PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 12, Problem 13PS

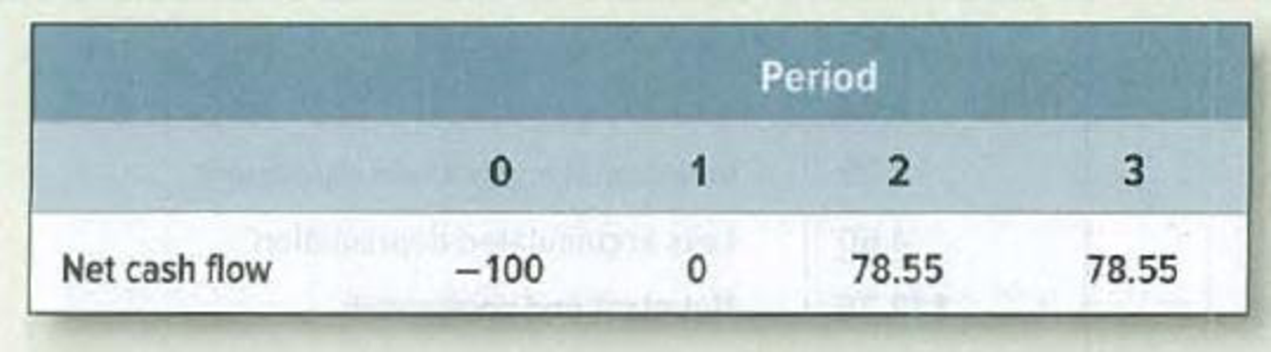

Economic income* Consider the following project:

The internal rate of return is 20%. The NPV, assuming a 20%

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

No Ai

The time value of money concept is based on the idea that:

a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.

The time value of money concept is based on the idea that:

a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.

What does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued. b) A company is overvalued. c) High investor confidence. d) Low profitability. need help!!

Chapter 12 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 12 - Terminology Define the following: a. Agency costs...Ch. 12 - Prob. 2PSCh. 12 - Prob. 3PSCh. 12 - Prob. 4PSCh. 12 - Prob. 5PSCh. 12 - Prob. 6PSCh. 12 - Management compensation We noted that management...Ch. 12 - Prob. 8PSCh. 12 - Prob. 9PSCh. 12 - Prob. 10PS

Ch. 12 - Prob. 11PSCh. 12 - Economic income Fill in the blanks: A projects...Ch. 12 - Economic income Consider the following project:...Ch. 12 - Accounting measures of performance Use the Beyond...Ch. 12 - Accounting measures of performance The Modern...Ch. 12 - Prob. 17PSCh. 12 - EVA Here are several questions about economic...Ch. 12 - EVA Herbal Resources is a small but profitable...Ch. 12 - Prob. 20PSCh. 12 - EVA Use the Beyond the Page feature to access the...Ch. 12 - EVA Ohio Building Products (OBP) is considering...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued. b) A company is overvalued. c) High investor confidence. d) Low profitability.arrow_forwardNo ai What does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued.b) A company is overvalued.c) High investor confidence.d) Low profitability.arrow_forwardWhat does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued.b) A company is overvalued.c) High investor confidence.d) Low profitability.arrow_forward

- The risk that cannot be eliminated through diversification is called: a) Market riskb) Credit riskc) Diversifiable riskd) Operational riskarrow_forwardNo AI The risk that cannot be eliminated through diversification is called: a) Market riskb) Credit riskc) Diversifiable riskd) Operational riskarrow_forwardDon't use chatgpt Which of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forward

- Which of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forwardNo chatgpt! What is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forwardNo ai Which of the following is a primary market transaction? a) Buying shares on a stock exchangeb) Buying bonds from a bondholderc) Initial Public Offering (IPO)d) Trading in derivativesarrow_forward

- What is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forwardNo Ai What is the term for a bond's fixed interest payment? a) Yieldb) Couponc) Principald) Discountarrow_forwardI need help!! 12. A beta value of 1.5 indicates: a) Less risk than the marketb) Same risk as the marketc) 50% more risk than the marketd) 50% less risk than the marketarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Internal Rate of Return (IRR); Author: The Finance Storyteller;https://www.youtube.com/watch?v=aS8XHZ6NM3U;License: Standard Youtube License