Principles Of Taxation For Business And Investment Planning 2020 Edition

23rd Edition

ISBN: 9781259969546

Author: Sally Jones, Shelley C. Rhoades-Catanach, Sandra R Callaghan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 4AP

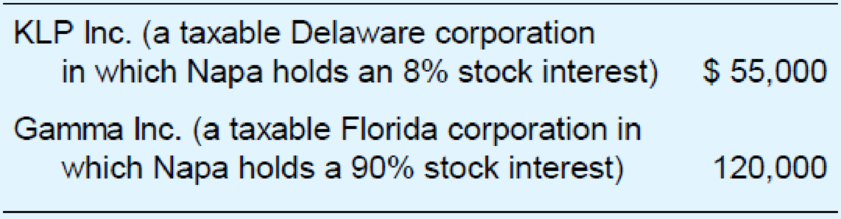

This year, Napa Corporation received the following dividends.

Napa and Gamma do not file a consolidated tax return. Compute Napa’s dividends-received deduction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you please help me by providing clear neat organized answers. Thank you!

Can you please help me by providing clear neat organized answers. Thank you!

Can you please help me by providing clear neat organized answers. Thank you!

Chapter 11 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Cramer Corporation, a calendar year, accrual basis...Ch. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Camden Corporation, a calendar year accrual basis...Ch. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - In 2018, NB Inc.s federal taxable income was...Ch. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please help me by providing clear neat organized answers. Thank you!arrow_forwardCan you please help me by providing clear neat organized answers. Thank you!arrow_forwardSummary: You will investigate a case of asset theft involving several fraudsters for this assignment. The case offers a chance to assess an organization's corporate governance, fraud prevention, and risk factors. Get ready: Moha Computer Services Limited Links to an external website: Finish the media activity. The scenario you need to finish the assignment is provided by this media activity. Directions: Make a four to five-page paper that covers the following topics. Management must be questioned by an auditor regarding the efficacy of internal controls and the potential for fraud. A number of warning signs point to the potential for fraud in this instance. List at least three red flags (risk factors for fraud) that apply to the Moha case. Sort them into three groups: opportunities, pressures/incentives, and (ethical) attitudes/justifications. Determine which people and organizations were impacted by Moha Computer Services Limited's enormous scam. Describe the fraud's financial and…arrow_forward

- Coarrow_forwardCritically assess the role of the Conceptual Framework in financial reporting and its influence onaccounting theory and practice. Discuss how the qualitative characteristics outlined in theConceptual Framework enhance financial reporting and contribute to decision-usefulness. Provideexamples to support your analysis.arrow_forwardCritically analyse the role of financial reporting in investment decision-making,emphasizing the qualitative characteristics that enhance the usefulness of financialstatements. Discuss how financial reporting influences both investor confidence andregulatory decisions, using relevant examples.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License