Tonya Jefferson (single), a sole proprietor, runs a successful lobbying business in Washington, DC. She doesn’t sell many business assets, but she is planning on retiring and selling her historic townhouse, from which she runs her business, to buy a place somewhere sunny and warm. Tonya’s townhouse is worth $1,000,000 and the land is worth another $1,000,000. The original basis in the townhouse was $600,000, and she has claimed $250,000 of

- a) What amount of gain or loss does Tonya recognize on the sale? What is the character of the gain or loss? What effect does the gain or loss have on her tax liability?

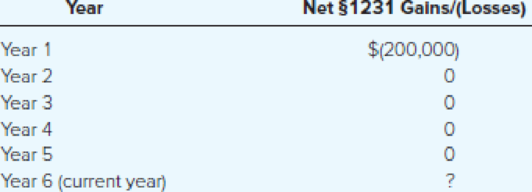

- b) In addition to the original facts, assume that Tonya reports the following nonrecaptured net §1231 loss:

What amount of gain or loss does Tonya recognize on the sale? What is the character of the gain or loss? What effect does the gain or loss have on her year 6 (the current year) tax liability?

- c) As Tonya’s tax adviser, you suggest that Tonya sell the townhouse in year 7 in order to reduce her taxes. What amount of gain or loss does Tonya recognize on the sale in year 7?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

TAXATION OF INDIVIDUALS AND BUSINESS EN

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT