Concept explainers

Expected return:

Expected return of the market refers to the return earned from the market over and above the risk-free  is the return that an investor must demand for inflation and the time-value of money, even when there is hardly any risk of any financial loss. Risk premium varies with the systematic risk in an investment. It is the market risk premium multiplied by the beta (ß) of a security. It is determined as the market risk premium multiplied by the beta of the security. The market risk premium is equal to the expected market return less the return earned from risk-free security.

is the return that an investor must demand for inflation and the time-value of money, even when there is hardly any risk of any financial loss. Risk premium varies with the systematic risk in an investment. It is the market risk premium multiplied by the beta (ß) of a security. It is determined as the market risk premium multiplied by the beta of the security. The market risk premium is equal to the expected market return less the return earned from risk-free security.

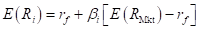

The expected return can be calculated using the formula given below.

Where,

is the expected return.

is the expected return. is the risk free rate of return.

is the risk free rate of return. is the beta of the asset.

is the beta of the asset. is the expected return of the market.

is the expected return of the market.

Beta:

Beta  measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta

measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta  of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

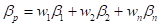

The beta  of a portfolio is the weighted average beta of the overall stocks in a portfolio.

of a portfolio is the weighted average beta of the overall stocks in a portfolio.

The beta  of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

Where,

is the beta of a portfolio.

is the beta of a portfolio. is the weight of a stock.

is the weight of a stock.

(a)

To determine:

The beta needed for the expectation to be consistent with the

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Fundamentals of Corporate Finance (3rd Edition) (Pearson Series in Finance)

- 4. A company has $100,000 in assets and $50,000 in liabilities. What is its equity? Need a helpful..???arrow_forward4. A company has a debt-to-equity ratio of 1:2. If debt is $200,000, what is equity?arrow_forward9. If a company's current ratio is 2 and its current liabilities are $50,000, what are its current assets?no chatgpt???arrow_forward

- 5. Calculate the return on equity (ROE) for a company with net income $150,000 and equity $750,000.arrow_forward6. What is the price of a bond with face value $1,000, coupon rate 8%, and market interest rate 10%?arrow_forward9. A company has fixed costs $50,000, variable costs $10/unit, and sells products at $20/unit. What is the break-even point?arrow_forward

- 8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). no gpt ..???arrow_forward8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). Need a helpful..??arrow_forward3. If a company's net income is $100,000 and it has 10,000 shares outstanding, what is the earnings per share (EPS)? Correctly answer..???arrow_forward

- 10. If a stock's dividend yield is 5% and stock price is $100, what is the annual dividend payment? no gpt..???arrow_forward8. A stock has a beta of 1.2 and the market return is 10%. If the risk-free rate is 2%, what is the expected return? need a ai ..???arrow_forwardA corporation buys on terms of 2/8, net 45 days, it does not take discountes, and it actually pays after 62 days, what is the effective annual percentage cost of its non-free trade credit? Use a 365-day year) keep to the 6th decimal place for accuracyarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education