Managerial Accounting

15th Edition

ISBN: 9780078025631

Author: Ray H Garrison, Eric Noreen, Peter C. Brewer Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 12, Problem 1F15

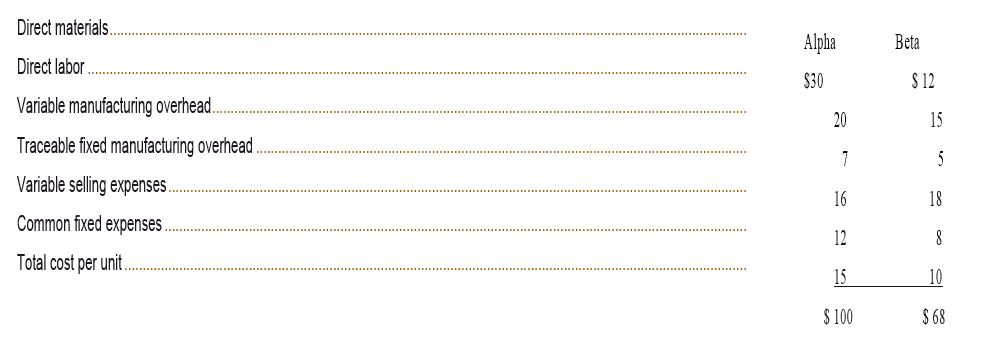

Cane Company manufactures two products called .Alpha and Beta that sell for $120 and $80: respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity7 to annually produce 100,000 units of each product. Its average cost per unit for each product at this level of activity are given below:

The company considers its traceable fixed manufacturing

Required:

(Answer each question independently unless instructed otherwise.)

1. What is the total amount of traceable fixed manufacturing overhead for each of the two products?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with this general accounting question using standard accounting techniques.

Can you explain this general accounting question using accurate calculation methods?

Please show me how to solve this financial accounting problem using valid calculation techniques.

Chapter 12 Solutions

Managerial Accounting

Ch. 12 - Prob. 1QCh. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - “Variable costs and differential costs mean the...Ch. 12 - 12-6 "All future costs are relevant in decision...Ch. 12 - Prentice Company is considering dropping one of...Ch. 12 - Prob. 8QCh. 12 - 12-9 What is the danger in allocating common fixed...Ch. 12 - 12-10 How does opportunity cost enter into a make...

Ch. 12 - 12-11 Give at least four examples of possible...Ch. 12 - 12-12 How will relating product contribution...Ch. 12 - Define the following terms: joint products, joint...Ch. 12 - 12-14 From a decision-making point of view, should...Ch. 12 - What guideline should be used in determining...Ch. 12 - Prob. 16QCh. 12 - Prob. 1AECh. 12 - Prob. 2AECh. 12 - Cane Company manufactures two products called...Ch. 12 - (

Alpha Beta

$30

$...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - (

Alpha Beta

$30

$...Ch. 12 - Prob. 7F15Ch. 12 -

Cane Company manufactures two products called...Ch. 12 - Prob. 9F15Ch. 12 - (

Alpha Beta

$30

$...Ch. 12 - Prob. 11F15Ch. 12 - Prob. 12F15Ch. 12 - (

Alpha ...Ch. 12 - (

Alpha Beta

$30

$...Ch. 12 - (

Alpha Beta

$30

$...Ch. 12 -

EXERCISE 12-1 Identifying Relevant Costs...Ch. 12 -

EXERCISE 12-2 Dropping or Retaining a Segment...Ch. 12 -

EXERCISE 12-3 Make or Buy Decision LO12-3

Troy...Ch. 12 -

EXERCISE 12-4 Special Order Decision...Ch. 12 -

EXERCISE 12-5 Volume Trade-Off Decisions...Ch. 12 - Prob. 6ECh. 12 - Prob. 7ECh. 12 - Prob. 8ECh. 12 - (

$5.10

$3.80

$1.00

$4.20

$1.50

$2.40

)

EXERCISE...Ch. 12 - Prob. 10ECh. 12 - (

$3.60

10.00

2.40

9.00

$25.00

)

EXERCISE 12-11...Ch. 12 - Prob. 12ECh. 12 - EXERCISE 12-13 Sell or Process Further Decision...Ch. 12 - en

r

Ch. 12 - Prob. 15ECh. 12 - (

$150

31

20

29

3

24

15

$272

$34

)

EXERCISE...Ch. 12 - Prob. 17ECh. 12 - Prob. 18PCh. 12 - PROBLEM 12-19 Dropping or Retaining a Segment...Ch. 12 -

PROBLEM 12-20 Sell or Process Further Decision...Ch. 12 - Prob. 21PCh. 12 - PROBLEM 12-22 Special Order Decisions LO12-4...Ch. 12 -

PROBLEM 12-23 Make or Buy Decision LO12-3

Silven...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Prob. 27PCh. 12 - Prob. 28PCh. 12 - CASE 12-29 Sell or Process Further Decision LO12-7...Ch. 12 -

CASE 12-30 Ethics and the Manager; Shut Dora or...Ch. 12 - CASE 12-31 Integrative Case: Relevant Costs;...Ch. 12 -

CASE 12-32 Make or Buy Decisions; Volume...Ch. 12 - Prob. 33C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you explain the correct methodology to solve this financial accounting problem?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardCan you provide the accurate answer to this financial accounting question using correct methods?arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- Please explain how to solve this financial accounting question with valid financial principles.arrow_forwardI need help solving this financial accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY