Concept explainers

Provide appropriate answer for (a) to (e).

Explanation of Solution

Provide appropriate answer for (a) to (e) as follows:

(a) Calculate the payback period for project A.

(b) Calculate the payback period for project B.

| Year | After tax cash inflows | Cumulative after tax cash inflows |

| 1 | $ 500 | $ 500 |

| 2 | $ 1,200 | $ 1,700 |

| 3 | $ 2,000 | $ 3,700 |

| 4 | $ 2,500 |

Table(1)

(c) Calculate the payback period for project C.

Working note (1):

Calculate the

Working note (2):

Calculate the taxable income each year.

Working note (3):

Calculate the annual after-tax net

(d) (1) Calculate the accounting rate of return based on the original investment of project D.

Working note (4):

Calculate the depreciation expense for project D.

Working note (5):

Calculate the operating income after tax for project D.

| Particulars | Amount ($) | Amount ($) |

| Sales | $ 4,000 | |

| Less: Expenses | ||

| Cash expenditures | $ 1,500 | |

| Depreciation (4) | $ 900 | $ 2,400 |

| Operating income before tax | $ 1,600 | |

| Less: Income tax @25% | $ 400 | |

| Operating income after tax | $ 1,200 |

Table (2)

(d) (2) Calculate the accounting rate of return based on the average investment of project D.

Working note (6):

Calculate the average book value.

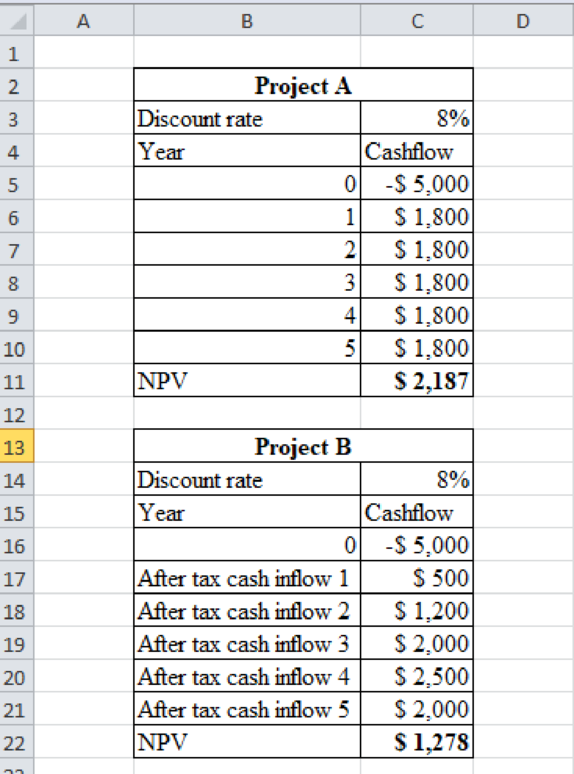

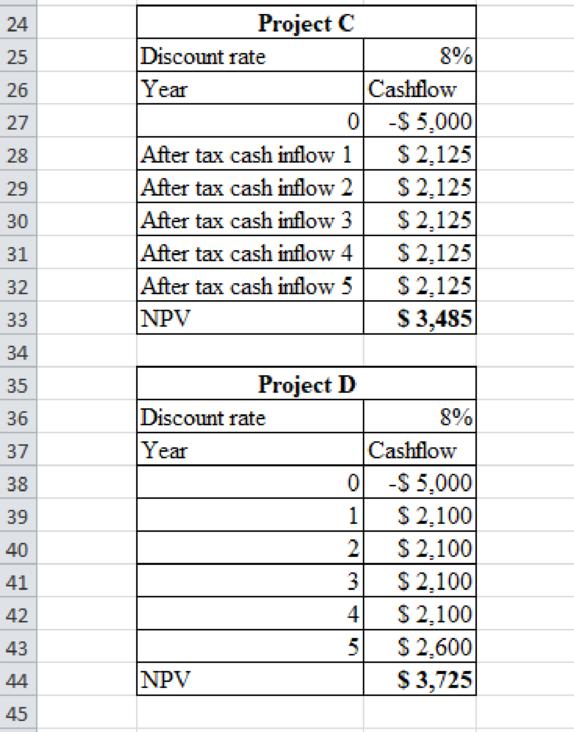

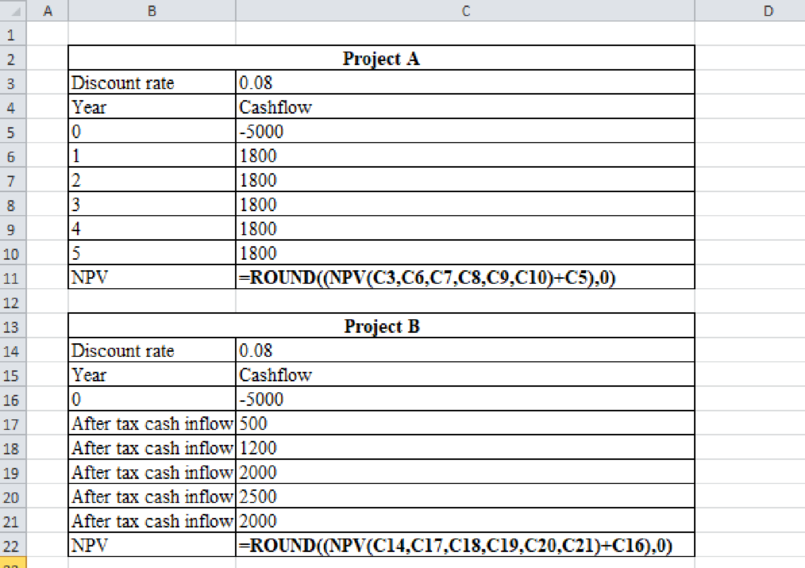

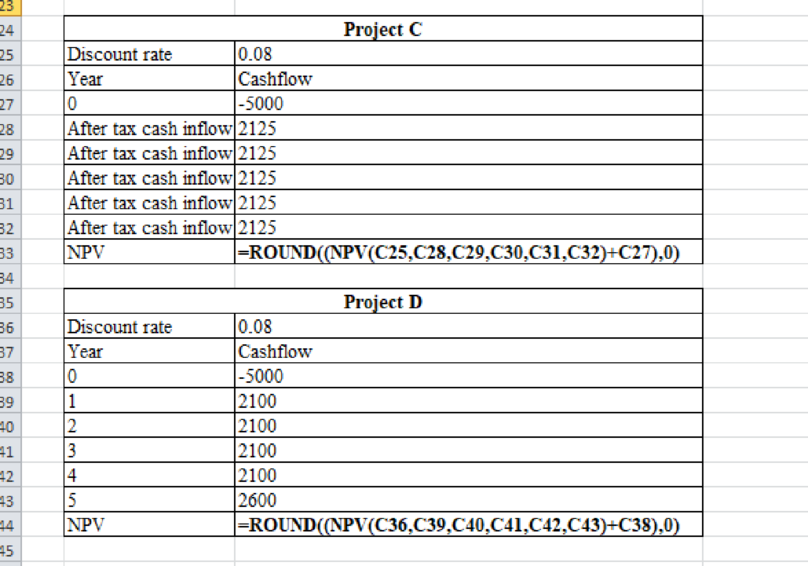

e. Calculate the net present value for project A, project B, project C and project D.

Table (3)

Workings:

Table (4)

Want to see more full solutions like this?

Chapter 12 Solutions

COST MANAGEMENT LOOSELEAF CUSTOM

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education