You have just graduated from the MBA program of a large university, and one of your favorite courses was Today’s Entrepreneurs. In fact, you enjoyed it so much you have decided you want to “be your own boss.” While you were in the master’s program, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-foods area, maybe two (if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on to something else.

You have narrowed your selection down to two choices: (1) Franchise L. Lisa’s Soups, Salads & Stuff, and (2) Franchise S, Sam’s Fabulous Fried Chicken.

The net cash flows that follow include the price you would receive for selling the franchise in Year 3 and the

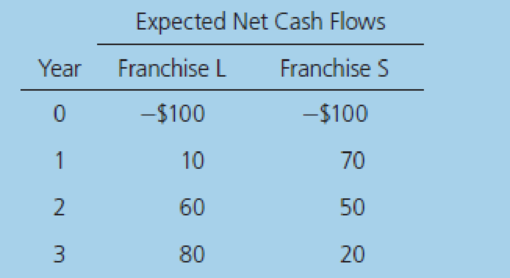

Here are the net cash flows (in thousands of dollars):

Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows.

You also have made subjective risk assessments of each franchise and concluded that both franchises have risk characteristics that require a return of 10%. You must now determine whether one or both of the franchises should be accepted.

- a. What is capital budgeting?

Trending nowThis is a popular solution!

Chapter 12 Solutions

INTERMEDIATE FINAN.MGMT.(LL)-W/MINDTAP

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning