(a)

To discuss:

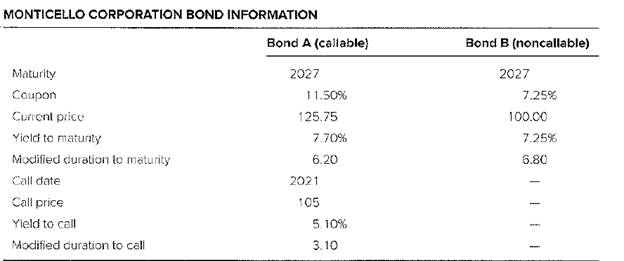

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation,shown in the table below.

The price and yield behavior of the two bonds under each of the following two scenarios is to be compared using the duration and yield information in the table:

- In case of rising inflation expectations,strong economic recovery

- In case of reduced inflation expectations,economic recession

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturityis known as Callable Bond.

(b)

To discuss:

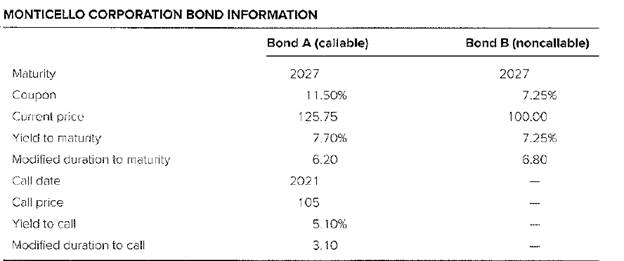

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation, shown in the table below:

The projected price change for Bond B if the yield to maturity for this bond falls by 75 basis points is to be calculated using the information in the table:

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond, is known as Yield to Maturity.

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturity is known as Callable Bond.

(c)

To Discuss:

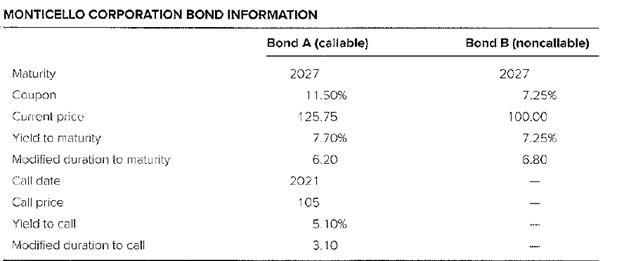

Two specific bond issues are to be evaluated as part of an analysis of debt issued by Monticello Corporation, shown in the table below:

The shortcoming of analyzing Bond A strictly to call or to maturity is to be described.

Introduction:

When specified payments are made by the issuer to the holder for a given period of time due to an obligation created by a security, then that security is known as Bond.The amount the holder will receive on maturity along with the coupon rate which is also known as the interest rate of the bond is known as the face value of the bond. The discount rate due to which the present payments from the bond become equal to its price i.e. it is the average rate of return which a holder can expect from a bond, is known as Yield to Maturity.

A bond's annual income when divided by the current price of the security is known as the current yield.

A bond due to whichthe issuer is permitted to hold the benefit of redeeming the bond at atime before the bond reaches its maturity is known as Callable Bond.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

CONNECT WITH LEARNSMART FOR BODIE: ESSE

- Chee Chew's portfolio has a beta of 1.27 and earned a return of 13.6% during the year just ended. The risk-free rate is currently 4.6%. The return on the market portfolio during the year just ended was 10.5%. a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended. b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's portfolio, which has a Jensen's measure of -0.25. Which portfolio performed better? Explain. c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended.arrow_forwardDuring the year just ended, Anna Schultz's portfolio, which has a beta of 0.91, earned a return of 8.1%. The risk-free rate is currently 4.1%, and the return on the market portfolio during the year just ended was 9.4%. a. Calculate Treynor's measure for Anna's portfolio for the year just ended. b. Compare the performance of Anna's portfolio found in part a to that of Stacey Quant's portfolio, which has a Treynor's measure of 1.39%. Which portfolio performed better? Explain. c. Calculate Treynor's measure for the market portfolio for the year just ended. d. Use your findings in parts a and c to discuss the performance of Anna's portfolio relative to the market during the year just ended.arrow_forwardNeed answer.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education