Calculating Common and Preferred Cash Dividends

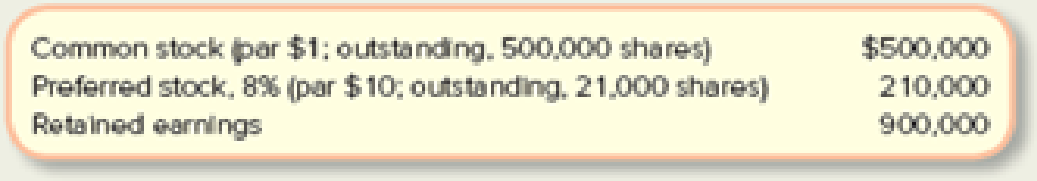

Ritz Company had the following stock outstanding and

On December 31, 2018, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2016 or 2017. Three independent cases are assumed:

Case A: The

Case B: The preferred stock is cumulative; the total amount of 2018 dividends would be $30,000. Dividends were not in arrears prior to 2016.

Case C: Same as Case B, except the amount is $75,000.

Required:

Compute the amount of dividends, in total and per share, payable to each class of stockholders if dividends were declared as described in each case. Show computations. Round per-share amounts to two decimal places.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Loose Leaf For Fundamentals Of Financial Accounting

- No AI The accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forwardRevenue is recognized in the accounting records when it is:A. CollectedB. EarnedC. DepositedD. Reportedarrow_forwardThe accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning