Cain Nelson is a divisional manager for Pigeon Company His anal pay raises me 1rgel determined by his divisions

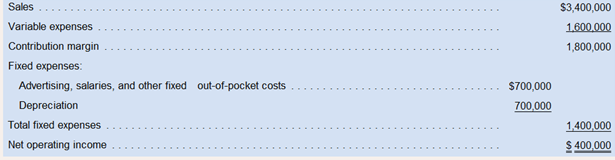

The project would provide net operating income each vet for five vets as follows:

Required:

1. What is the project’s net present value?

2. What is the project’s internal rate of return to the nearest whole percent?

3. What is the project’s simple rate of return?

4. Would the company wait Casey to pursue this investment opportunity? Would Casey be inclined to pursue this investment opportunity? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Loose Leaf For Introduction To Managerial Accounting

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT