Concept explainers

Analyzing the Accounts

The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year:

a. Purchased supplies on credit, $18,600

b. Paid $14,800 cash toward the purchase in Transaction a

c. Provided services to customers on credit1 $46,925

d. Collected $39,650 cash from

e. Recorded

f. Employee salaries accrued, $15,650

g. Paid $15,650 cash to employees for salaries earned

h. Accrued interest expense on long-term debt, $1,950

i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h

j. Paid $2,220 cash for l year’s insurance coverage in advance

k. Recognized insurance expense, $1,340, that was paid in a previous period

l. Sold equipment with a book value of $7,500 for $7,500 cash

m. Declared cash dividend, $12,000

n. Paid cash dividend declared in Transaction m

o. Purchased new equipment for $28,300 cash.

p. Issued common stock for $60,000 cash

q. Used $10,700 of supplies to produce revenues

Summit Sales uses the indirect method to prepare its statement of

Required:

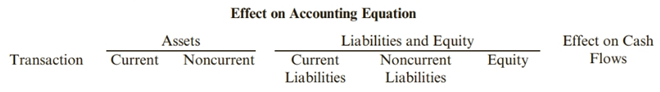

1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental

2. Indicate whether each transaction results in a

3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.

(a)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. It is also known as statement of cash flows.

To construct:

A table and to indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the effect in the accounts due to each transaction by giving

Explanation of Solution

Table showing the effect of each transaction on the financial accounts:

| Assets |

Liabilities and Equity |

||||

| Transactions | Current | Non-Current | Current | Non-Current | Equity |

| Purchased supplies on credit, |

|||||

| Paid |

|||||

| Provided services to customer on credit, |

|||||

| Collected |

|||||

| Record Depreciation expense, |

|||||

| Employee salary accrued, |

|||||

| Paid |

|||||

| Accrues Interest expense on long-term debt, |

|||||

| Paid a total of |

|||||

| Paid |

|||||

| Recognised insurance expense, |

|||||

| Sold equipment with a book value of |

|||||

| Declared cash dividend, |

|||||

| Paid cash dividend declared in above | |||||

| Purchased new equipment for |

|||||

| Issued common stock for |

|||||

| Used |

|||||

(b)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. Itis also known as statement of cash flows.

To construct:

A table and indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the effect in the accounts due to each transaction in terms of cash inflow and cash outflow.

Explanation of Solution

Table showing the effect of each transaction on the financial accounts:

| Transactions | Cash Flow |

| Purchased supplies on credit, |

None |

| Paid |

|

| Provided services to customer on credit, |

None |

| Collected |

|

| Record Depreciation expense, |

None |

| Employee salary accrued, |

None |

| Paid |

|

| Accrued Interest expense on long-term debt, |

None |

| Paid a total of |

|

| Paid |

|

| Recognised insurance expense, |

None |

| Sold equipment with a book value of |

|

| Declared cash dividend, |

None |

| Paid cash dividend declared in above | |

| Purchased new equipment for |

|

| Issued common stock for |

|

| Used |

None |

(c)

Concept introduction:

Cash flow statement shows inflow and outflow of cash and it is divided into three categories, i.e., operating, investing and financing activities. Itis also known as statement of cash flows.

To construct:

A table and indicate the effect of each transaction on the financial accounts in terms of cash inflow and cash outflow.

Answer to Problem 38E

The table is constructed providing the classification of each transaction on the financial accounts in terms of cash flow from operating, investing and financing activities.

Explanation of Solution

Table showing the classification of each transaction on the financial accounts:

| Transactions | Classification |

| Purchased supplies on credit, |

Non-cash activity |

| Paid |

Operating activity |

| Provided services to customer on credit, |

Non-cash activity |

| Collected |

Operating activity |

| Record Depreciation expense, |

Non-cash activity |

| Employee salary accrued, |

Non-cash activity |

| Paid |

Operating activity |

| Accrued Interest expense on long-term debt, |

Non-cash activity |

| Paid a total of |

Investing activity |

| Paid |

Operating activity |

| Recognised insurance expense, |

Non-cash activity |

| Sold equipment with a book value of |

Investing activity |

| Declared cash dividend, |

Non-cash activity |

| Paid cash dividend declared in above | Financing activity |

| Purchased new equipment for |

Investing activity |

| Issued common stock for |

Financing activity |

| Used |

Non-cash activity |

Want to see more full solutions like this?

Chapter 11 Solutions

Cornerstones of Financial Accounting - With CengageNow

- What is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation?no aiarrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- What are index funds, and why are they popular among long-term investors in finance? need helparrow_forwardJoe and Ethan form JH Corporation. Joe transfers equipment (basis of $210,000 and fair market value of $180,000) while Ethan transfers land (basis of $15,000 and fair market value of $150,000) and $30,000 of cash. Each receives 50% of JH’s stock. As a result of these transfers: a. Joe has a recognized loss of $30,000, and Ethan has a recognized gain of $135,000. b. Neither Joe nor Ethan has any recognized gain or loss.c. Joe has no recognized loss, but Ethan has a recognized gain of $30,000. d. JH Corporation will have a basis in the land of $45,000.e. None of the above.arrow_forwardWhat is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage