a.

Calculate the change in cash that occurred during 2016.

a.

Explanation of Solution

Calculate the change in cash during 2016.

Cash balance as of 31st December 2015 is $33,000

Cash balance as of 31st December 2016 is $41,000

Hence, the change in cash during 2016 is ($8,000).

b.

Prepare a statement of

b.

Explanation of Solution

Statement of cash flows: Statement of cash flows reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Indirect method: Under this method, the following amounts are to be adjusted from the Net Income to calculate the net cash provided from operating activities.

Prepare a statement of cash flows using indirect method for Company R.

| Company R | ||

| Statement of Cash Flows - Indirect Method | ||

| For the year ended December 31, 2016 | ||

| Details | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Net income | 81,000 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | ||

| Depreciation expense | 22,000 | |

| Decrease in | 8,000 | |

| Increase in merchandise inventory | (26,000) | |

| Increase in prepaid rent | (4,000) | |

| Increase in accounts payable | 12,000 | |

| Increase in wages payable | 7,000 | |

| Decrease in income tax payable | (1,000) | 18,000 |

| Net cash provided by operating activities | 99,000 | |

| Cash flows from investing activities: | ||

| Acquisition of plant asset (1) | (120,000) | |

| Net cash used for investing activities | (120,000) | |

| Cash flows from financing activities: | ||

| Issuance of common stock (2) | 43,000 | |

| Paid-in capital on common stock | 14,000 | |

| Cash payment of dividends | (28,000) | |

| Net cash provided by financing activities | 29,000 | |

| Net increase (decrease) in Cash | 8,000 | |

| Cash balance, December 31, 2015 | 33,000 | |

| Cash balance, December 31, 2016 | 41,000 | |

Table (1)

Working note:

Prepare the schedule in the change of current assets and liabilities.

| Schedule in the Change of Current Assets and Liabilities | ||||

| Details | Amount ($) | Effect on Operating Activities | ||

|

2016 ($) |

2015 ($) |

Increase/ (Decrease) ($) | ||

| Accounts receivable | 52,000 | 60,000 | (8,000) | Add |

| Inventory | 142,000 | 116,000 | 26,000 | Less |

| Prepaid rent | 14,000 | 10,000 | 4,000 | Less |

| Accounts payable | 29,000 | 17,000 | 12,000 | Add |

| Wages payable | 14,000 | 7,000 | 7,000 | Add |

| Income tax payable | 7,000 | 8,000 | (1,000) | Less |

Table (2)

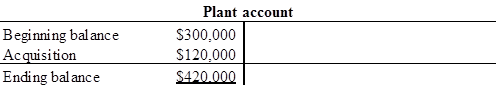

Calculate the acquisition of plant:

(1)

Calculate the issue of common stock for cash:

Common stock in 2016 = $295,000

Common stock in 2015 = $252,000

c.

Compute the

c.

Explanation of Solution

Free cash flow:

Free cash flow signifies cash that is provided by the operations of the Company after making capital expenditures for acquiring or expanding its assets.

Formula to calculate free cash flow:

Compute free cash flow:

Amount of net cash flow from operating activities is $99,000

Amount of Net capital expenditure is $120,000

Amount of dividend is $28,000

Thus, the free cash flow of Company R is (49,000).

d.

Compute the operating cash flow to

d.

Explanation of Solution

Operating cash flow to current liabilities ratio measures the capability of the company to pay it current liabilities. In this, higher the ratio shows that the company has sufficient cash flow to pay its debts.

Formula to calculate the operating cash flow to current liabilities ratio is:

Compute the Operating cash flow to current liabilities ratio.

Amount of cash flow from operating activities is $99,000

Amount of average current liabilities is $41,000 (3)

Working note:

Calculate the average current liabilities:

Thus, the operating cash flow to current liabilities ratio of Company R is 2.41.

e.

Compute the operating cash flow to capital expenditure ratio for Company R.

e.

Explanation of Solution

Operating cash flow to capital expenditure ratio measures the capability of the company to finance its capital investments from the operating cash flow.

Formula to calculate cash flow to capital expenditure ratio is:

Compute the operating cash flow to capital expenditure ratio.

Cash flow from operating activities is $99,000

Amount of capital expenditure is $120,000

Thus, the operating cash flow to expenditure ratio of Company R is 0.83.

Want to see more full solutions like this?

Chapter 12 Solutions

Financial Accounting for Undergr. -Text Only (Instructor's)

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- I need assistance with this financial accounting question using appropriate principles.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education