FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

15th Edition

ISBN: 9781337955447

Author: WARREN/TAYLOR

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 4MAD

Analyze and compare Hilton and Marriott

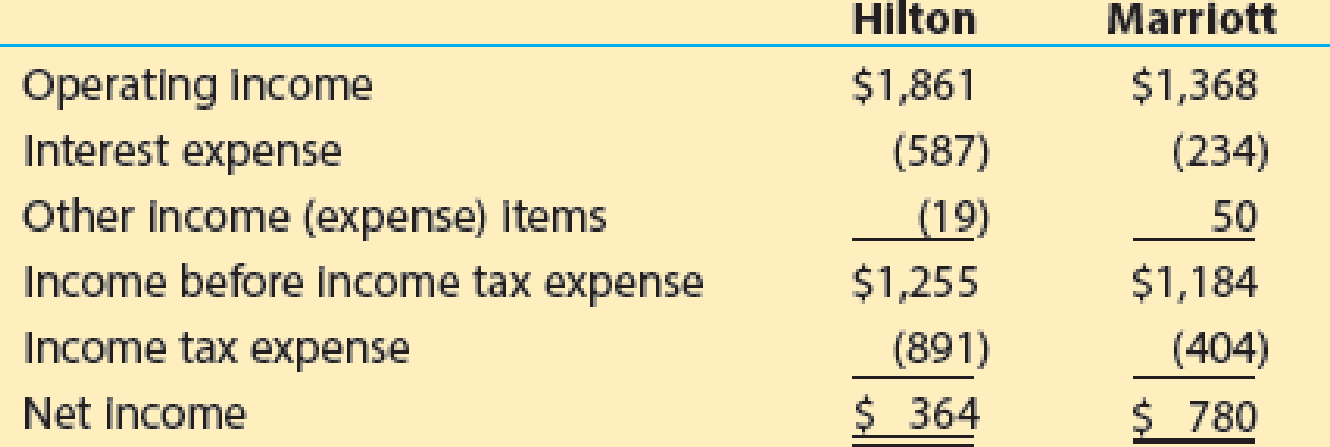

Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions):

- a. Compute the times interest earned ratio for each company. Round to one decimal place.

- b. Which company appears to better protect creditor interest? Why?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General accounting

Can you solve this general accounting question with accurate accounting calculations?

I need assistance with this general accounting question using appropriate principles.

Chapter 11 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

Ch. 11 - Describe the two distinct obligations incurred by...Ch. 11 - Explain the meaning of each of the following terms...Ch. 11 - If you asked your broker to purchase for you a 12%...Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Fleeson Company needs additional funds to purchase...Ch. 11 - Prob. 9DQCh. 11 - Issuing bonds at face amount On January 1, the...

Ch. 11 - Issuing bonds at a discount On the first day of...Ch. 11 - Prob. 3BECh. 11 - Prob. 4BECh. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Times interest earned Averill Products Inc....Ch. 11 - Prob. 1ECh. 11 - Entries for issuing bonds Thomson Co. produces and...Ch. 11 - Prob. 3ECh. 11 - Prob. 4ECh. 11 - Prob. 5ECh. 11 - Entries for issuing and calling bonds; gain Mia...Ch. 11 - Prob. 7ECh. 11 - Present value of amounts due Assume that you are...Ch. 11 - Prob. 9ECh. 11 - Present value of an annuity On January 1, you win...Ch. 11 - Prob. 11ECh. 11 - Prob. 12ECh. 11 - Prob. 13ECh. 11 - Prob. 14ECh. 11 - Appendix 2 Amortize premium by interest method...Ch. 11 - Prob. 16ECh. 11 - Prob. 17ECh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PACh. 11 - Entries for bonds payable, including bond...Ch. 11 - Appendix 1 and Appendix 2 Bond discount, entries...Ch. 11 - Prob. 5PACh. 11 - Bond discount, entries for bonds payable...Ch. 11 - Prob. 2PBCh. 11 - Entries for bonds payable, including bond...Ch. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Analyze and compare Amazon.com and Wal-Mart...Ch. 11 - Analyze and compare Clorox and Procter Gamble The...Ch. 11 - Prob. 3MADCh. 11 - Analyze and compare Hilton and Marriott Hilton...Ch. 11 - Prob. 1TIFCh. 11 - Prob. 3TIFCh. 11 - Prob. 4TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Understanding Credit; Author: UCBStudentAffairs;https://www.youtube.com/watch?v=EBdXREhOuME;License: Standard Youtube License