Concept explainers

a.

Calculate pre-determined

a.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials. The pre-determined overhead rate is calculated as follows:

Calculate Pre-determined overhead rate:

| Particulars | Amount |

| Rent on factory space | $25,000 |

| Indirect materials | $12,000 |

| Maintenance costs for factory equipment | $4,000 |

| Utilities costs for factory space | $3,000 |

| $10,000 | |

| Total estimated overhead cost (A) | $54,000 |

| Estimated direct labor hours (B) | 6,500 hours |

| Pre-determined overhead rate (C) | $8.31 per labor hour |

Table (1)

Hence, the pre-determined overhead rate is $8.31 per labor hour.

Requirements b., c., and d.

Determine the ending balance in (b) raw materials inventory, (c) finished goods inventory, (d) work-in process inventory.

Requirements b., c., and d.

Explanation of Solution

(b)

Raw materials inventory: Raw material inventory are the primary materials which are used in the production process to get the finished product.

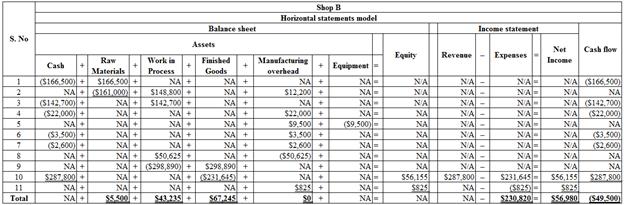

The ending balance of raw materials inventory is $4,500 (Refer Table (2).

(c)

Finished goods inventory: Finished goods inventory are the goods that are ready for sale after completing the production process.

The ending balance of raw materials inventory is $67,245(Refer Table (2).

(d)

Work-in-process inventory: Work-in-process inventory is the middle part of raw materials and finished goods. This inventory is the portion of the manufactured inventory for which the process has been started but not yet completed.

The ending balance of raw materials inventory is $43,235(Refer Table (2).

Working Note:

Compute the balance of raw material inventory:

Table (2)

Note for 8:

Prepare summary

| Summary job cost sheet | ||||||

| Job Number | Direct Materials | Direct Labor | Manufacturing Overhead | Total costs | ||

| Rate | Hours | Cost | ||||

| 421 | $33,900 | $31,400 | $13.50 | 720 | $9,720 | $75,020 |

| 422 | $27,800 | $33,100 | $13.50 | 850 | $11,475 | $72,375 |

| 423 | $32,800 | $39,300 | $13.50 | 900 | $12,150 | $84,250 |

| 424 | $31,800 | $23,700 | $13.50 | 870 | $11,745 | $67,245 |

| 425 | $22,500 | $15,200 | $13.50 | 410 | $5,535 | $43,235 |

| Totals | $148,800 | $142,700 | 3,750 | $50,625 | $342,125 | |

Table (3)

Thus, the cost of manufacturing overhead is $50,625.

Note for 9:

Determine the

Note for 10.

Cash of $287,800 is the sum of sales price of Jobs 421, 422 and 423 and the cost of finished goods sold is $231,645 which is the sum total of costs of Jobs 421, 422 and 423.

Note for 11.

The total of manufacturing overhead is $49,800 (Refer table (2)). The balance of Manufacturing Overhead before over-applied overhead is

e.

Determine the cost of goods manufactured.

e.

Explanation of Solution

Cost of goods manufactured: The cost of goods manufactured is the total costs incurred for the manufacturing of a product which is transferred from work-in process inventory account to the finished goods inventory account.

The Cost of goods manufactured is $298,890 (Refer Note 9).

f.

Determine the cost of goods sold.

f.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

The cost of goods sold is $231,645 (Refer Note 10).

g.

Determine the amount of gross margin that would be earned from Jobs 421, 422 and 423.

g.

Explanation of Solution

Gross margin (gross profit): Gross margin is the amount of revenue earned from goods sold over the costs incurred for the goods sold.

Compute the amount of gross margin that would be earned from Jobs 421, 422 and 423:

| Computation of gross margin for Shop B | |||

| Job Number |

Sales Price (1) | Cost of goods sold (2) |

Gross Margin |

| 421 | $100,900 | $75,020 | $25,880 |

| 422 | $96,100 | $72,375 | $23,725 |

| 423 | $90,800 | $84,250 | $6,550 |

Table (4)

Note: Refer table (3) for the cost of goods sold (total cost column) for each job.

Thus, the gross margin earned from Jobs 421, 422 and 423 are $25,880, $23,725 and $6,550 respectively.

h.

Determine the amount of over applied or under applied of overhead that would exist at the end of the year.

h.

Explanation of Solution

Manufacturing overhead costs: The costs, which do not relate directly with the manufacturing of products, are referred to as manufacturing overhead costs or indirect costs. Manufacturing overhead cost per unit is the cost of manufacturing overhead incurred to produce one unit of product.

Determine the amount of over applied or under applied of overhead:

Given, the total of manufacturing overhead is $49,800 (Refer table (2)) and the manufacturing overhead cost applied to work in process is $50,625 (Refer Table (3)).

Thus, the over applied of overhead that would exist at the end of the year is ($825).

Want to see more full solutions like this?

Chapter 12 Solutions

Fundamental Managerial Accounting Concepts with Access

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forward

- Subject : Financial accountingarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Helparrow_forward

- Cooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education