Concept explainers

1.

Prepare the necessary

1.

Explanation of Solution

Straight-line depreciation method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Prepare the necessary journal entries to record the given transactions as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2016 | Trucks (1) | 160,000 | |

| Cash | 160,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2016 | Depreciation expense (2) | 30,400 | |

| | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2017 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 4,000 | ||

| Trucks | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2017)) | |||

| December 31, 2017 | Depreciation expense (4) | 28,880 | |

| Accumulated depreciation-Trucks | 28,880 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2018 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks | 13,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2018)) | |||

| December 31, 2018 | Depreciation expense (4) | 24,320 | |

| Accumulated depreciation-Trucks | 24,320 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2019 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks | 29,000 | ||

| Trucks | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2019)) | |||

| December 31, 2019 | Depreciation expense (4) | 15,200 | |

| Accumulated depreciation-Trucks | 15,200 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks | 34,000 | ||

| Trucks | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (4) | 7,600 | |

| Accumulated depreciation-Trucks | 7,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 20,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (4) | 3,040 | |

| Accumulated depreciation-Trucks | 3,040 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks | 15,000 | ||

| Trucks | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2022)) | |||

| December 31, 2022 | Loss on disposal of property, plant and equipment (6) | 5,560 | |

| Accumulated depreciation-Trucks | 5,560 | ||

| (To record the loss on disposal of property, plant and equipment) |

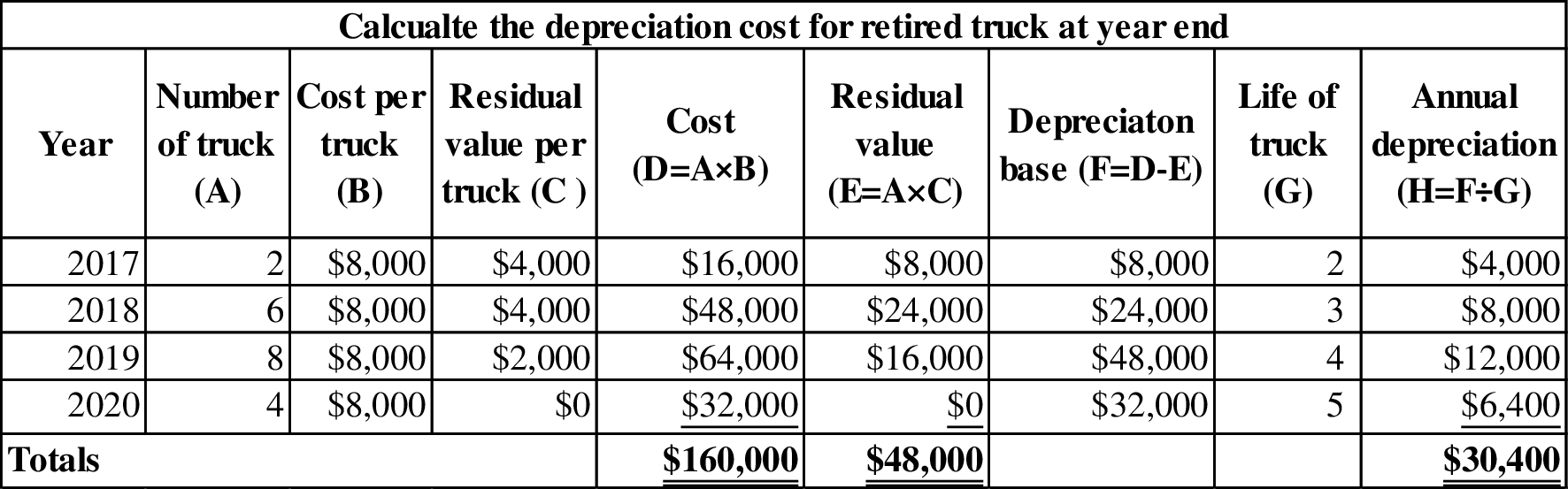

Table (1)

Working note (1):

Calculate the total cost of trucks.

Working note (2):

Figure (1)

Working note (3):

Calculate the depreciation rate.

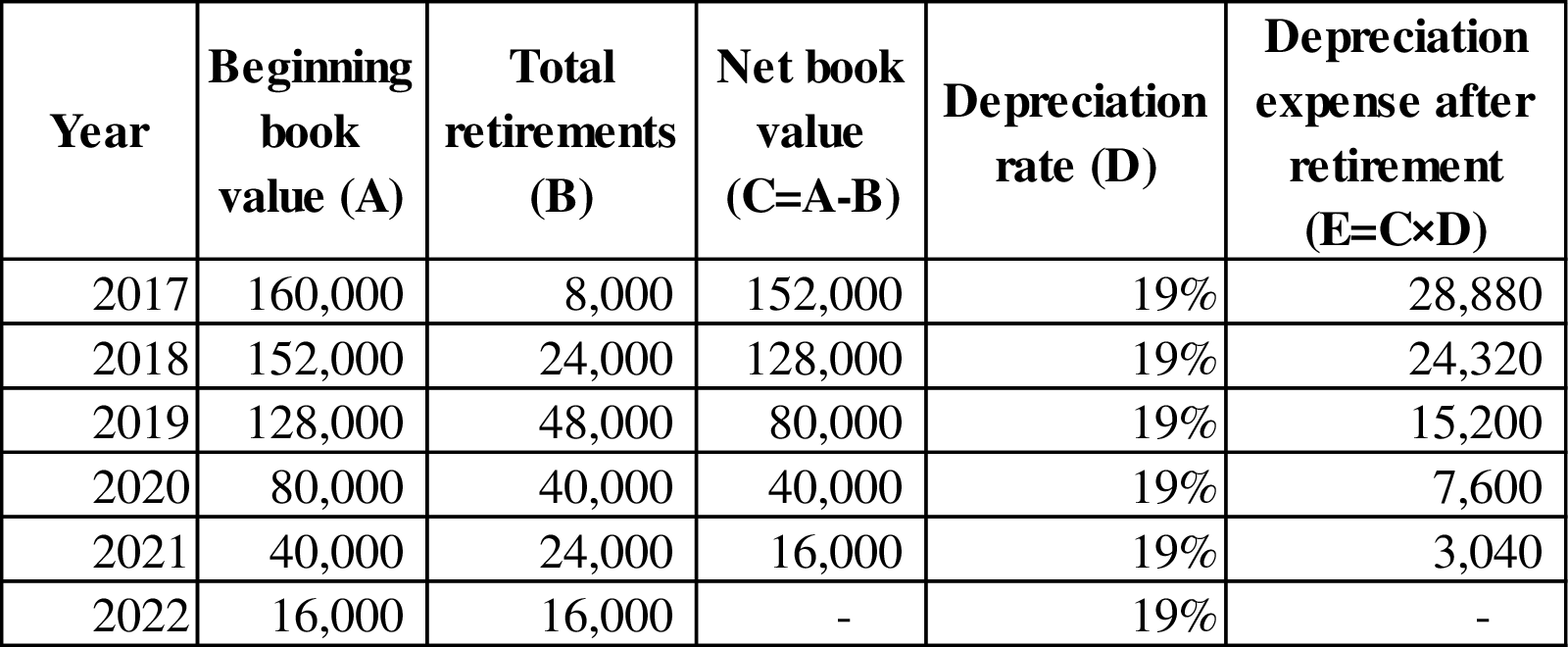

Working note (4):

Calculate the depreciation expense after retirement of truck for each year.

Figure (2)

Working note (5):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2016 | $0 | $30,400 (2) |

| 2017 | $4,000 | $28,880 (4) |

| 2018 | $13,000 | $24,320 (4) |

| 2019 | $29,000 | $15,200 (4) |

| 2020 | $34,000 | $7,600 (4) |

| 2021 | $20,000 | $3,040 (4) |

| 2022 | $15,000 | $0 |

| Total depreciation | $115,000 | $109,440 |

Table (2)

Working note (6):

Calculate the loss on disposal of property, plant and equipment.

2.

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each.

2.

Explanation of Solution

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2016 | Trucks (1) | 1,60,000 | |

| Cash | 1,60,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2016 | Depreciation expense (7) | 32,000 | |

| Accumulated depreciation-Trucks | 32,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2017 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 4,000 | ||

| Trucks | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2017)) | |||

| December 31, 2017 | Depreciation expense (8) | 30,400 | |

| Accumulated depreciation-Trucks | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2018 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks | 13,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2018)) | |||

| December 31, 2018 | Depreciation expense (8) | 25,600 | |

| Accumulated depreciation-Trucks | 25,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2019 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks | 29,000 | ||

| Trucks | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2019)) | |||

| December 31, 2019 | Depreciation expense (8) | 16,000 | |

| Accumulated depreciation-Trucks | 16,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks | 34,000 | ||

| Trucks | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (8) | 8,000 | |

| Accumulated depreciation-Trucks | 8,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 20,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (8) | 800 | |

| Accumulated depreciation-Trucks | 800 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks | 15,000 | ||

| Trucks | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2022)) | |||

| December 31, 2022 | Loss on disposal of property, plant and equipment (12) | 2,200 | |

| Accumulated depreciation-Trucks | 2,200 | ||

| (To record the loss on disposal of property, plant and equipment) |

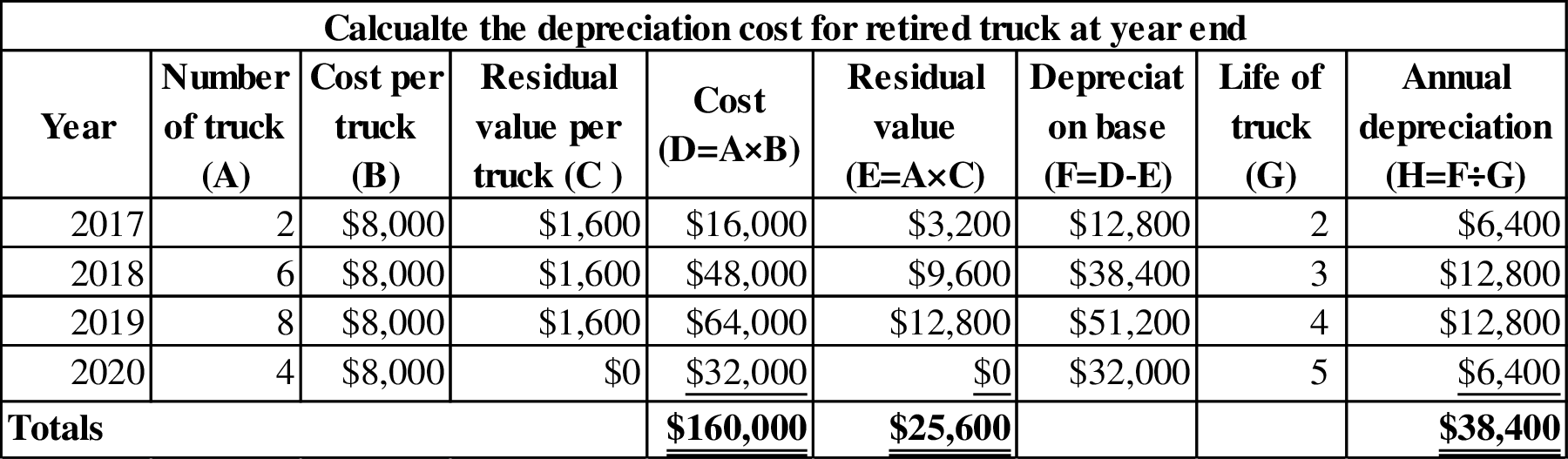

Table (3)

Working note (7):

Calculate the group depreciation cost under straight line method:

Working note (8):

Calculate the depreciation rate.

Working note (9):

Calculate the depreciation expense after retirement of truck for each year.

Figure (3)

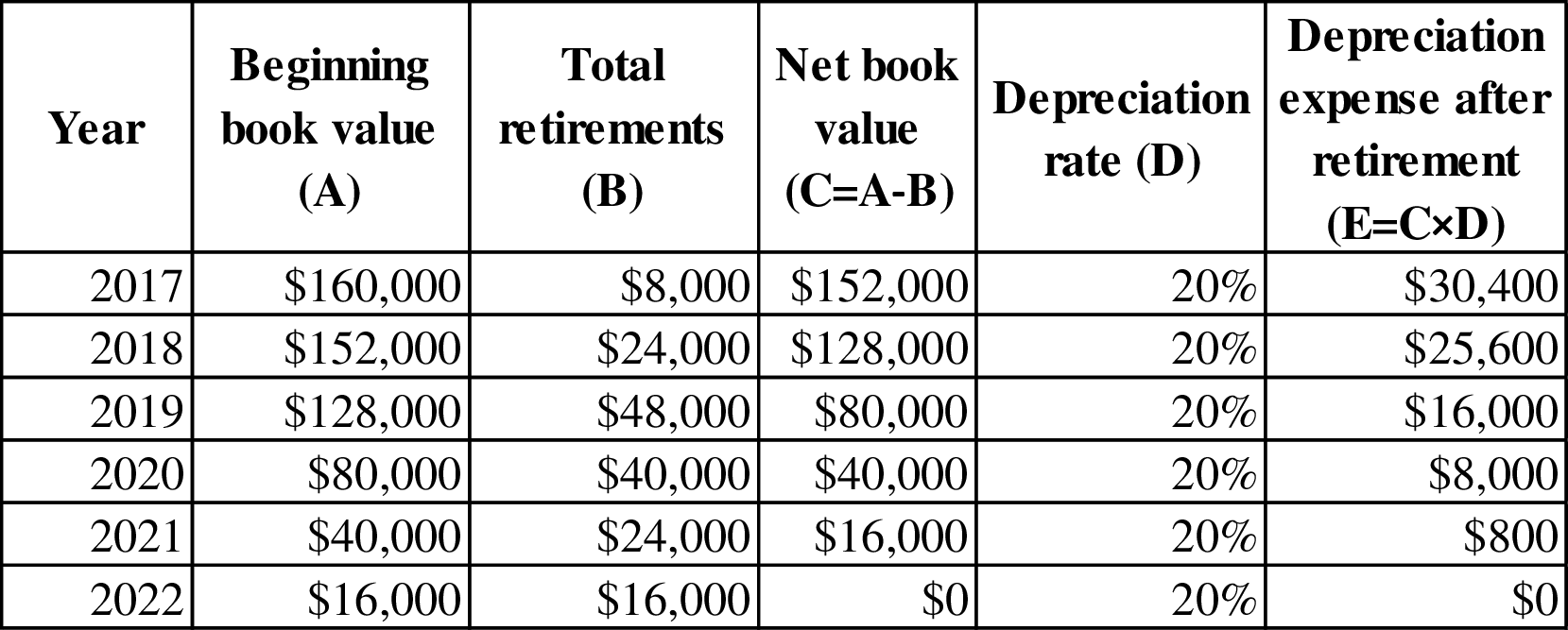

Note: Depreciation expense after retirement for the year 2021 is $800, because the amount of $3,200 would reduce the book value of remaining two trucks (2 trucks) in the year 2022. Hence, the depreciation expense for 2021 is 800

Working note (10):

Calculate the depreciation expense after retirement of truck for each year.

Figure (4)

Working note (11):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2016 | $0 | $32,000 (7) |

| 2017 | $4,000 | $30,400 (10) |

| 2018 | $13,000 | $25,600 (10) |

| 2019 | $29,000 | $16,000 (10) |

| 2020 | $34,000 | $8,000 (10) |

| 2021 | $20,000 | $800 (10) |

| 2022 | $15,000 | $0 |

| Total depreciation | $115,000 | $112,800 |

Table (4)

Working note (12):

Calculate the loss on disposal of property, plant and equipment.

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- can you help me with this question answer ? general accountingarrow_forwardThe magnitude of operating leverage for Roshanarrow_forwardOn September 1, your business had a beginning cash balance of $500. Your sales for August were $800, and your sales for September totaled $1,000. During September, you paid $200 in cash expenses and paid off $350 of accounts payable. Your accounts receivable collection period is 30 days. What is your firm's beginning cash balance on October 1?arrow_forward

- Everlast Corp. has total maintenance department expenses of $40,200. The maintenance costs are allocated based on square footage, where the Processing department occupies 6,000 square feet, and the Packaging department occupies 3,000 square feet. Compute the amount of maintenance department expense allocated to Processing.arrow_forwardwanted general account questions answerarrow_forwardgeneral accountingarrow_forward