Beta:

Beta  is the covariance of a security with the market upon the variance of the market. Beta

is the covariance of a security with the market upon the variance of the market. Beta  measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta

measures the change in percentage in the excess return of a particular security for 1% change in the excess return of a market portfolio or a benchmark portfolio. The beta  of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

of a market portfolio is always 1. However, the securities may have either higher or lower betas as compared to the beta of the market portfolio. The primary reason for this difference is the sensitivity of the individual industries to the economy.

The beta  of a portfolio is the weighted average beta of the overall stocks in a portfolio.

of a portfolio is the weighted average beta of the overall stocks in a portfolio.

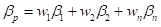

The beta  of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

of a portfolio with three stocks, Stock E, Stock C, and Stock K can be calculated using the formula given below.

Where,

is the beta of a portfolio.

is the beta of a portfolio. is the weight of a stock.

is the weight of a stock.

To determine:

The beta of the portfolio.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

- Explain. What is working capital?* Equity Capital + Retained Earnings Equity Capital - Total Liabilities Total Assets - Total Liabilities Current Assets - Current Liabilitiesarrow_forwardExplain Which of the following is not true about goodwill?* Goodwill needs to be evaluated for impairment yearly Goodwill is treated as a tangible asset in accounting Goodwill is a result of purchasing a company for a price higher than the fair market value of the target company's net assets Goodwill can be comprised of things such as good reputation, loyal client base, and brand recognition.arrow_forwardSolve plsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education