Beta:

Beta  is the covariance of a security with the market upon the variance of the market. Beta

is the covariance of a security with the market upon the variance of the market. Beta  measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta

measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta  of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

The beta  of a portfolio is the weighted average beta of the overall stocks in a portfolio.

of a portfolio is the weighted average beta of the overall stocks in a portfolio.

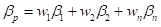

The beta  of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

Where,

is the beta of a portfolio.

is the beta of a portfolio. is the weight of a stock.

is the weight of a stock.

To determine:

The beta of the portfolio.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

FUND.OF CORP.FINANCE PKG. F/BU >C<

- QUESTION 1 Examine the information provided below and answer the following question. (10 MARKS) The hockey stick model of start-up financing, illustrated by the diagram below, has received a lot of attention in the entrepreneurial finance literature (Cumming & Johan, 2013; Kaplan & Strömberg, 2014; Gompers & Lerner, 2020). The model is often used to describe the typical funding and growth trajectory of many startups. The model emphasizes three main stages, each of which reflects a different phase of growth, risk, and funding expectations. Entrepreneur, 3 F's Debt(banks & microfinance) Research Business angels/Angel Venture funds/Venture capitalists Merger, Acquisition Grants investors PO Public market Growth (revenue) Break even point Pide 1st round Expansion 2nd round 3rd round Research commercial idea Pre-seed Initial concept Seed Early Expansion Financial stage Late IPO Inception and prototype Figure 1. The hockey stick model of start-up financing (Lasrado & Lugmayr, 2013) REQUIRED:…arrow_forwardcritically discuss the hockey stick model of a start-up financing. In your response, explain the model and discibe its three main stages, highlighting the key characteristics of each stage in terms of growth, risk, and funding expectations.arrow_forwardSolve this problem please .arrow_forward

- Take value of 1.01^-36=0.699 . step by steparrow_forwardsolve this question.Pat and Chris have identical interest-bearing bank accounts that pay them $15 interest per year. Pat leaves the $15 in the account each year, while Chris takes the $15 home to a jar and never spends any of it. After five years, who has more money?arrow_forwardWhat is corporate finance? explain all thingsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education