICPA, FASB, and SEC play in accounting, particularly with regards to the financial statements?arrow_forward

- K Sunlight Design Corporation sells glass vases at a wholesale price of $3.50 per unit. The variable cost to manufacture is $1.75 per unit. The monthly fixed costs are $7,500. Its current sales are 27,000 units per month. If the company wants to increase its operating income by 30%, how many additional units must it sell? (Round any intermediate calculations to two decimal places and your final answer up to the nearest whole unit.) A. 7,500 glass vases OB. 33,815 glass vases OC. 6,815 glass vases D. 94,500 glass vasesarrow_forwardCan you help me with of this question general accountingarrow_forwardWhat is the correct option? General accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,