Concept explainers

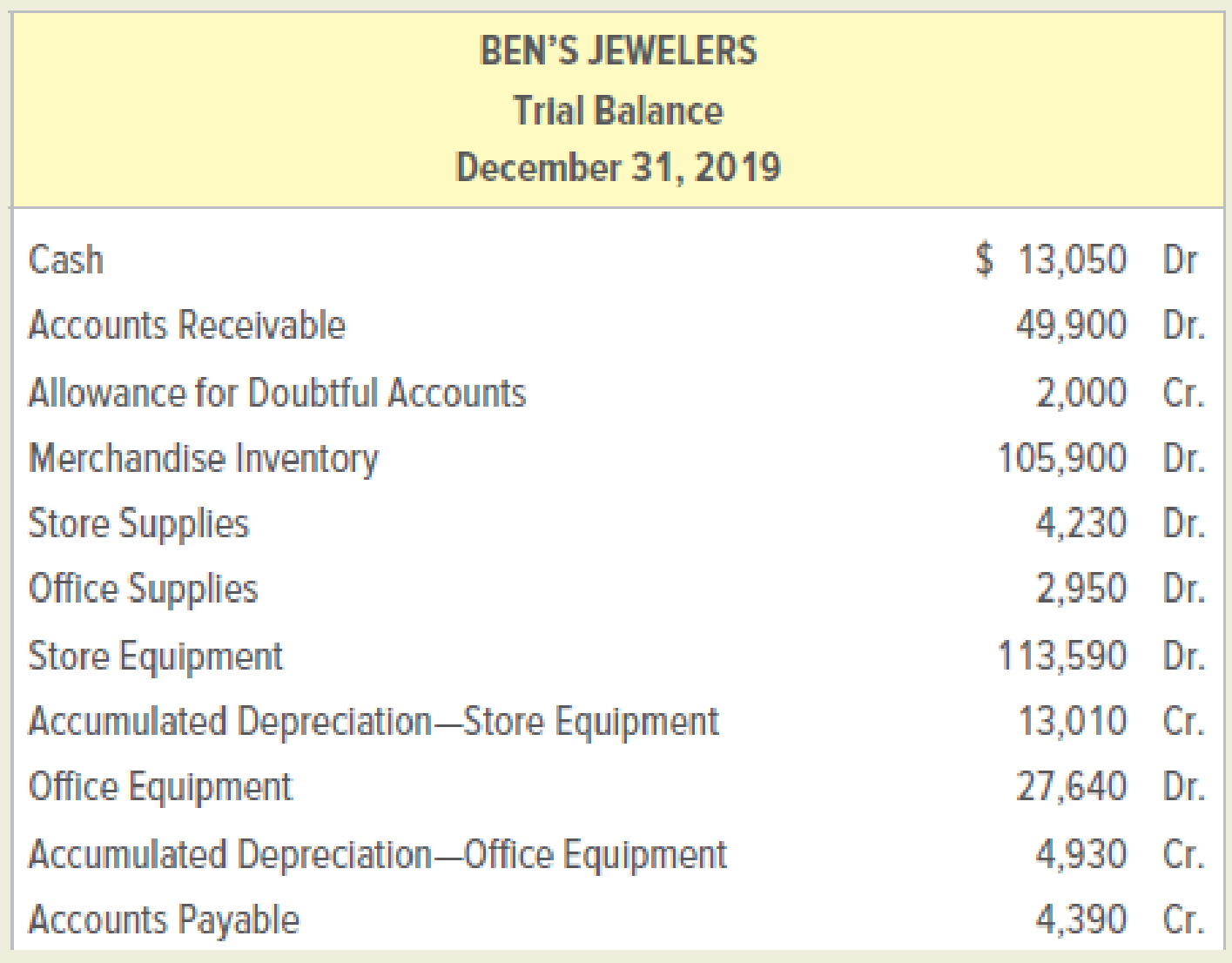

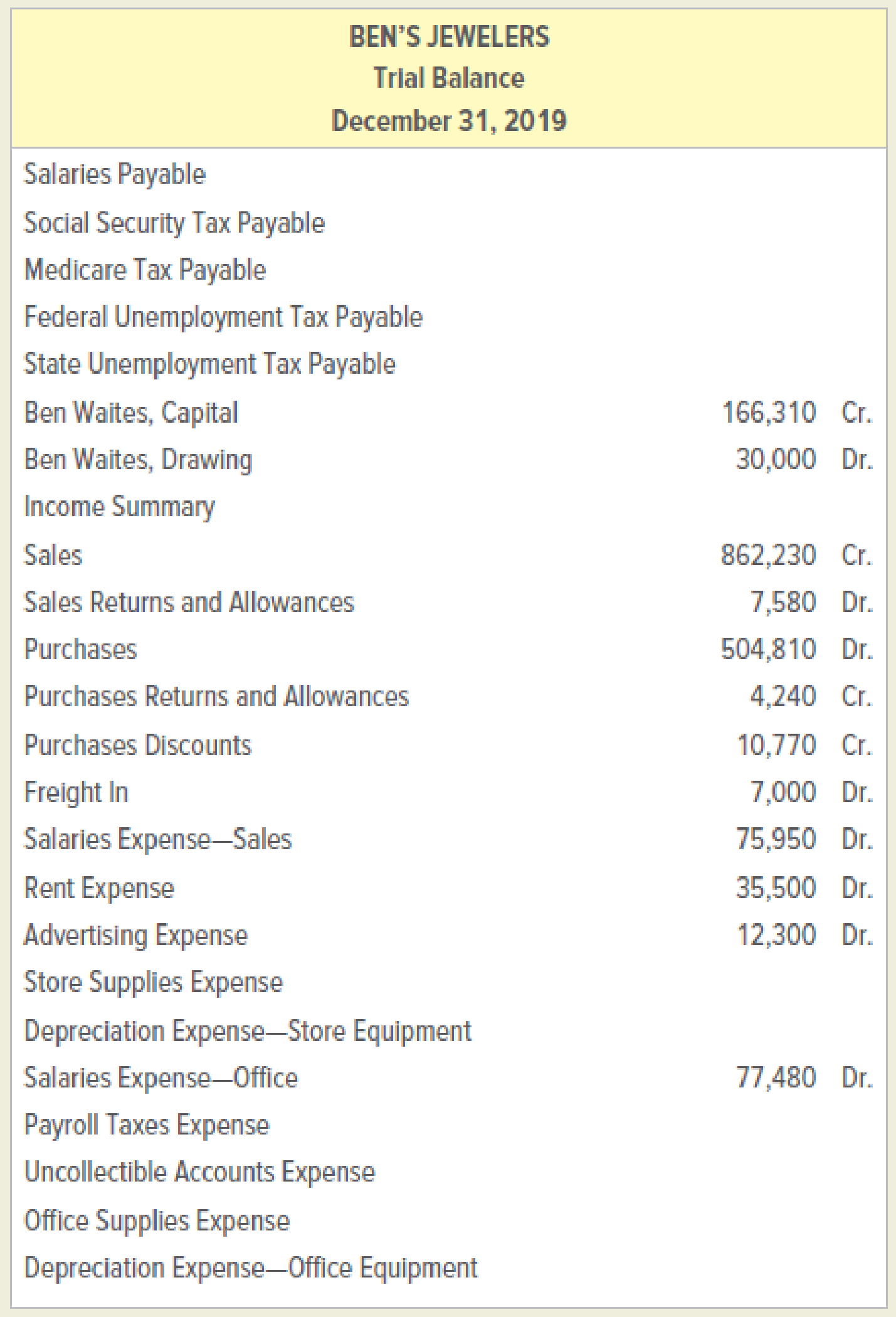

The unadjusted

INSTRUCTIONS

- 1. Copy the unadjusted trial balance onto a worksheet and complete the worksheet using the following information:

a.–b.

Ending merchandise inventory, $98,700. c.

Uncollectible accounts expense, $1,000. d.

Store supplies on hand December 31, 2019, $625. e.

Office supplies on hand December 31, 2019, $305. f.

Depreciation on store equipment, $11,360.g.

Depreciation on office equipment, $3,300. h.

Accrued sales salaries, $4,000, and accrued office salaries, $1,000. i.

Social security tax on accrued salaries, $326; Medicare tax on accrued salaries, $76. (Assumes that tax rates have increased.) j.

Federal unemployment tax on accrued salaries, $56; state unemployment tax on accrued salaries, $270. - 2. Journalize the

adjusting entries on page 30 of the general journal. Omit descriptions. - 3. Journalize the closing entries on page 32 of the general journal. Omit descriptions.

- 4. Compute the following:

- a. net sales

- b. net delivered cost of purchases

- c. cost of goods sold

- d. net income or net loss

- e. balance of Ben Waites, Capital on December 31, 2019.

Analyze: What change(s) to Ben Waites, Capital will be reported on the statement of owner’s equity?

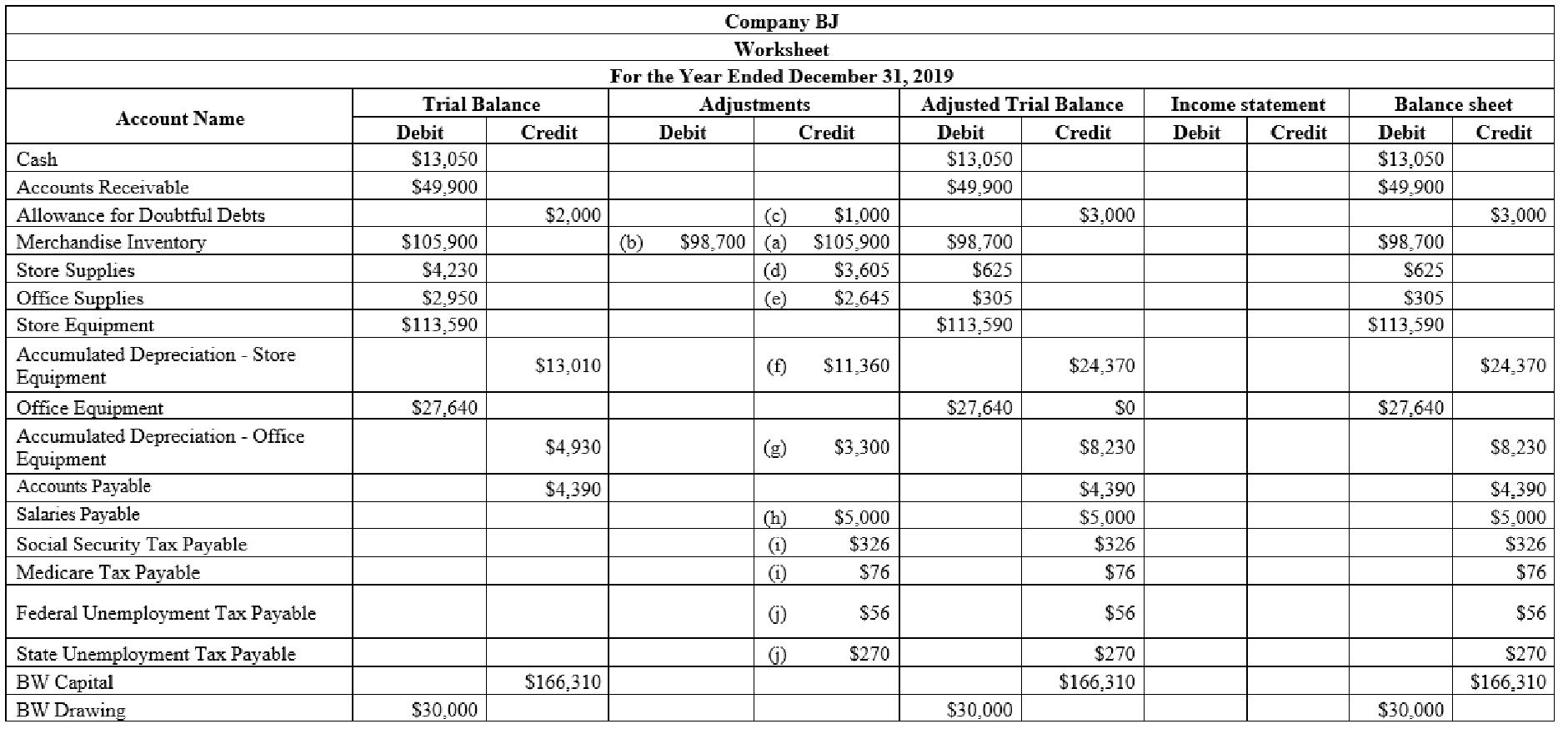

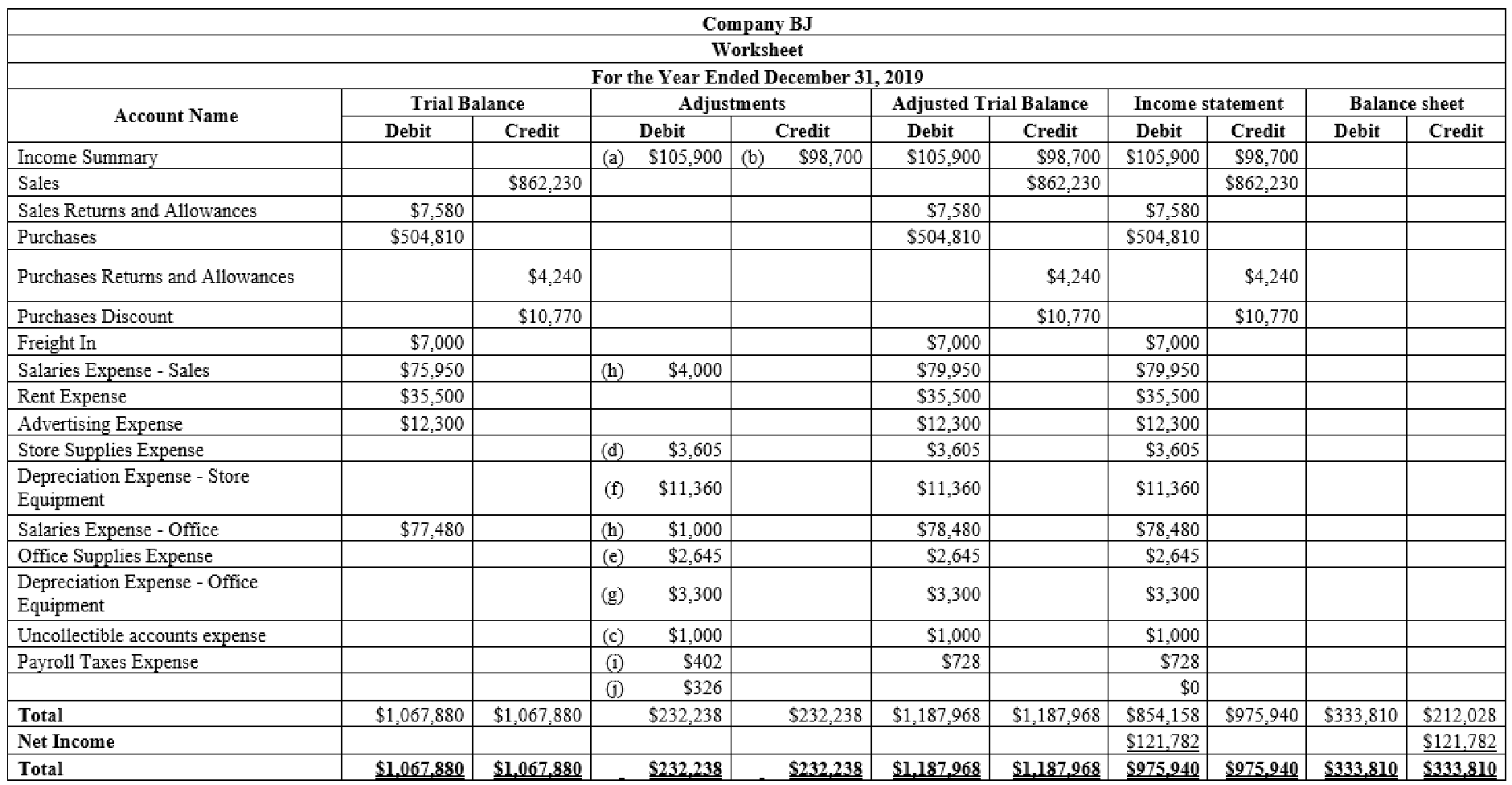

1.

Prepare the worksheet and complete the sections of Trial balance, adjustments and compute the changes to the BW Capital that will be shown in the statement of owner's equity.

Explanation of Solution

Worksheet: A worksheet is the used in the preparation of the financial statement. It is a pre-defined form, having multiple columns, used in the adjustment process.

Prepare the classified income statement:

Figure (1)

Figure (2)

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company BJ | ||

| Statement of Owner's Equity | ||

| Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| BW Capital, January 1, 2019 | $166,310 | |

| Net income for the year | $121,782.00 | |

| Deduct - Withdrawals | $30,000.00 | |

| Increase in Capital | $91,782.00 | |

| BW Capital, December 31, 2019 | $258,092.00 | |

Table (1)

The BW Capital increases by $91,782.

2.

Journalize the adjusting entries as on December 31, 2019.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Pass the adjusting entry for the given transaction:

| General Journal | Page - 30 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $105,900 | ||

| Merchandise Inventory | $105,900 | |||

| (To record the beginning inventory) | ||||

| December 31 | Merchandise Inventory | $98,700 | ||

| Income Summary | $98,700 | |||

| (To record the closing inventory) | ||||

| December 31 | Uncollectible Accounts Expense | $1,000 | ||

| Allowance for Doubtful Accounts | $1,000 | |||

| (To record the estimated loss on the net credit sale) | ||||

| December 31 | Store Supplies Expense | $3,605 | ||

| Store Supplies | $3,605 | |||

| (To record the Supplies used) | ||||

| December 31 | Office Supplies Expense | $2,645 | ||

| Office Supplies | $2,645 | |||

| (To record the Supplies used) | ||||

| December 31 | Depreciation Expense - Store Equipment | $11,360 | ||

| Accumulated Depreciation - Store Equipment | $11,360 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Depreciation Expense - Office Equipment | $3,300 | ||

| Accumulated Depreciation - Office Equipment | $3,300 | |||

| (To record the depreciation on equipment) |

Table (2)

3.

Journalize the closing entries as on December 31, 2019.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Pass the closing entries:

| General Journal | Page - 32 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Sales | $862,230 | ||

| Purchases Returns and allowances | $4,240 | |||

| Purchases Discounts | $10,770 | |||

| Income Summary | $877,240 | |||

| (To record the closing entry for the income) | ||||

| December 31 | Income Summary | $121,782 | ||

| BW Capital | $121,782 | |||

| (To record the closing entry for the capital) | ||||

| December 31 | BW Capital | $30,000 | ||

| BW Drawings | $30,000 | |||

| (To record the closing entry for the capital) |

Table (3)

| General Journal | Page - 32 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $748,258.00 | ||

| Sales Returns and Allowances | $7,580 | |||

| Purchases | $504,810 | |||

| Freight In | $7,000 | |||

| Salaries Expense - Sales | $79,950 | |||

| Rent Expense | $35,500 | |||

| Advertising Expense | $12,300 | |||

| Store Supplies Expense | $3,605 | |||

| Depreciation Expense - Store Equipment | $11,360 | |||

| Salaries Expense - Office | $78,480 | |||

| Uncollectible Accounts Expense | $1,000 | |||

| Depreciation Expense - Office Equipment | $3,300 | |||

| Office Supplies Expense | $2,645 | |||

| Payroll Taxes Expense | $728 | |||

| (To record the closing entry for the expenses) |

Table (4)

4.

Calculate the required ratios.

Explanation of Solution

a. Net Sales:

Compute the net sales:

| Particulars | Amount ($) |

| Sales | $862,230 |

| Less: Sales Discount | 7,580 |

| Net Sales | $854,650 |

Table (5)

b. Net delivered cost of purchases

Compute the Net delivered cost of purchases:

| Particulars | Amount ($) | Amount ($) |

| Purchases | $504,810 | |

| Freight In | $7,000 | |

| Delivered Cost of Purchases | $511,810 | |

| Less: Purchases Returns and Allowances | $4,240 | |

| Purchases Discount | $10,770 | $15,010 |

| Net Delivered Cost of Purchases | $496,800 |

Table (6)

c. Cost of Goods Sold:

Compute the cost of goods sold:

| Particulars | Amount ($) |

| Merchandise Inventory, January 1, 2019 | $105,900 |

| Net Delivered Cost of Purchases | $496,800 |

| Total Merchandise Available for sale | $602,700 |

| Less: Merchandise Inventory, closing | $98,700 |

| Cost of Goods Sold | $504,000 |

Table (7)

d. Net Income:

The net income for the year is $121,782.

e. Balance of BW capital on December 31, 2019

Compute the Balance of BW capital on December 31, 2019:

| Particulars | Amount ($) | Amount ($) |

| BW Capital, January 1, 2019 | $166,310 | |

| Net income for the year | $121,782 | |

| Deduct - Withdrawals | $30,000 | |

| Increase in Capital | $91,782 | |

| BW Capital, December 31, 2019 | $258,092 |

Table (8)

Want to see more full solutions like this?

Chapter 12 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- A pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forward

- hello tutor provide solutionarrow_forwardGerry Co. has a gross profit of $990,000 and $290,000 in depreciation expenses. Selling and administrative expense is $129,000. Given that the tax rate is 37%, compute the cash flow for Gerry Co. a. $700,000 b. $128,963 c. $649,730 d. $652,230arrow_forwardProvide correct answer this financial accounting questionarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,