MANAGERIAL ACCOUNTING W/CONNECT

3rd Edition

ISBN: 9781307583946

Author: Whitecotton

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 10ME

Interpreting

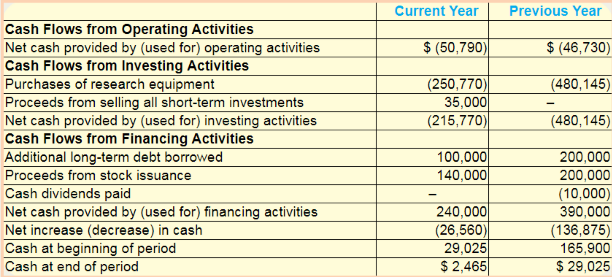

Quantum Dot, Inc., is a nanotechnology company that manufactures “quantum dots,” which are tiny pieces of silicon consisting of loo or more molecules. Quantum dots can be used to illuminate very small objects, enabling scientists to see the blood vessels beneath a mouse’s skin ripple with each heartbeat, at the rate of 100 times per second.

Evaluate this research intensive company’s cash flows, assuming the following was reported in its statement of cash flows.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help me solve this general accounting problem with the correct financial process.

A machine costs $50,000 with a salvage value of $5,000 and a useful life of 5 years. Calculate the annual depreciation expense using straight-line, double-declining balance, and sum-of-years-digits methods.

During 2022, Hunter Enterprises generated revenues of $175,000. The company's expenses were as follows: cost of goods sold of $92,000, operating expenses of $32,000, and a loss on disposal of assets of $5,000. Hunter's gross profit is_.

Chapter 12 Solutions

MANAGERIAL ACCOUNTING W/CONNECT

Ch. 12 - Compare the purposes of the income statement, the...Ch. 12 - What information does the statement of cash flows...Ch. 12 - Prob. 3QCh. 12 - What are the major categories of business...Ch. 12 - Prob. 5QCh. 12 - Prob. 6QCh. 12 - Prob. 7QCh. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10Q

Ch. 12 - As a junior analyst, you are evaluating the...Ch. 12 - Prob. 12QCh. 12 - Prob. 13QCh. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1MCCh. 12 - Prob. 2MCCh. 12 - Prob. 3MCCh. 12 - Prob. 4MCCh. 12 - Prob. 5MCCh. 12 - Prob. 6MCCh. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - Prob. 1MECh. 12 - Prob. 2MECh. 12 - Prob. 3MECh. 12 - Prob. 4MECh. 12 - Prob. 5MECh. 12 - Prob. 6MECh. 12 - Prob. 7MECh. 12 - Prob. 8MECh. 12 - Prob. 9MECh. 12 - Interpreting Cash Flows from Operating, Investing,...Ch. 12 - Prob. 11MECh. 12 - Prob. 12MECh. 12 - Prob. 13MECh. 12 - Prob. 1ECh. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Prob. 4ECh. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - Prob. 7ECh. 12 - Prob. 8ECh. 12 - Reporting and Interpreting Cash Flows from...Ch. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Prob. 17ECh. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Prob. 21ECh. 12 - Prob. 22ECh. 12 - (Supplement 12B) Preparing a Statement of Cash...Ch. 12 - Prob. 1GAPCh. 12 - Prob. 2GAPCh. 12 - Prob. 3.1GAPCh. 12 - Prob. 3.2GAPCh. 12 - Prob. 4.1GAPCh. 12 - Prob. 4.2GAPCh. 12 - Prob. 5GAPCh. 12 - Preparing and Interpreting a Statement of Cash...Ch. 12 - Prob. 7.1GAPCh. 12 - Prob. 7.2GAPCh. 12 - Prob. 1GBPCh. 12 - Prob. 2GBPCh. 12 - Prob. 3.1GBPCh. 12 - Prob. 3.2GBPCh. 12 - Prob. 4.1GBPCh. 12 - Prob. 4.2GBPCh. 12 - Prob. 5GBPCh. 12 - Prob. 6GBP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jefferson Corp. recently reported a net income of $7,840 and depreciation of $1,230. How much was its net cash flow, assuming it had no amortization expense and sold none of its fixed assets?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forward

- Solve thisarrow_forwardThe gross profit amount as a percentage of the sales amount for teslaarrow_forwardDuring FY 2024 Matrix Industries had total manufacturing costs of $563,000. Their cost of goods manufactured for the year was $598,000. The January 1, 2025 balance of the Work-in-Process Inventory is $57,000. Use this information to determine the dollar amount of the FY 2024 beginning Work-in-Process Inventory.arrow_forward

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost control, Why cost control is necessary for a business?; Author: Educationleaves;https://www.youtube.com/watch?v=yMg3gJx48Fg;License: Standard youtube license