EBK INTERMEDIATE ACCOUNTING: REPORTING

2nd Edition

ISBN: 9781305727557

Author: PAGACH

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 2RE

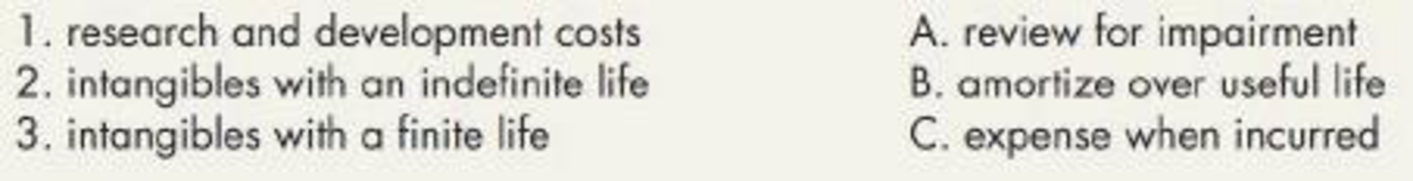

Match the following items with correct accounting treatment (A through C):

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

No Ai

3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidity need help

Financial Accounting Question Solution with Detailed Explanation and Correct Answer

Ivanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the

company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on

experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all

occur at December 31, 2025.)

In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor.

What balance will be reported as a current liability in the 2025 balance sheet with regard to these transactions?

Current Liabilities-

eTextbook and Media

List of Accounts

Assistance Used

Chapter 12 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

Ch. 12 - Prob. 1GICh. 12 - Prob. 2GICh. 12 - Prob. 3GICh. 12 - Prob. 4GICh. 12 - Prob. 5GICh. 12 - Prob. 6GICh. 12 - Prob. 7GICh. 12 - What activities are included in RD? Which are...Ch. 12 - What elements of RD activities does a company...Ch. 12 - How does a company record a patent worth 100,000...

Ch. 12 - Prob. 11GICh. 12 - Prob. 12GICh. 12 - Over how many years are patents amortized?...Ch. 12 - Prob. 14GICh. 12 - Prob. 15GICh. 12 - Prob. 16GICh. 12 - Prob. 17GICh. 12 - Prob. 18GICh. 12 - Prob. 19GICh. 12 - Prob. 20GICh. 12 - What is the proper time or time period over which...Ch. 12 - Prob. 2MCCh. 12 - Prob. 3MCCh. 12 - Which of the following assets typically are...Ch. 12 - Prob. 5MCCh. 12 - Prob. 6MCCh. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - Prob. 1RECh. 12 - Match the following items with correct accounting...Ch. 12 - Notting Hill Company incurred the following costs...Ch. 12 - Hook Corp. incurred the following start-up costs,...Ch. 12 - Prob. 5RECh. 12 - Prob. 6RECh. 12 - Prob. 7RECh. 12 - Prob. 8RECh. 12 - Prob. 9RECh. 12 - Prob. 10RECh. 12 - Prob. 1ECh. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Prob. 4ECh. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - KLK Clothing Company manufactures professional...Ch. 12 - Prob. 8ECh. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - Prob. 3PCh. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Prob. 8PCh. 12 - Prob. 9PCh. 12 - Prob. 10PCh. 12 - Prob. 11PCh. 12 - Prob. 1CCh. 12 - Prob. 2CCh. 12 - Prob. 3CCh. 12 - Prob. 4CCh. 12 - Prob. 5CCh. 12 - Prob. 6CCh. 12 - NBC paid 401 million for the rights to televise...Ch. 12 - Prob. 8C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

What is precedent, and how does it affect common law?

Business in Action

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forwardImpact Window Company makes storm-resistant windows. The company's sales manager estimated the sales volume to be 160,000 windows. Due to the increased hurricane activity this year, the total demand for this type of window increased from 800,000 windows to 1,000,000 windows. At the same time the company's market share fell from 20 percent to 15 percent. The company's standard contribution margin is $15.00 per window. What is the company's market share variance? Multiple Choice $740,000 favorable $740,000 unfavorable $750,000 unfavorable None of these. $750,000 favorablearrow_forwardNo chatgpt 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forward

- Please Make Perfect Answer For this Financial Accounting Question. Need Perfect Answerarrow_forwardNo AI 3. What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forwardWhat is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidityarrow_forward

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardPlease Get the Correct answer to this General Accounting Question without any problemarrow_forwardI want Answer of this General Account Question Step by steparrow_forward

- About this Financial Accounting Question Please Provide Solutionarrow_forwardI Tried to solve but I can't Please Provide Solution of this Account Based Questionarrow_forwardIvanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all occur at December 31, 2025.) In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor. Record the entries to reflect the above transactions (accrual method) for 2025 and 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation 2025 2026 2025 Cash Sales Revenue (To record sale of computers) Warranty Expense Warranty…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License