Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 5BTN

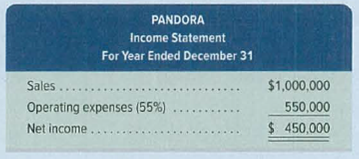

Review the chapter’s opening feature about Tim Westergren and the business he founded, Pandora. Assume that he is considering expanding the business to Europe and that the current abbreviated income statement appears as follows.

Assume also that the company currently has no interest-bearing debt. If it expands to Europe, it will require a $300,000 loan. The company has found a bank that will loan it the money on a 7% note payable. The company believes that, at least for the first few years, sales in Europe will equal $250,000 and that all expenses at both locations will continue to equal 55% of sales.

Required

- 1. Prepare an income statement (showing three separate columns for current operations, European, and total) for the company assuming that it borrows the funds and expands to Europe. Annual revenues for current operations are expected to remain at $1,000,000.

- 2. Compute the company’s times interest earned under the expansion assumptions in part 1.

- 3. Assume sales in Europe are $400,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 4. Assume sales in Europe are $100,000. Prepare an income statement (with columns for current operations, European, and total) for the company and compute times interest earned.

- 5. Comment on your results from parts 1 through 4.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciation

No chatgpt

What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

I need help

10. What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

Chapter 11 Solutions

Principles of Financial Accounting.

Ch. 11 - On December 1, a company signed a 6,000, 90-day,...Ch. 11 - Prob. 2MCQCh. 11 - Prob. 3MCQCh. 11 - Prob. 4MCQCh. 11 - Prob. 5MCQCh. 11 - Prob. 1DQCh. 11 - Prob. 2DQCh. 11 - What are the three important questions concerning...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQ

Ch. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Prob. 8DQCh. 11 - Prob. 9DQCh. 11 - Prob. 10DQCh. 11 - Prob. 11DQCh. 11 - What amount of income tax is withheld from the...Ch. 11 - Prob. 13DQCh. 11 - Prob. 14DQCh. 11 - Prob. 15DQCh. 11 - Refer to Samsungs recent balance sheet in Appendix...Ch. 11 - Which of the following items are normally...Ch. 11 - Prob. 2QSCh. 11 - Prob. 3QSCh. 11 - Prob. 4QSCh. 11 - Prob. 5QSCh. 11 - Prob. 6QSCh. 11 - Prob. 7QSCh. 11 - Prob. 8QSCh. 11 - Prob. 9QSCh. 11 - Prob. 10QSCh. 11 - Prob. 11QSCh. 11 - Prob. 12QSCh. 11 - Prob. 13QSCh. 11 - Prob. 14QSCh. 11 - Prob. 15QSCh. 11 - Prob. 1ECh. 11 - Prob. 2ECh. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Prob. 7ECh. 11 - Prob. 8ECh. 11 - Prob. 9ECh. 11 - Prob. 10ECh. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Prob. 18ECh. 11 - Prob. 19ECh. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Prob. 3APCh. 11 - Prob. 4APCh. 11 - Shown here are condensed income statements for two...Ch. 11 - Prob. 6APCh. 11 - Prob. 1BPCh. 11 - Prob. 2BPCh. 11 - Prob. 3BPCh. 11 - Prob. 4BPCh. 11 - Prob. 5BPCh. 11 - Entries for payroll transactions MLS Company has...Ch. 11 - Prob. 11SPCh. 11 - Prob. 1AACh. 11 - Prob. 2AACh. 11 - Prob. 3AACh. 11 - Beyond the Numbers Cameron Bly is a sales manager...Ch. 11 - Prob. 2BTNCh. 11 - Review the chapters opening feature about Tim...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed answerarrow_forwarddont use ai What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardFill in the attached balance sheet with the data provided on the SEC for years 2020, 2021 and 22 NIKE, INC BALANCE SHEET Financial Statements 2020 2021 2022 Assets Current Assets Cash and Cash Equivalents [insert value] [insert value] [insert value] Accounts Receivable Net [insert value] [insert value] [insert value] Inventory [insert value] [insert value] [insert value] Other Current Assets [insert value] [insert value] [insert value] Total Current Assets $ - $ - $ - Non-Current Assets Property, Plant and Equipment Net [insert value] [insert value] [insert value] Intangibles [insert value] [insert value] [insert value] Other Assets [insert value] [insert value] [insert value] Total Non-Current/Fixed Assets $ - $…arrow_forward

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets helparrow_forwardNo chatgpt What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed helparrow_forward

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardNo AI 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardNeed help ! 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardCalculate the times-interest-earned ratios for PEPSI CO, Given the following informationarrow_forwardCalculate the times-interest-earned ratios for Coca Cola in 2020. Explain if the times-interest-earned ratios is adequate? Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income? Can the company afford the interest expense on a new loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Liquidity Risk (FRM Part 2 – Book 4 – Chapter 1); Author: AnalystPrep;https://www.youtube.com/watch?v=TguAvyxM6vg;License: Standard Youtube License