Concept Introduction:

An unincorporated association in which two or more people engage in business as co-owners for profit is known as

To calculate:

Prepare three tables with the following column headings.Complete the tables,one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered.

Answer to Problem 2APSA

Explanation of Solution

The partnership income or loss should be allocated in the above manner under the four plans.

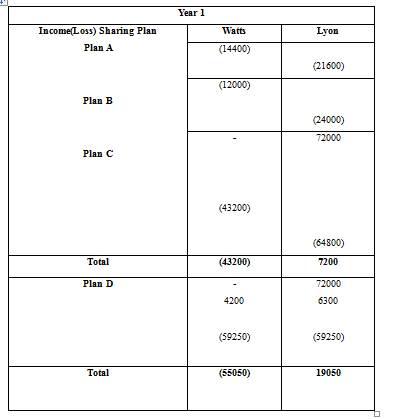

| Year 1 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A |

| (14400) |

(21600) |

| Plan B |

| (12000) |

(24000) |

| Plan C | Salary allowanceRemaining bal=(-36000-72000=-108000

| -(43200) | 72000

(64800) |

| Total | (43200) | 7200 | |

| Plan D | Salary allowance10% interestRemaining bal=(-36000-72000-4200-6300)=(118500) | -

4200 (59250) | 72000

6300 (59250) |

| Total | (55050) | 19050 | |

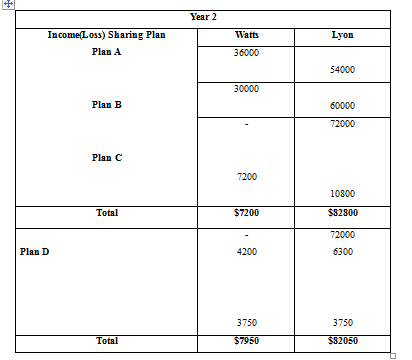

| Year 2 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A | 90000×42/105

90000×63/105 | 36000 |

54000 |

| Plan B | 90000×1/3

90000×2/3 | 30000 |

60000 |

| Plan C | Salary allowanceRemaining bal

(90000-72000=18000) 18000×42/105 18000×63/105 | -

7200 | 72000

10800 |

| Total | $7200 | $82800 | |

| Plan D | Salary allowance10% interestRemaining bal(90000-72000-4200-6300=7500)

7500×1/2 7500×1/2 | -

4200 3750 | 72000

6300 3750 |

| Total | $7950 | $82050 | |

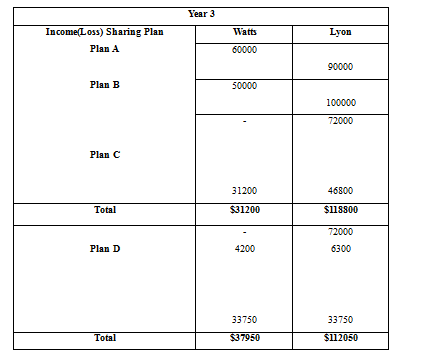

| Year 3 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A | 150000×42/105

150000×63/105 | 60000 |

90000 |

| Plan B | 150000×1/3

150000×2/3 | 50000 |

100000 |

| Plan C | Salary allowanceRemaining bal(150000-72000=78000)

78000×42/105 78000×63/105 | -

31200 | 72000

46800 |

| Total | $31200 | $118800 | |

| Plan D | Salary allowance10% interestRemaining bal(150000-72000-4200-6300=67500)

67500×1/2 67500×1/2 | -

4200 33750 | 72000

6300 33750 |

| Total | $37950 | $112050 | |

Want to see more full solutions like this?

Chapter 12 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)-W/ACCESS

- I need help with this financial accounting question using accurate methods and procedures.arrow_forwardStarlight Medical Equipment maintains inventory cards. Item #456 shows: beginning 210 units, received 320 units, issued 390 units. Physical count reveals 125 units. Determine the missing units. Need answerarrow_forwardReva Systems budgeted sales at 30,000 units at $80 per unit. The actual sales were 29,000 units at $83 per unit. What was Reva Systems' sales price variance?arrow_forward

- Viler business purchased a 6-month, 8% note receivable for $50,000 on March 1. What is the amount of interest income that should be recorded on June 30?arrow_forwardStarlight Medical Equipment maintains inventory cards. Item #456 shows: beginning 210 units, received 320 units, issued 390 units. Physical count reveals 125 units. Determine the missing units.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- I want to this question answer for General accounting question not need ai solutionarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education