Mean and Standard Deviation of Monthly Returns:

Mean monthly return

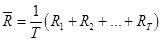

Mean monthly return of a stock during some historical period is the average of the realized returns for each month of the period. The formula used to calculate the mean monthly return is given below.

Here, R is realized return in a year and T is the number of years.

Standard deviation:

Standard deviation is a tool that helps in measuring the risk involved in a particular investment. It indicates how much predictability is possible in an investment. When the standard deviation is more than 1, it implies the series of data across the boundary. In such cases, however, control and prediction becomes a complex process. When the value of standard deviation is lower than the mean values, it implies that there is a high prediction possibility. When the value of standard deviation is lower, it gives confidence to the investor to opt for a share.

To do: Calculate the mean monthly returns and standard deviations for the monthly returns of each of the stocks.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

FUND.OF CORP.FINANCE PKG. F/BU >C<

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education