Step Method with Three Service Departments

Model, Inc., produces model automobiles made from metal. It operates two production departments, Molding and Painting, and has three service departments, Administration, Accounting, and Maintenance. The accumulated costs in the three service departments were $250,000, $400,000, and $200,000, respectively. Management is concerned that the costs of its service departments are getting too high. In particular, managers would like to keep the costs of service departments under $3.50 per unit on average. You have been asked to allocate service department costs to the two production departments and compute the unit costs.

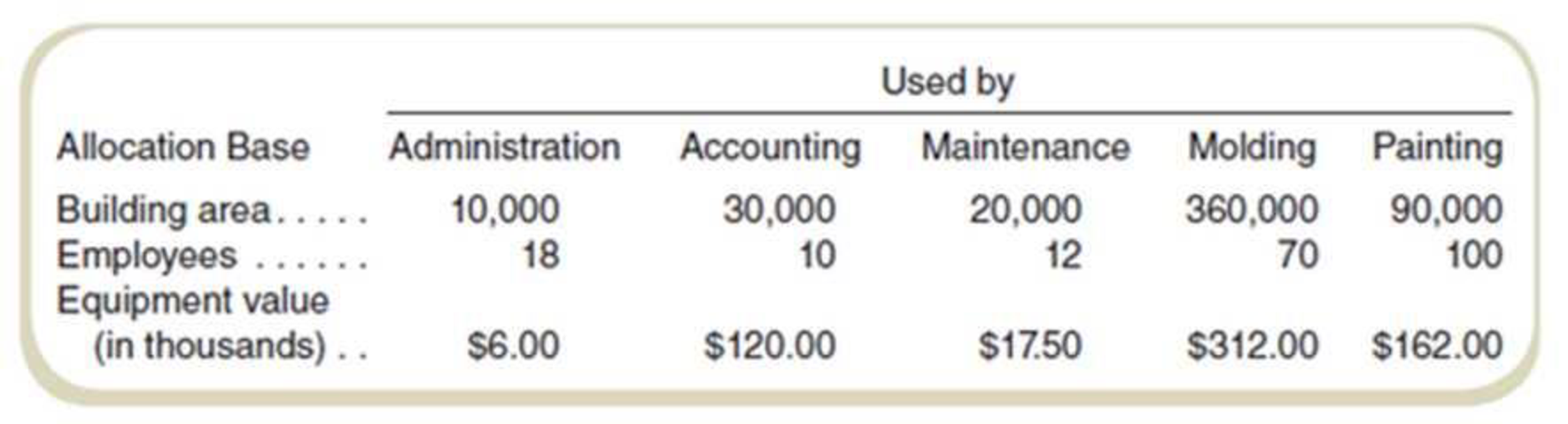

The company decided that Administration costs should be allocated on the basis of square footage used by each production and service department. Accounting costs are allocated on the basis of number of employees. Maintenance costs are allocated on the basis of the dollar value of the equipment in each department. The use of each base by all departments during the current period follows:

Direct costs of the Molding Department included $237,500 in direct materials, $337,500 in direct labor, and $112,500 in

Required

- a. Using the step method, determine the allocated costs and the total costs in each of the two producing departments. Ignore self-usage (for example, ignore work done by Administration for itself). Rank order the allocation as follows: (1) Maintenance, (2) Accounting, and (3) Administration.

- b. Assume that 100,000 units were processed through these two departments. What is the unit cost for the sum of direct materials, direct labor, and overhead (1) for Molding, (2) for Painting, and (3) in total?

- c. Compute the cost per unit for the service department costs allocated to the production departments. Did the company meet management’s standards of keeping service department costs below $3.50 per unit?

a.

Use the step method and determine the allocated costs and the total costs in each of the two producing departments. Make order the allocation as follows: (1) Maintenance, (2) Accounting, and (3) Administration.

Answer to Problem 54P

The cost allocation for molding department and painting department is $1,190,632 and $831,868.

Explanation of Solution

Step method:

Step method allows the allocation of the cost to the production department and service departments. Unlike the direct method, it also allocates the cost of the service to various service departments. Allocation of the cost starts from the department that has provided the highest proposition of service to the department that has provided the least service. Step method allows only one-way allocation of cost among service departments.

Calculate the allocation of costs:

| Department | |||||

| Amount | Maintenance | Accounting | Administration | Molding | Painting |

| Direct costs | $200,000 | $400,000 | $250,000 | $687,500 | $485,000 |

| Maintenance | $ (200,000) | $40,000 | $2,000 | $104,000 | $54,000 |

| Accounting | - | $ (440,000) | $42,128 | $163,830 | $234,042 |

| Administration | - | - | $(294,128) | $235,302 | $58,826 |

| Total cost | $0 | $0 | $0 | $1,190,632 | $831,868 |

Table: (1)

Thus, the cost allocation for the molding department and painting department is $1,190,632 and $831,868.

Working note 1:

Calculate the allocation of maintenance cost:

| Particulars |

Maintenance cost (a) |

Equipment value (b) |

Amount |

| Allocation to maintenance cost : | |||

| Accounting department | $200,000 | $120.0 | $40,000 |

| Administration department | $200,000 | $17.5 | $2,000 |

| Molding department | $200,000 | 312 | $104,000 |

| Painting department | $200,000 | 162 | $54,000 |

| Total | $611.50 |

Table: (2)

Working note 2:

Calculate the allocation of accounting department:

| Particulars |

Accounting cost (a) |

Number of employees (b) |

Amount |

| Allocation to accounting cost: | |||

| Administration department | $400,000 | 12 | $4,800,000 |

| Molding department | $400,000 | 70 | $28,000,000 |

| Painting department | $400,000 | 100 | $40,000,000 |

| Total | $182 | $0 |

Table: (3)

Working note 3:

Calculate the allocation of administration department:

| Particulars |

Administration cost (a) |

Building area (b) |

Amount |

| Allocation to accounting cost: | |||

| Molding department | $294,128 |

$360,000 | $235,302 |

| Painting department | $294,128 | $90,000 | $58,826 |

| Total | $450,000 |

Table: (4)

b.

Calculate the unit cost for the sum of direct materials, direct labor, and overhead cost (1) for Molding, (2) for Painting, and (3) in total.

Answer to Problem 54P

The unit cost of molding and painting is $11.91 and $8.31 respectively.

Explanation of Solution

Joint cost allocation:

Joint cost is the cost that occurs for two or more products of a business. When two or more products have the same production process then they share some common cost, that common cost is known as the joint cost of the production.

Calculate the unit cost for molding:

Calculate the unit cost for painting:

Thus, the unit cost of molding and painting is $11.91 and $8.31 respectively.

c.

Compute the cost per unit for the service department costs which are allocated to the production departments. Also, identify whether the company meets management’s standards of keeping service department costs below $3.50 per unit.

Answer to Problem 54P

The unit cost of the service department for the molding and painting department is $5.03 and $3.46.

Explanation of Solution

Joint cost allocation:

Joint cost is the cost that occurs for two or more products of a business. When two or more products have the same production process then they share some common cost, that common cost is known as the joint cost of the production.

Calculate the molding cost per unit:

Calculate the painting cost per unit:

Thus, the unit cost of the service department for the molding and painting department is $5.03 and $3.46 respectively.

Working note 4:

Calculate the service department cost:

| Particulars | Molding | Painting |

| Maintenance | $104,000 | $54,000 |

| Accounting | $163,830 | $234,042 |

| Administration | $235,302 | $58,826 |

| Total service costs | $503,132 | $346,868 |

Table: (5)

Want to see more full solutions like this?

Chapter 11 Solutions

FUND.OF COST ACCT >CUSTOM<

- hello teacher please solve questionarrow_forwardAssume that Brightview Senior Care has two categories of payers. Medicare pays $75.00 per day, and private pay patients pay the established per diem rate, but approximately 8% of private pay charges are not collected. If 40% of the patients are Medicare and 60% are private pay, what rate must be set to generate $200,000 in profit? Variable costs are $50.00 per day, and fixed costs are expected to be $1,200,000. Expected volume is 60,000 patient days.arrow_forward29) As part of his job as cost analyst, John Kelly collected the following information concerning the operations of the Machining Department: Observation Machine-hours Total Operating Costs January 4,700 $43,000 February 5,060 45,395 March 4,180 42,535 April 4,500 43,600 May 4,250 42,890 Required: a. Use regression analysis to estimate the cost function with machine-hours as the cost driver. b. If June's estimated machine-hours are 4,300, calculate the total estimated costs of the Machining Department?arrow_forward

- Provide correct answer general accounting questionarrow_forwardCorrect answerarrow_forwardDuring 20x2 Creswell Corporation sold $5,500 of inventory on credit. The company's beginning and ending accounts receivable balances were $30,000 and $32,500, respectively. How much cash did Creswell Corporation collect on the account? If the ending accounts receivable had been $27,000, how much cash would Creswell Corporation have collected?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning