(a)

To discuss:

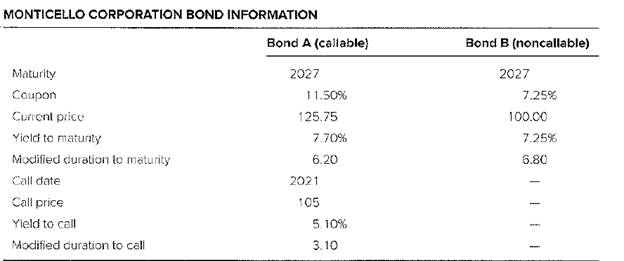

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation,shown in the table below.

The price and yield behavior of the two bonds under each of the following two scenarios is to be compared using the duration and yield information in the table:

- In case of rising inflation expectations,strong economic recovery

- In case of reduced inflation expectations,economic recession

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturityis known as Callable Bond.

(b)

To discuss:

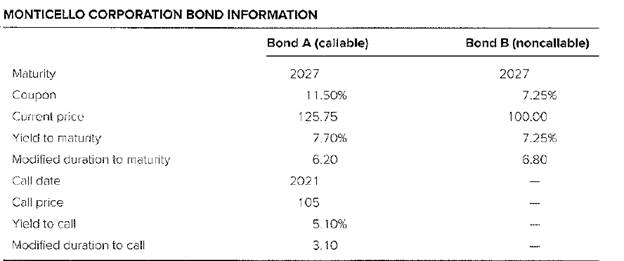

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation, shown in the table below:

The projected price change for Bond B if the yield to maturity for this bond falls by 75 basis points is to be calculated using the information in the table:

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond, is known as Yield to Maturity.

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturity is known as Callable Bond.

(c)

To Discuss:

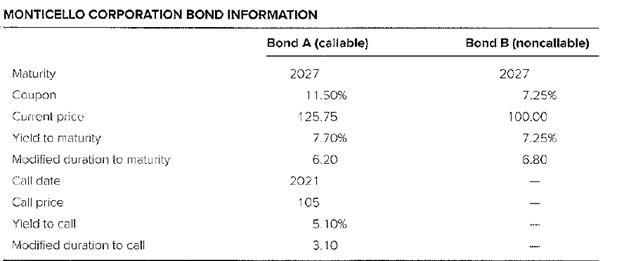

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation, shown in the table below:

The shortcoming of analyzing Bond A strictly to call or to maturity is to be described.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond, is known as Yield to Maturity.

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturity is known as Callable Bond.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

ESS. OF INVESTMENTS - ETEXT ACCESS CARD

- Crenshaw, Incorporated, is considering the purchase of a $367,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method. The market value of the computer will be $67,000 in five years. The computer will replace five office employees whose combined annual salaries are $112,000. The machine will also immediately lower the firm's required net working capital by $87,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 22 percent. The appropriate discount rate is 15 percent. Calculate the NPV of this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPV Answer is complete but not entirely correct. S 103,141.80arrow_forwardYour firm is contemplating the purchase of a new $610,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $66,000 at the end of that time. You will save $240,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $81,000 (this is a one-time reduction). If the tax rate is 21 percent, what is the IRR for this project? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. IRR %arrow_forwardQUESTION 1 Examine the information provided below and answer the following question. (10 MARKS) The hockey stick model of start-up financing, illustrated by the diagram below, has received a lot of attention in the entrepreneurial finance literature (Cumming & Johan, 2013; Kaplan & Strömberg, 2014; Gompers & Lerner, 2020). The model is often used to describe the typical funding and growth trajectory of many startups. The model emphasizes three main stages, each of which reflects a different phase of growth, risk, and funding expectations. Entrepreneur, 3 F's Debt(banks & microfinance) Research Business angels/Angel Venture funds/Venture capitalists Merger, Acquisition Grants investors PO Public market Growth (revenue) Break even point Pide 1st round Expansion 2nd round 3rd round Research commercial idea Pre-seed Initial concept Seed Early Expansion Financial stage Late IPO Inception and prototype Figure 1. The hockey stick model of start-up financing (Lasrado & Lugmayr, 2013) REQUIRED:…arrow_forward

- critically discuss the hockey stick model of a start-up financing. In your response, explain the model and discibe its three main stages, highlighting the key characteristics of each stage in terms of growth, risk, and funding expectations.arrow_forwardSolve this problem please .arrow_forwardSolve this finance question.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education