Payroll accounts and year-end entries

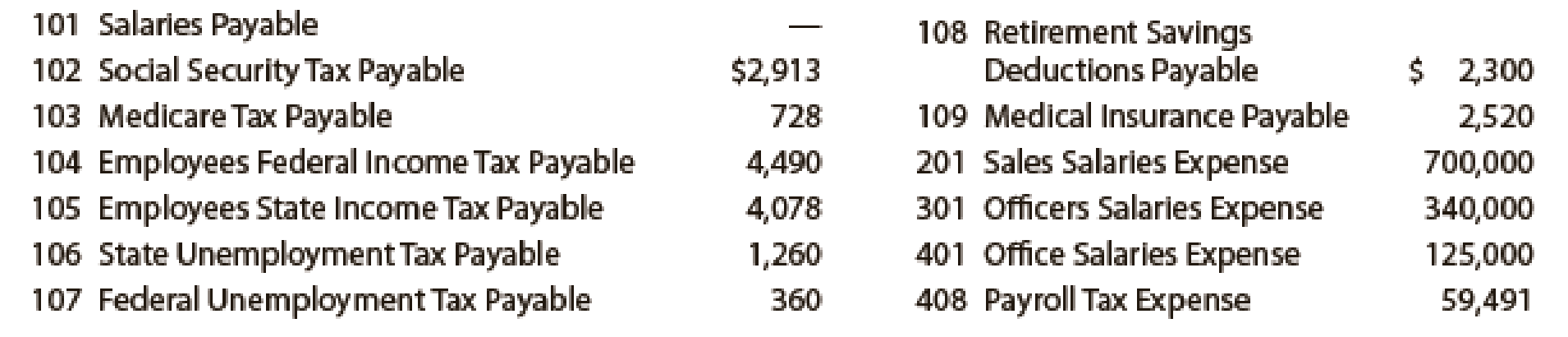

The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year:

The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December:

Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy.

1. Issued Check No. 816 to Alvarez Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due.

2. Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees.

12.

Dec. 1. Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy.

1. Issued Check No. 816 to Alvarez Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due.

2. Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees.

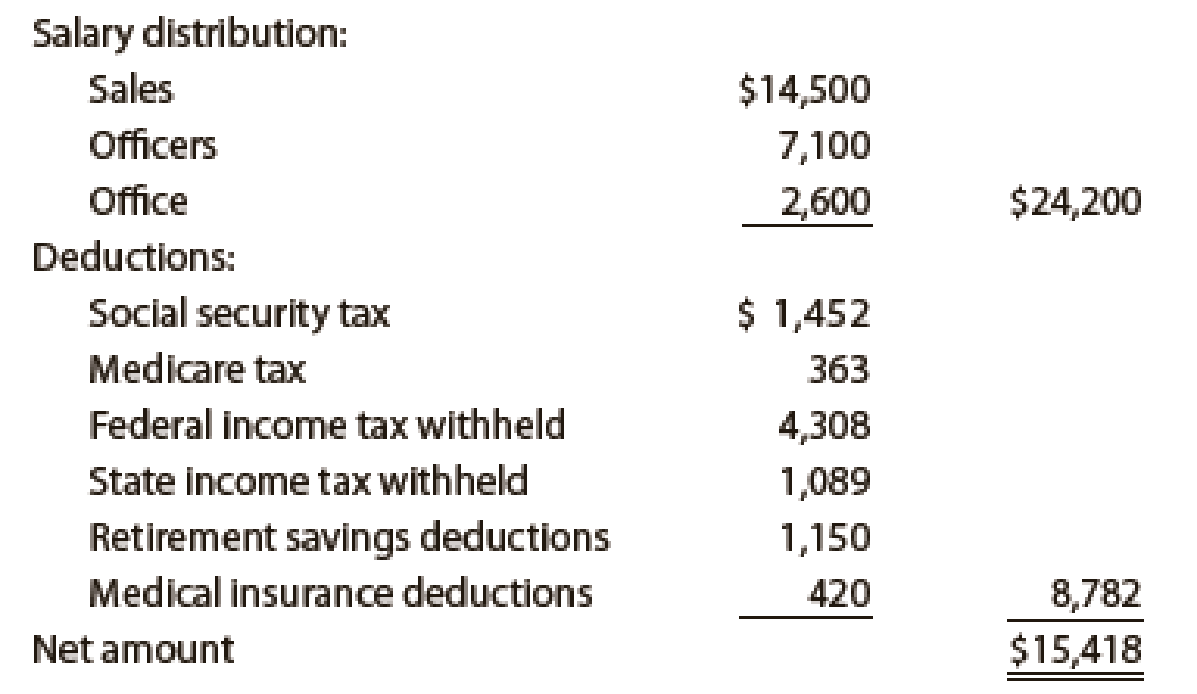

12. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

12. Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund the payroll bank account.

12. Journalized the entry to record payroll taxes on employees’ earnings of December12: social security tax, $1,452; Medicare tax, $363; state

15. Issued Check No. 830 to Alvarez Bank for $7,938, in payment of $2,904 of social security tax, $726 of Medicare tax, and $4,308 of employees’ federal income tax due.

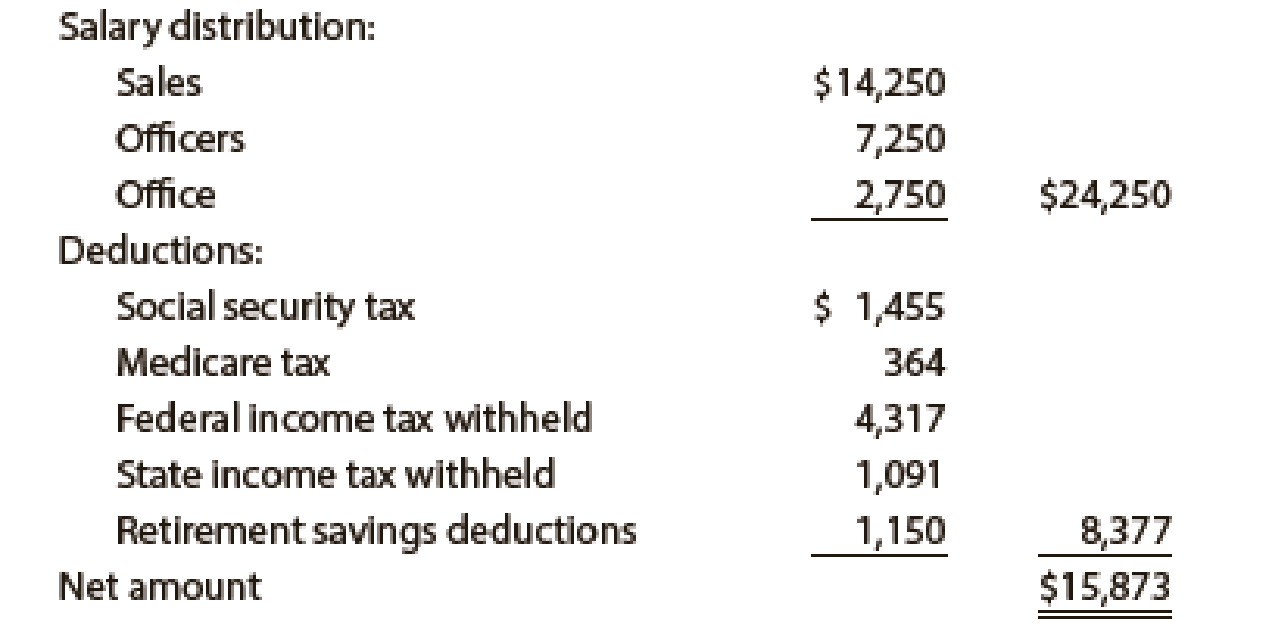

26. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

26. Issued Check No. 840 for the net amount of the biweekly payroll to fund the payroll bank account.

Dec. 26. Journalized the entry to record payroll taxes on employees’ earnings of December 26: social security tax, $1,455; Medicare tax, $364; state unemployment tax, $150; federal unemployment tax, $40.

30. Issued Check No. 851 for $6,258 to State Department of Revenue, in payment of employees’ state income tax due on December 31.

30. Issued Check No. 852 to Alvarez Bank for $2,300 to invest in a retirement savings account for employees.

31. Paid $55,400 to the employee pension plan. The annual pension cost is $65,500. (Record both the payment and the unfunded pension liability.)

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $13,350.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,