Concept Introduction:

An unincorporated association in which two or more people engage in business as co-owners for profit is known as

To calculate:

Prepare three tables with the following column headings.Complete the tables,one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered.

Answer to Problem 2APSA

Explanation of Solution

The partnership income or loss should be allocated in the above manner under the four plans.

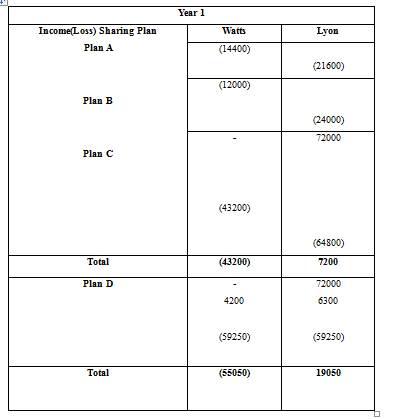

| Year 1 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A |

| (14400) |

(21600) |

| Plan B |

| (12000) |

(24000) |

| Plan C | Salary allowanceRemaining bal=(-36000-72000=-108000

| -(43200) | 72000

(64800) |

| Total | (43200) | 7200 | |

| Plan D | Salary allowance10% interestRemaining bal=(-36000-72000-4200-6300)=(118500) | -

4200 (59250) | 72000

6300 (59250) |

| Total | (55050) | 19050 | |

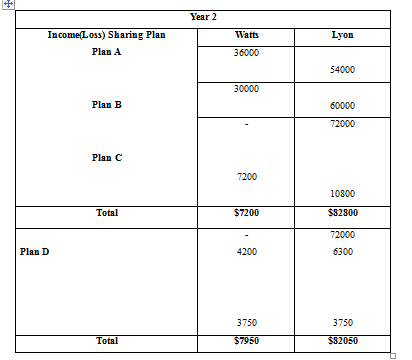

| Year 2 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A | 90000×42/105

90000×63/105 | 36000 |

54000 |

| Plan B | 90000×1/3

90000×2/3 | 30000 |

60000 |

| Plan C | Salary allowanceRemaining bal

(90000-72000=18000) 18000×42/105 18000×63/105 | -

7200 | 72000

10800 |

| Total | $7200 | $82800 | |

| Plan D | Salary allowance10% interestRemaining bal(90000-72000-4200-6300=7500)

7500×1/2 7500×1/2 | -

4200 3750 | 72000

6300 3750 |

| Total | $7950 | $82050 | |

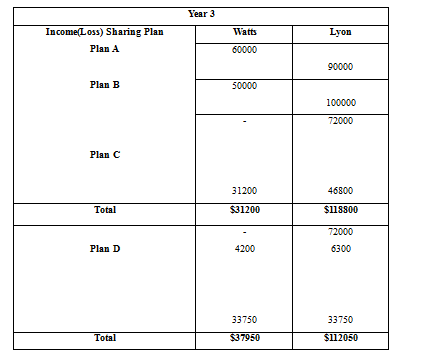

| Year 3 | |||

| Income(Loss) Sharing Plan | Calculations | Watts | Lyon |

| Plan A | 150000×42/105

150000×63/105 | 60000 |

90000 |

| Plan B | 150000×1/3

150000×2/3 | 50000 |

100000 |

| Plan C | Salary allowanceRemaining bal(150000-72000=78000)

78000×42/105 78000×63/105 | -

31200 | 72000

46800 |

| Total | $31200 | $118800 | |

| Plan D | Salary allowance10% interestRemaining bal(150000-72000-4200-6300=67500)

67500×1/2 67500×1/2 | -

4200 33750 | 72000

6300 33750 |

| Total | $37950 | $112050 | |

Want to see more full solutions like this?

Chapter 12 Solutions

Connect Access Card For Fundamental Accounting Principles

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education