Real World Case 12–1

Intel’s investments

• LO12-4

The following disclosure note appeared in the December 26, 2015, annual report of the Intel Corporation.

Note 5: Cash and Investments (partial)

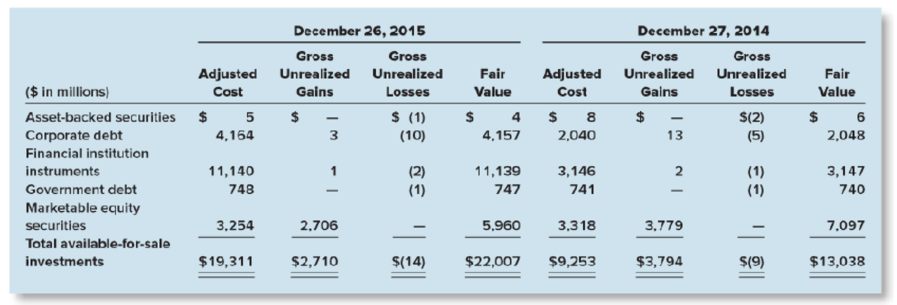

Available-for-sale investments as of December 26, 2015, and December 27, 2014, were as follows:

Intel also indicates the following: “During 2015, we sold available-for-sale investments for proceeds of $2.2 billion . . . The gross realized gains on sales of available-for-sale investments were $133 million in 2015. Intel’s Note 24 (Other Comprehensive Income) indicates unrealized holding losses of $999 million during 2015, and a reclassification adjustment of $93 for gains that had previously been included in OCI and recorded in the fair value adjustment but which were now being included in net income after being realized upon sale. Note: Intel’s 2015 financial statements were issued prior to the effective date of ASU 2016-01, so Intel includes equity investments among its available-for-sale investments. That difference from current GAAP will not affect your answer to the case questions.

Required:

1. Draw a T-account that shows the change between the December 27, 2014, and December 26, 2015, balances for the fair value adjustment associated with Intel’s AFS investments for 2015. By how much did the fair value adjustment change during 2015?

2. Prepare a

3. Prepare a journal entry that records any reclassification adjustment for available-for-sale investments sold during 2015. Ignore income taxes.

4. Using your journal entries from requirements 2 and 3, adjust your T-account from requirement 1. Have you accounted for the entire change in the fair value adjustment that occurred during 2015? Speculate as to the cause of any difference.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

SPICELAND GEN CMB LL INTRM ACCTG; CNCT

- helparrow_forwardKindly help me with accounting questionsarrow_forwardSierra Adventures has a net income of $3 million this year. The book value of Sierra Adventures' common equity is $12 million. The company's dividend payout ratio is 50% and is expected to remain this way. What is Sierra Adventures' internal growth rate?arrow_forward

- If beginning work in process was 750 units, 1,800 additional units were put into production, and ending work in process was 620 units, how many units were completed?arrow_forwardCalculate cameron corporations total assetsarrow_forwardThe Meridian Division's operating data for the year 2021 is as follows: . Return on investment = 13.5% . . Minimum required rate of return 9.5% Average net operating assets = $750,000 Sales $2,500,000 Compute the margin for 2021.arrow_forward

- Subject: general accountingarrow_forwardCan you help me with accounting questionsarrow_forwardParker Investments Co. purchased 30% of the common stock of Brightwood Inc. for $200,000. During the year, Brightwood Inc. earned a net income of $60,000 and paid dividends of $40,000. What is the carrying value of Parker Investments' stake in Brightwood Inc. at year-end? A) $206,000 B) $218,000 C) $220,000 D) $200,000arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning